5 Specialist Pay Rates in the US Army

Unlocking the Finances of the US Army: A Comprehensive Guide to Specialist Pay Rates

Serving in the US Army comes with its own set of rewards and challenges. One of the most significant benefits is the competitive pay and allowances that come with donning the uniform. For Specialist (SPC) ranks, understanding the pay rates is crucial for planning and managing one’s finances effectively. In this article, we’ll delve into the intricacies of Specialist pay rates in the US Army, covering the various aspects that affect their compensation.

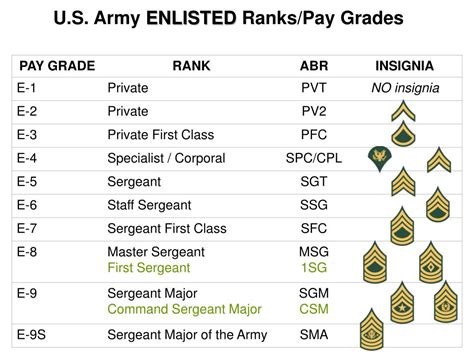

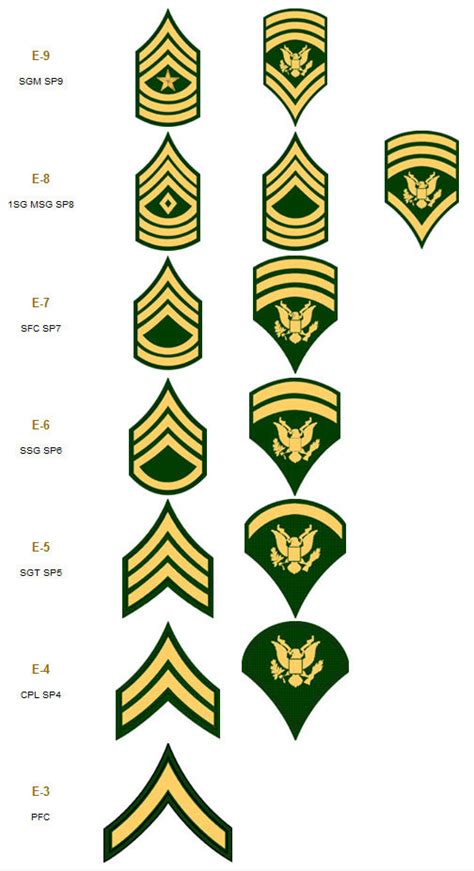

What is a Specialist in the US Army?

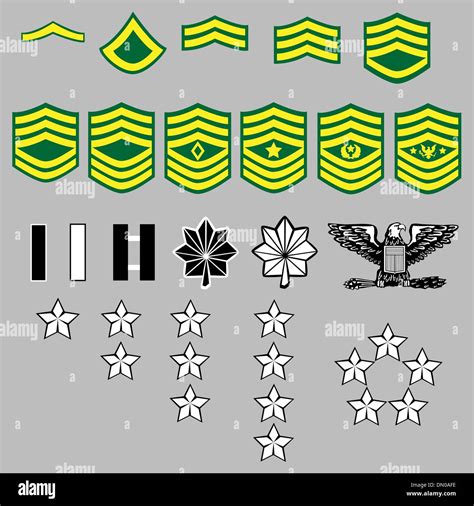

A Specialist (SPC) is a junior non-commissioned officer (NCO) rank in the US Army, equivalent to the pay grade of E-4. This rank is typically held by soldiers who have gained experience and expertise in their specific Military Occupational Specialty (MOS). Specialists often serve as team leaders, providing guidance and mentorship to junior soldiers.

Specialist Pay Rates: A Breakdown

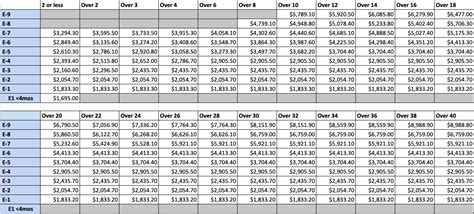

The US Army’s pay rates are based on the soldier’s time in service, rank, and time in grade. The following table illustrates the Specialist pay rates for 2022:

| Pay Grade | Years of Service | Monthly Base Pay |

|---|---|---|

| E-4 (Specialist) | 2 or less | $2,454.90 |

| E-4 (Specialist) | Over 2 | $2,586.40 |

| E-4 (Specialist) | Over 3 | $2,777.40 |

| E-4 (Specialist) | Over 4 | $2,944.90 |

| E-4 (Specialist) | Over 6 | $3,155.10 |

| E-4 (Specialist) | Over 8 | $3,357.30 |

| E-4 (Specialist) | Over 10 | $3,576.90 |

| E-4 (Specialist) | Over 12 | $3,831.90 |

| E-4 (Specialist) | Over 14 | $4,092.10 |

| E-4 (Specialist) | Over 16 | $4,358.50 |

| E-4 (Specialist) | Over 18 | $4,638.10 |

| E-4 (Specialist) | Over 20 | $4,930.50 |

📝 Note: These rates are subject to change and do not include additional forms of compensation, such as allowances and bonuses.

Allowances and Bonuses: Adding to the Specialist's Pay

In addition to the base pay, Specialists may receive various allowances and bonuses, including:

- Basic Allowance for Housing (BAH): Varies by location and dependents

- Basic Allowance for Subsistence (BAS): $369.39 per month

- Cost of Living Allowance (COLA): Varies by location

- Special Duty Pay: 150-500 per month

- Hazardous Duty Pay: 150-500 per month

- Jump Pay: 150-500 per month

- Dive Pay: 150-500 per month

Tax Advantages: Reducing the Tax Burden

As a member of the US Army, Specialists may be eligible for various tax advantages, including:

- Tax-free allowances: BAH, BAS, and COLA are tax-free

- Combat zone tax exclusion: Tax-free income while serving in a combat zone

- Moving expense deduction: Deductible moving expenses for PCS moves

Conclusion

Serving as a Specialist in the US Army comes with a competitive pay and benefits package. Understanding the Specialist pay rates, allowances, and bonuses can help soldiers manage their finances effectively. By taking advantage of tax benefits and planning for the future, Specialists can make the most of their military compensation.

How much does a Specialist in the US Army make per year?

+

A Specialist in the US Army can make between 29,419.20 and 59,226.60 per year, depending on their time in service and time in grade.

What is the difference between base pay and allowances?

+

Base pay is the soldier’s monthly salary, while allowances are additional forms of compensation, such as BAH and BAS, which are intended to offset the costs of living and subsistence.

Can I receive tax benefits as a Specialist in the US Army?

+

Yes, as a member of the US Army, you may be eligible for various tax benefits, including tax-free allowances and combat zone tax exclusion.