Global Savings Secrets: 5 Nations Compared

In the quest for financial stability and wealth accumulation, understanding where and how people save money can be a transformative lesson for anyone interested in optimizing their personal finances. In this comparative analysis, we delve into the savings cultures of five distinct countries - Japan, Germany, Brazil, the UK, and Singapore - to uncover the secrets behind their saving habits.

Japan: The Art of Savings

Japan is renowned not just for its technological advancements but also for its unique saving culture:

- Education: Inculcated from a young age, saving is seen as a virtue, with money management lessons integrated into school curricula.

- Postal Savings: The country’s postal savings system, which offers easy access to banking services, has long been a fundamental part of Japan’s savings infrastructure.

- Old-School Methods: Many Japanese still prefer cash and physical savings tools like savings boxes (called ‘kakeibo’) to keep track of their expenditures manually.

- Delayed Gratification: This principle, inherent in Japanese culture, contributes significantly to their high savings rates.

📝 Note: The Japanese also have a system known as Tanomoshi, a type of rotating savings and credit association, which promotes savings and helps small businesses flourish without relying on formal banking structures.

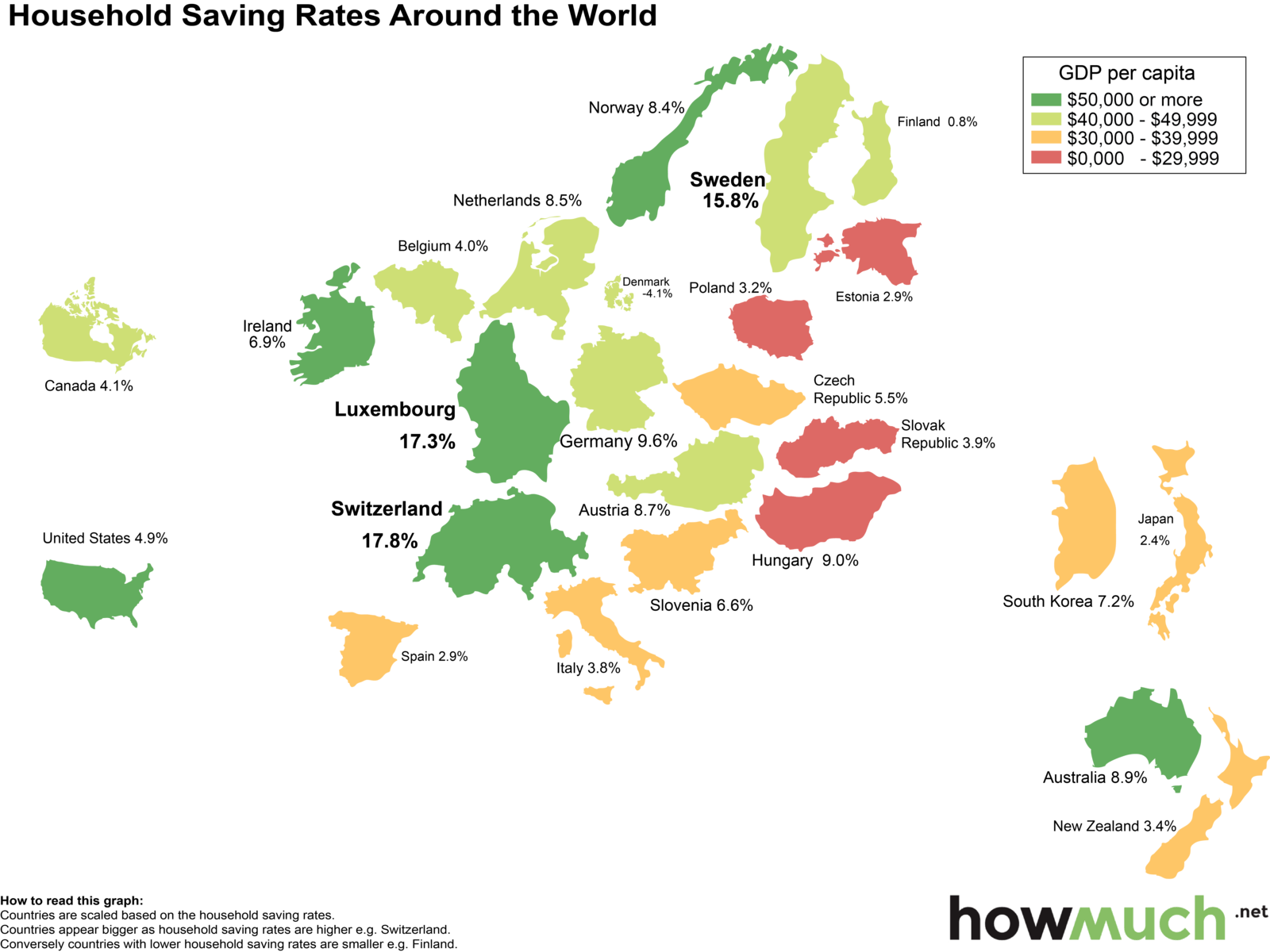

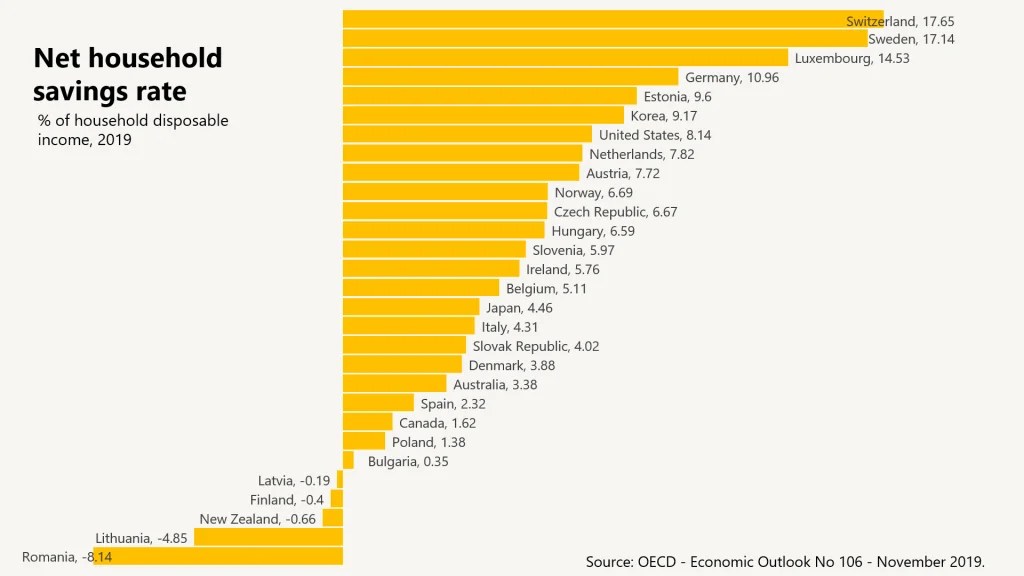

Germany: Structured Savings with a Social Twist

Germany boasts one of the highest savings rates in Europe, with:

- Work Policies: Regulations that encourage employees to save a portion of their income directly from their salaries.

- Christmas Bonus: Companies often give an annual bonus which, traditionally, is saved for the upcoming year.

- Culture of Modesty: Germans are known for their restraint in spending and preference for investing in long-term assets like real estate.

- Cooperative Banks: These offer services tailored for all income levels, promoting financial inclusion and savings habits across society.

📝 Note: Germany’s cooperative banking system plays a crucial role in fostering a saving culture among citizens from all walks of life.

Brazil: The Spirit of Jugaad

Brazil exhibits an ingenious approach to savings:

- Unconventional Savings: The use of ‘Piggy Banks’, ‘Cassettes’, or saving clubs (rodadas de compras) where people pool money together.

- Entrepreneurial Spirit: The mindset of always having a Plan B, a common practice where savings are often invested in small businesses to generate additional income.

- Remittances: A significant portion of savings comes from Brazilians living abroad, who send money home to support their families.

- Frugality: Despite economic fluctuations, Brazilians have learned to save through various means, showcasing a resilient approach to financial management.

📝 Note: The Brazilian ‘Jugaad’ spirit reflects a creative and flexible approach to saving, adapting to economic hardships with optimism.

United Kingdom: Encouraging Financial Literacy

The UK is pushing towards a new era of financial literacy with:

- State Support: Programs like ISAs (Individual Savings Accounts) encourage tax-efficient saving.

- Financial Education: Schools are increasingly teaching children about money management to equip the next generation with savings skills.

- Banking Apps: The rise of user-friendly mobile banking apps has made tracking and saving money easier than ever.

- Encouragement of Retirement Planning: The UK promotes the importance of saving for retirement through initiatives like auto-enrolment into pension schemes.

📝 Note: The UK’s commitment to financial education is fostering a more savings-conscious public.

Singapore: A Blueprint for National Savings

Singapore’s system for national savings, the Central Provident Fund (CPF), is a model:

- Mandatory Savings: A percentage of income is automatically allocated to retirement, healthcare, and housing through the CPF.

- Home Ownership: The CPF also allows individuals to use savings for housing, promoting homeownership.

- Investment Opportunities: Singaporeans can invest their CPF funds in approved schemes, providing an avenue for growth.

- Government Incentives: Various initiatives encourage citizens to save more through matched contributions and tax benefits.

📝 Note: The CPF’s structure has been pivotal in ensuring economic security and fostering a culture of savings in Singapore.

Final Thoughts

Exploring the saving habits of these five countries illuminates diverse strategies that can inspire our own financial journey. Japan’s cultural emphasis on savings, Germany’s structured approach, Brazil’s inventive methods, the UK’s focus on financial literacy, and Singapore’s innovative national savings plan each offer unique insights into saving money effectively. Learning from these nations, we can craft a personal saving strategy that aligns with our goals, cultural context, and economic environment. Savings, in its essence, is about future security and freedom, and these countries demonstrate varied paths to achieve that.

What is Tanomoshi, and how does it work in Japan?

+

Tanomoshi is a rotating savings and credit association in Japan where members contribute money into a communal pot, and one member takes the entire sum each cycle until every member has received it once.

How do Germans manage to save with such high taxes?

+

Many Germans save through structured policies at work, and by opting for long-term investments like real estate, which grow over time. Additionally, the Christmas bonus plays a significant role in their yearly savings strategy.

What role does financial education play in the UK’s saving habits?

+

The UK is increasingly emphasizing financial education in schools, which is fostering a new generation of savers. Initiatives like ISAs provide tax benefits, making saving attractive and understandable for all age groups.

Can the Brazilian Jugaad approach work in other countries?

+

The Brazilian approach, focusing on resourcefulness and adaptability, can indeed be adapted elsewhere. It encourages people to think creatively about saving money even in economic hardship.

How does Singapore’s CPF encourage savings?

+

The CPF mandates savings from income, promoting security in retirement, healthcare, and housing. It also offers investment options, making saving an appealing strategy for wealth accumulation.