5 Ways to Calculate State Active Duty Pay

Understanding State Active Duty Pay

As a member of the National Guard or a reserve component, you may be eligible for state active duty pay when called to serve in a state active duty status. This type of pay is different from federal active duty pay, and the calculation methods may vary depending on your state and the type of duty you are performing. In this article, we will explore five ways to calculate state active duty pay.

Method 1: Base Pay Rate

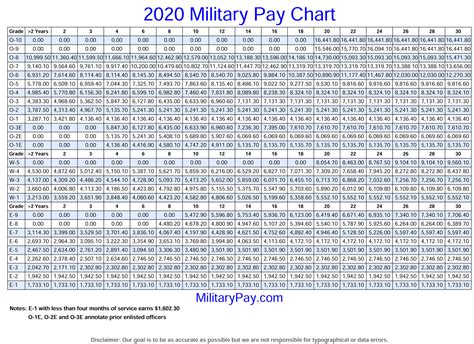

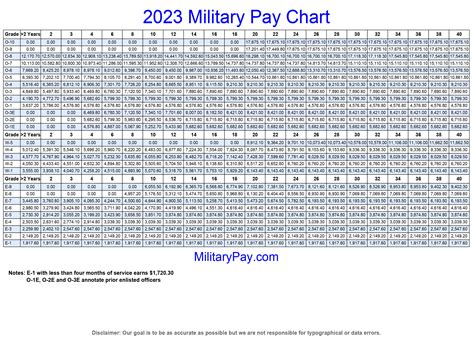

The most common method of calculating state active duty pay is based on your base pay rate. This rate is typically determined by your rank and time in service. To calculate your state active duty pay using this method, you can follow these steps:

- Determine your base pay rate based on your rank and time in service.

- Multiply your base pay rate by the number of days you are serving in a state active duty status.

- The result is your total state active duty pay for that period.

For example, if your base pay rate is 200 per day and you are serving in a state active duty status for 30 days, your total state active duty pay would be 6,000.

Method 2: Drill Pay Rate

Another method of calculating state active duty pay is based on your drill pay rate. This rate is typically determined by your rank and time in service, and it is usually lower than your base pay rate. To calculate your state active duty pay using this method, you can follow these steps:

- Determine your drill pay rate based on your rank and time in service.

- Multiply your drill pay rate by the number of days you are serving in a state active duty status.

- The result is your total state active duty pay for that period.

For example, if your drill pay rate is 150 per day and you are serving in a state active duty status for 30 days, your total state active duty pay would be 4,500.

Method 3: Flat Rate

Some states pay a flat rate for state active duty, regardless of your rank or time in service. To calculate your state active duty pay using this method, you can follow these steps:

- Determine the flat rate for state active duty in your state.

- Multiply the flat rate by the number of days you are serving in a state active duty status.

- The result is your total state active duty pay for that period.

For example, if the flat rate for state active duty in your state is 100 per day and you are serving in a state active duty status for 30 days, your total state active duty pay would be 3,000.

| State | Flat Rate |

|---|---|

| California | $120 per day |

| New York | $100 per day |

| Florida | $90 per day |

Method 4: Hourly Rate

Some states pay an hourly rate for state active duty, which can be calculated based on the number of hours you work. To calculate your state active duty pay using this method, you can follow these steps:

- Determine your hourly rate based on your rank and time in service.

- Multiply your hourly rate by the number of hours you work in a state active duty status.

- The result is your total state active duty pay for that period.

For example, if your hourly rate is 20 per hour and you work 40 hours in a state active duty status, your total state active duty pay would be 800.

Method 5: Special Duty Pay

Some states offer special duty pay for certain types of state active duty, such as hazardous duty or emergency response. To calculate your state active duty pay using this method, you can follow these steps:

- Determine the special duty pay rate for your type of duty.

- Multiply the special duty pay rate by the number of days you are serving in a state active duty status.

- The result is your total state active duty pay for that period.

For example, if the special duty pay rate for hazardous duty is 250 per day and you are serving in a state active duty status for 30 days, your total state active duty pay would be 7,500.

📝 Note: The calculation methods and rates may vary depending on your state and the type of duty you are performing. It's essential to check with your state's military department or human resources office to determine the correct calculation method and rate for your specific situation.

Your state active duty pay is an essential part of your compensation package, and understanding the different calculation methods can help you plan your finances and make informed decisions about your service. Remember to check with your state’s military department or human resources office to determine the correct calculation method and rate for your specific situation.

What is state active duty pay?

+

State active duty pay is a type of pay received by National Guard or reserve component members when called to serve in a state active duty status.

How is state active duty pay calculated?

+

State active duty pay can be calculated using different methods, including base pay rate, drill pay rate, flat rate, hourly rate, and special duty pay.

What is the difference between state active duty pay and federal active duty pay?

+

State active duty pay is paid by the state, while federal active duty pay is paid by the federal government. The calculation methods and rates may also differ between state and federal active duty pay.