Simple Interest Made Easy: Worksheet With Answers

Simple interest is a fundamental concept in finance and mathematics, often taught early in schools to introduce students to the basics of money management and investment. This concept involves calculating the interest earned or paid on a principal sum without considering the effect of compounding. In this blog post, we'll explore simple interest in detail, providing you with a practical worksheet to master the calculation and comprehension of simple interest.

What Is Simple Interest?

Simple interest (SI) is the interest calculated on the principal, or original, amount of a loan or deposit. Unlike compound interest, which is applied to the accumulated amount of the principal plus any previously earned interest, simple interest is straightforward:

- The interest is calculated only on the initial principal amount.

- It does not accrue over time in terms of compounding.

The formula to calculate simple interest is:

SI = P × R × T

- P is the principal amount, or the original sum of money.

- R is the annual interest rate (usually expressed as a percentage).

- T is the time the money is invested or borrowed for, in years.

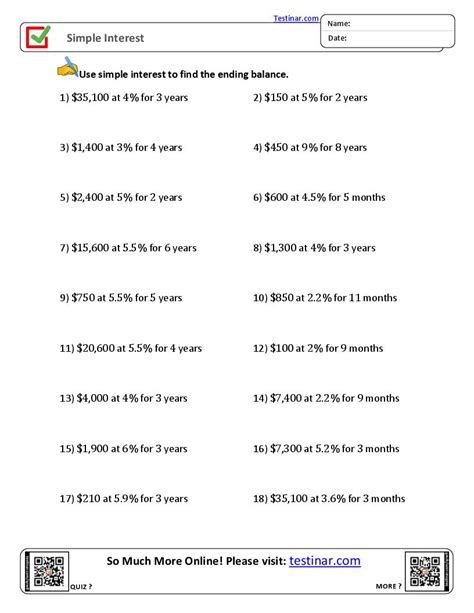

Worksheet: Calculating Simple Interest

Here is a simple worksheet that you can use to practice calculating simple interest:

| Principal (P) | Annual Interest Rate ® | Time in Years (T) | Simple Interest (SI) | Amount (P + SI) |

|---|---|---|---|---|

| 1000</td> <td>5%</td> <td>3</td> <td></td> <td></td> </tr> <tr> <td>1500 | 6% | 2 | ||

| $500 | 4% | 5 |

Example Calculation:

Let’s solve the first row:

Given:

P = 1000<br>

R = 5% (or 0.05 as a decimal)<br>

T = 3 years<br>

SI = P × R × T = 1000 × 0.05 × 3 = 150

The Amount = P + SI = 1000 + 150 = 1150</p> <p>Here's what the completed table looks like:</p> <table> <tr> <th>Principal (P)</th> <th>Annual Interest Rate (R)</th> <th>Time in Years (T)</th> <th>Simple Interest (SI)</th> <th>Amount (P + SI)</th> </tr> <tr> <td>1000 5% 3 150</td> <td>1150 1500</td> <td>6%</td> <td>2</td> <td>180 1680</td> </tr> <tr> <td>500 4% 5 100</td> <td>600

💡 Note: It's beneficial to practice these calculations manually to truly understand the mechanics of simple interest.

Using Simple Interest in Real Life

Simple interest has applications in:

- Loans where interest is calculated on the initial principal only.

- Short-term investments where you want to see your returns grow linearly.

- Understanding the time value of money in basic financial planning.

By understanding simple interest, individuals can make informed decisions about:

- The cost of borrowing money.

- The potential earnings from lending or investing.

- How to manage personal finances more effectively.

Pitfalls and Considerations

When dealing with simple interest:

- Be cautious of the rate and time: A higher rate or longer period can significantly increase the amount of interest paid or received.

- Interest rates can change: Unlike in our worksheet where rates are fixed, in real life, they might fluctuate, affecting your calculations.

- Legalities and terms: Make sure you understand all terms of an investment or loan, as they can affect how simple interest is calculated and applied.

🌱 Note: Keep in mind that while simple interest is easier to calculate, real-world scenarios often involve compound interest which can lead to significantly different financial outcomes over time.

Wrapping Up

We’ve delved into the concept of simple interest, its formula, practical applications, and potential pitfalls. By practicing with the worksheet provided, you can gain a hands-on understanding of how simple interest works. This knowledge is not just for academic purposes but is invaluable in everyday financial decision-making, from planning personal savings to understanding loan terms. Remember, mastering simple interest is a stepping stone to more complex financial concepts.

Why is simple interest used more in short-term investments?

+

Simple interest is favored in short-term investments because it provides a straightforward calculation of returns, and the effect of compounding isn’t significant over shorter periods. It allows investors to quickly estimate earnings without needing advanced mathematical tools.

Can simple interest become compound interest?

+

Simple interest does not inherently become compound interest; they are fundamentally different methods of interest calculation. However, an investment or loan might initially be calculated with simple interest but might later switch to compound interest if the terms change or if new investments are made.

What is the disadvantage of simple interest?

+

The primary disadvantage of simple interest is that over long periods, the growth of money or debt does not keep pace with inflation or the potential growth rates of compound interest. This makes it less attractive for long-term investments or loans where the money should grow exponentially over time.