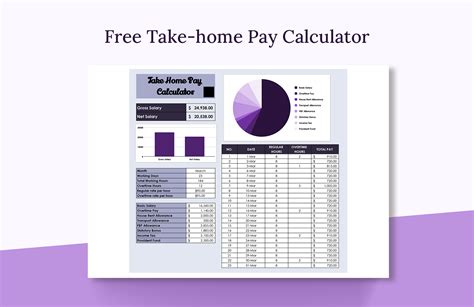

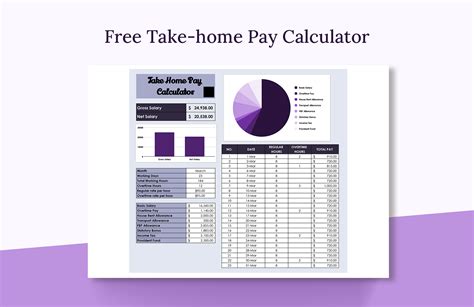

Washington Take Home Pay Calculator

Introduction to Washington Take Home Pay Calculator

The Washington take home pay calculator is a useful tool for employees and employers in the state of Washington to calculate the net pay or take-home pay of an individual. This calculator takes into account various factors such as gross income, taxes, and deductions to provide an accurate estimate of the net pay. In this article, we will discuss the importance of using a take home pay calculator, how it works, and the benefits of using one.

Why Use a Take Home Pay Calculator?

Using a take home pay calculator is essential for individuals to understand their net pay and plan their finances accordingly. It helps to avoid any surprises or discrepancies in the paycheck, ensuring that the individual is aware of the exact amount they will receive after taxes and deductions. Additionally, it allows employers to provide their employees with accurate pay stubs and helps to build trust and transparency in the workplace.

How Does the Washington Take Home Pay Calculator Work?

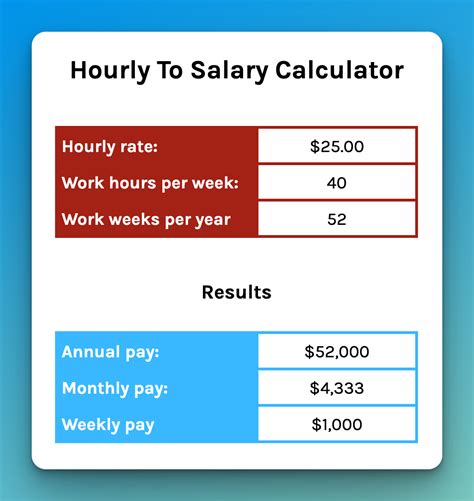

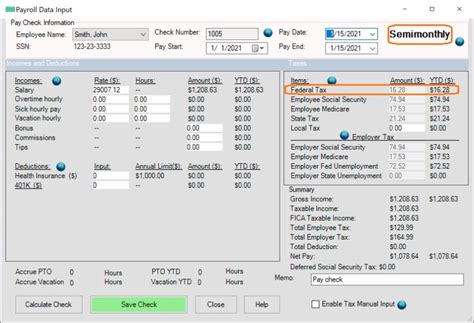

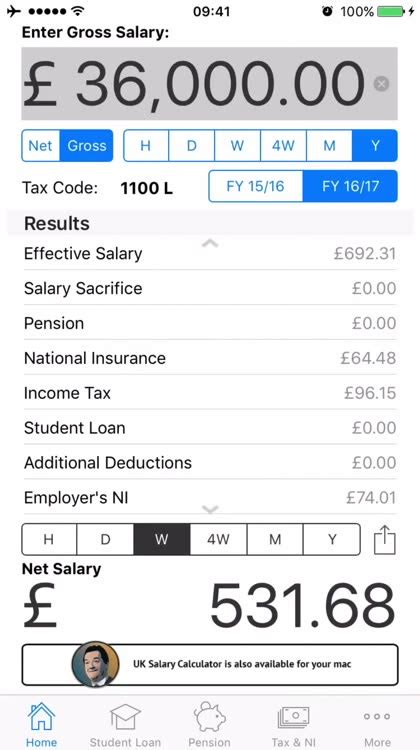

The Washington take home pay calculator works by considering several factors, including:

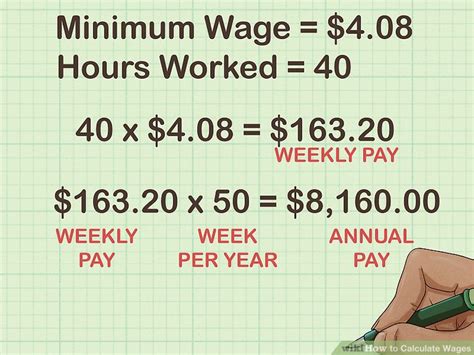

- Gross income: The total amount of money earned by an individual before taxes and deductions.

- Taxes: Federal, state, and local taxes that are deducted from the gross income.

- Deductions: Other deductions such as health insurance, 401(k), and other benefits.

Benefits of Using a Take Home Pay Calculator

Using a take home pay calculator has several benefits, including:

- Accurate calculations: The calculator provides accurate estimates of the net pay, avoiding any surprises or discrepancies.

- Time-saving: The calculator saves time and effort, as it eliminates the need for manual calculations.

- Increased transparency: The calculator helps to build trust and transparency in the workplace, as employees can see exactly how their pay is calculated.

Washington State Taxes

Washington state has a progressive tax system, with seven tax brackets ranging from 10% to 37%. The state also has a business and occupation (B&O) tax, which is a tax on the gross income of businesses. The take home pay calculator takes into account these taxes and other deductions to provide an accurate estimate of the net pay.

Using the Take Home Pay Calculator

To use the take home pay calculator, individuals can follow these steps:

- Enter the gross income: Enter the total amount of money earned before taxes and deductions.

- Enter the tax filing status: Select the tax filing status, such as single, married, or head of household.

- Enter the number of dependents: Enter the number of dependents, such as children or other relatives.

- Enter the deductions: Enter any deductions, such as health insurance or 401(k) contributions.

- Calculate the net pay: Click the calculate button to see the estimated net pay.

📝 Note: The take home pay calculator is for estimation purposes only and should not be considered as tax or financial advice.

Take Home Pay Calculator Example

Here is an example of how the take home pay calculator works:

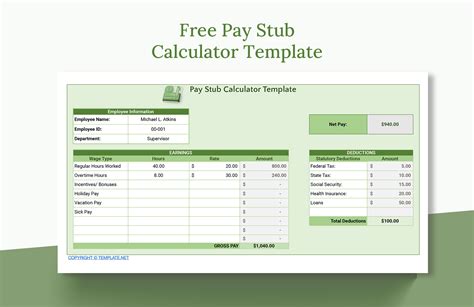

| Gross Income | Taxes | Deductions | Net Pay |

|---|---|---|---|

| 50,000</td> <td>10,000 | 5,000</td> <td>35,000 |

In this example, the individual has a gross income of 50,000, with taxes of 10,000 and deductions of 5,000. The estimated net pay is 35,000.

Conclusion and Final Thoughts

In conclusion, the Washington take home pay calculator is a useful tool for individuals and employers to calculate the net pay or take-home pay of an individual. It takes into account various factors such as gross income, taxes, and deductions to provide an accurate estimate of the net pay. By using the take home pay calculator, individuals can plan their finances accordingly and avoid any surprises or discrepancies in the paycheck.

What is the purpose of the Washington take home pay calculator?

+

The purpose of the Washington take home pay calculator is to provide an accurate estimate of the net pay or take-home pay of an individual, taking into account various factors such as gross income, taxes, and deductions.

How does the take home pay calculator work?

+

The take home pay calculator works by using a complex algorithm to calculate the net pay, taking into account the various tax rates and deductions. It also considers other factors such as the number of dependents, filing status, and other tax credits.

What are the benefits of using a take home pay calculator?

+

The benefits of using a take home pay calculator include accurate calculations, time-saving, and increased transparency. It helps individuals to plan their finances accordingly and avoid any surprises or discrepancies in the paycheck.