-

Mastering the 199a Worksheet by Activity Form for Maximum Deductions

A detailed guide to help users navigate and fill out the 199a Worksheet by Activity Form.

Read More » -

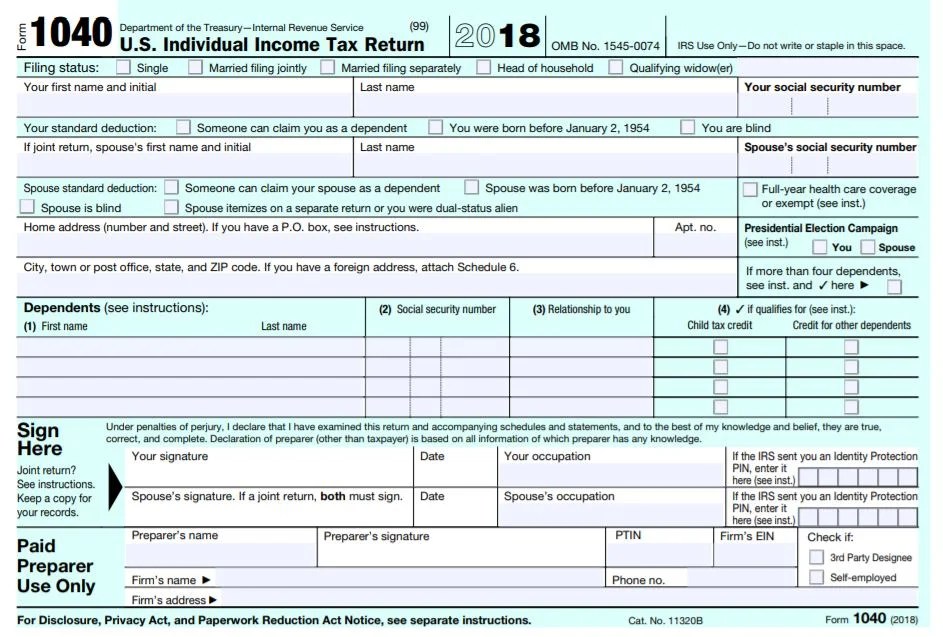

Master the IRC 1341 Worksheet: Simplified Guide

Discover the details of IRS form 1341 for reclaiming overpaid taxes due to erroneous inclusion of income. Learn how to complete the worksheet.

Read More » -

5 Essential Tips for E&M Audit Success

This article provides a detailed audit worksheet for evaluating and documenting evaluation and management (E&M) services to ensure proper coding and billing compliance in healthcare settings.

Read More » -

1031 Exchange: Simplified Worksheet for Tax Savings Calculation

Simplify your 1031 exchange process with this detailed calculation worksheet, designed to ensure compliance and optimize your tax benefits.

Read More » -

Maximize Your Tax Deductions with Section 199a Worksheet

The Section 199a Information Worksheet helps taxpayers compute and qualify for the deduction of 20% of qualified business income for tax purposes.

Read More » -

Like Kind Exchange Worksheet Excel: Simplify Your Transactions

This worksheet provides a structured format in Excel for managing real estate transactions utilizing a like-kind exchange to defer capital gains tax.

Read More »