NYC Take Home Pay Calculator

Introduction to NYC Take Home Pay Calculator

When it comes to calculating take-home pay, especially in a city like New York, it can be quite complex due to the various taxes and deductions involved. The NYC take home pay calculator is a tool designed to help individuals estimate their net income after considering federal, state, and local taxes, as well as other deductions. Understanding how these calculations work can provide valuable insights into managing one’s finances more effectively.

How the NYC Take Home Pay Calculator Works

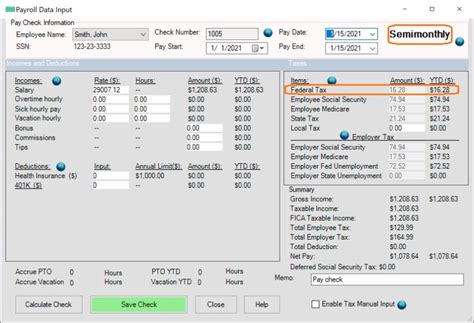

The calculator typically requires some basic information: - Gross Income: The total amount of money earned before any deductions or taxes. - Filing Status: Whether the individual is single, married, head of household, etc., which affects tax rates. - Number of Dependents: The number of dependents claimed, which can impact tax deductions. - Pay Frequency: How often the individual is paid, such as bi-weekly or monthly.

Using this information, the calculator applies the relevant tax rates and deductions to estimate the take-home pay. Key considerations include: - Federal Income Tax: Applies to all U.S. citizens and varies based on income level and filing status. - New York State Income Tax: Ranges from 4% to 8.82%, depending on income level. - New York City Income Tax: Ranges from 2.907% to 3.648%, also dependent on income level. - Other Deductions: Such as health insurance premiums, 401(k) contributions, and other pre-tax deductions.

Importance of Accurate Calculations

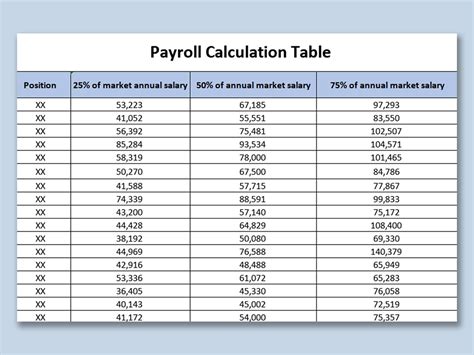

Accurate take-home pay calculations are crucial for: - Budgeting: Understanding how much money is actually available for spending each month. - Savings: Planning for savings and investments based on net income. - Financial Planning: Making informed decisions about major purchases, retirement planning, and other long-term financial goals.

Using the Calculator for Financial Planning

To make the most of the NYC take home pay calculator, consider the following steps: - Input Accurate Information: Ensure all details, including income, filing status, and deductions, are correct and up-to-date. - Adjust for Changes: Regularly update the calculator with changes in income, marital status, number of dependents, or other factors that could affect taxes and deductions. - Explore Different Scenarios: Use the calculator to simulate different financial scenarios, such as a raise, a move to a different tax bracket, or changes in deductions.

Tips for Maximizing Take-Home Pay

Several strategies can help maximize take-home pay: - Utilize Pre-Tax Deductions: Contribute to 401(k), health savings accounts (HSAs), and flexible spending accounts (FSAs) to reduce taxable income. - Optimize Tax Credits: Claim all eligible tax credits, such as the Earned Income Tax Credit (EITC) or child tax credits. - Consider Tax-Advantaged Investments: Invest in tax-efficient vehicles, such as Roth IRAs or municipal bonds, to minimize tax liability.

Common Mistakes to Avoid

When using the NYC take home pay calculator, beware of the following common mistakes: - Underestimating Taxes: Failing to account for all applicable taxes, including local and state taxes. - Overlooking Deductions: Not claiming all eligible deductions, which can lead to overpaying taxes. - Ignoring Changes in Tax Law: Failing to update calculations based on changes in tax rates, brackets, or deductions.

📝 Note: Always consult with a financial advisor or tax professional to ensure accuracy and compliance with current tax laws.

Conclusion and Final Thoughts

In conclusion, the NYC take home pay calculator is a powerful tool for estimating net income and planning finances effectively. By understanding how the calculator works, accurately inputting information, and exploring different financial scenarios, individuals can make informed decisions about their financial futures. Remember, maximizing take-home pay involves a combination of utilizing pre-tax deductions, optimizing tax credits, and considering tax-advantaged investments. Always stay informed about changes in tax laws and consult with professionals when necessary to ensure the best possible financial outcomes.

What is the purpose of the NYC take home pay calculator?

+

The NYC take home pay calculator is designed to help individuals estimate their net income after taxes and deductions, providing a clearer picture of their financial situation.

How do I use the NYC take home pay calculator effectively?

+

To use the calculator effectively, input accurate and up-to-date information, adjust for changes in your financial situation, and explore different scenarios to plan for your financial future.

What are some common mistakes to avoid when using the NYC take home pay calculator?

+

Common mistakes include underestimating taxes, overlooking deductions, and ignoring changes in tax laws. Always consult with a financial advisor or tax professional to ensure accuracy and compliance.