Same Day Taxpayer Worksheet: Simplify Your Tax Filing

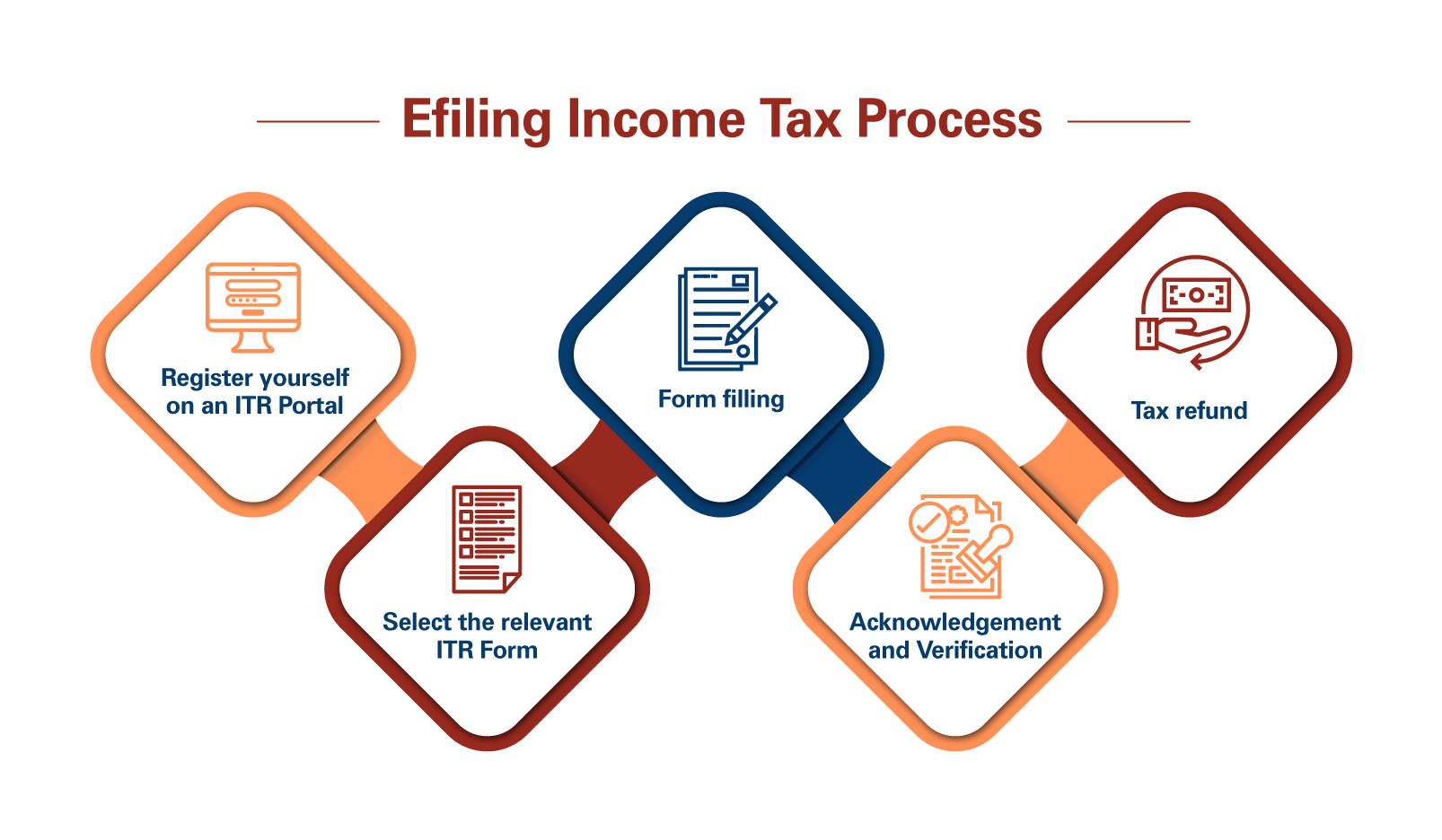

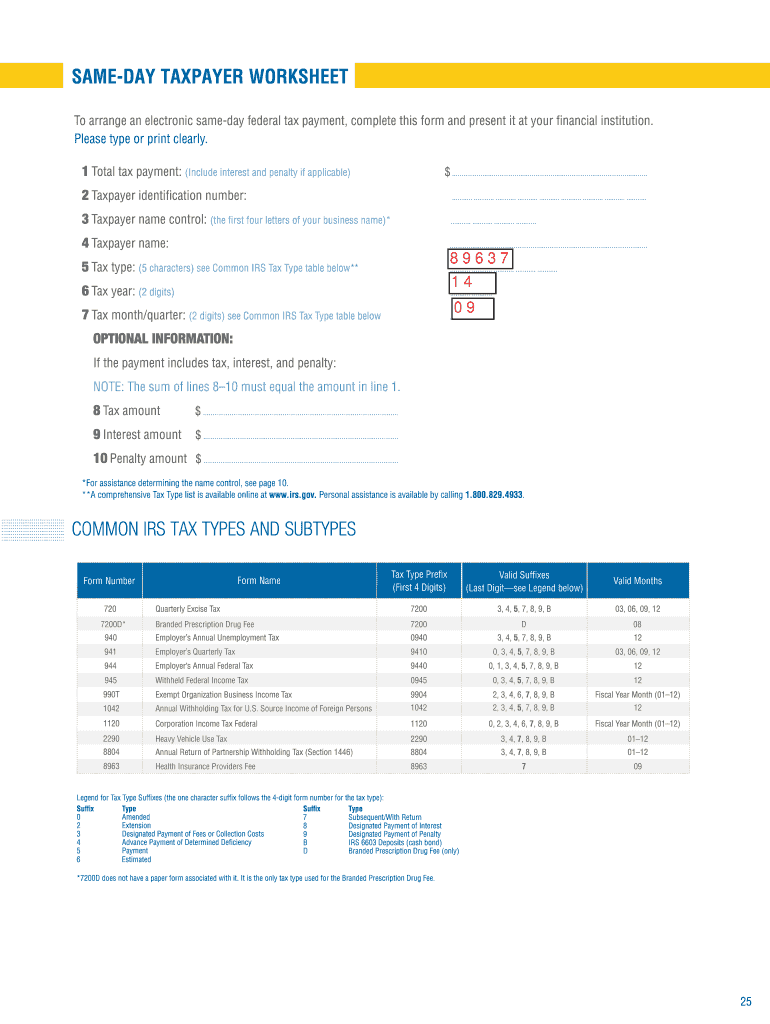

When the clock is ticking and you're in a race against the tax filing deadline, every minute counts. One of the tools designed to help you navigate this annual crunch is the Same Day Taxpayer Worksheet (SDTW). Designed to streamline the process and simplify your tax preparation, the SDTW can be a lifesaver for those last-minute tax filers.

What is the Same Day Taxpayer Worksheet?

The Same Day Taxpayer Worksheet is a specialized document used by tax professionals to quickly gather necessary information from clients. Here’s how it works:

- Data Collection: It acts as a checklist, ensuring all relevant information is collected in one place.

- Efficiency: It’s structured to expedite the filing process, minimizing the back-and-forth between the tax preparer and the taxpayer.

- Compliance: Ensures that the tax return is accurate and compliant with current tax laws.

How Does It Help?

The SDTW is not just about speed; it’s about accuracy and completeness:

- Comprehensive: It includes prompts for all the necessary personal details, income, deductions, and credits you might forget in the rush.

- Organized: It's designed in a logical flow, following the sequence of tax form, making the process smoother for both you and your tax professional.

- Mitigation of Errors: With a structured worksheet, the chances of missing crucial information or making errors are significantly reduced.

Filling Out the SDTW

To ensure you get the most out of this worksheet:

Personal Information

Start with basic personal details like:

- Name, Social Security Number, Date of Birth

- Current Address and Contact Information

Income Information

List all sources of income:

- Wages, Salaries, and Tips from W-2s

- 1099 Forms for Contract Work

- Interest, Dividends, Capital Gains

Deductions and Credits

Don’t forget about what you can deduct or claim:

- Mortgage Interest

- Medical Expenses

- Education Credits

- Charitable Contributions

Here is a table to help you quickly assess common deductions:

| Deduction Type | Relevant Form | Additional Notes |

|---|---|---|

| Home Mortgage Interest | Form 1098 | Acquisition debt must not exceed $750,000 for purchases after 2017 |

| Medical Expenses | Schedule A | Only amounts above 7.5% of AGI are deductible |

| Education Credits | Form 8863 | Credits like the American Opportunity Tax Credit (AOTC) have limits and phaseouts |

⚠️ Note: Ensure you have all the necessary documentation before filling out the SDTW. Missing documents can lead to delays or errors in filing.

What to Do with the Completed Worksheet

- Review: Double-check the information for accuracy.

- Submit: Provide the worksheet to your tax preparer or if you’re filing yourself, keep it for reference.

The Benefits of Using the SDTW

Why should you consider using this worksheet?

- Reduced Stress: With a clear path to follow, you’re less likely to feel overwhelmed.

- Time Savings: Organize your data once, and you’re ready to go when filing.

- Minimized Delays: Having everything in one place means no last-minute searches for missing forms.

At the end of the tax season, when deadlines loom, you'll appreciate the clarity and speed that the SDTW brings to the process. By having a prepared and organized document, you streamline your preparation, ensuring your tax return is complete and accurate. Whether you are a first-time filer or a seasoned veteran, the SDTW can be an invaluable tool in your tax filing arsenal.

Remember, though, this worksheet is just a part of the process. Filing your taxes involves more than just data collection; it's about making the best decisions for your financial situation, optimizing your deductions, and potentially consulting with a tax professional. Use the SDTW to gather information, but always keep in mind the bigger picture of your tax strategy.

Can I use the Same Day Taxpayer Worksheet for electronic filing?

+

The SDTW is designed for manual data collection but the information gathered can be used to fill out electronic tax forms.

Is the SDTW only useful for individuals, or can businesses use it too?

+

While it’s primarily for individual filers, businesses can adapt the worksheet to collect similar information for their tax returns.

How can I ensure my SDTW is filled out correctly?

+

Double-check all entries, make sure you have supporting documentation, and if possible, have a tax professional review it.

What if I find out I’ve missed a piece of information after submitting the SDTW?

+

Inform your tax preparer immediately so they can make the necessary adjustments to your tax return.