Georgia Salary Calculator Tool

Introduction to Georgia Salary Calculator Tool

The Georgia Salary Calculator Tool is a valuable resource for individuals living in Georgia, providing them with an accurate estimate of their net salary based on their gross income. This tool takes into account various factors such as tax rates, deductions, and exemptions to give users a clear picture of their take-home pay. In this article, we will delve into the features and benefits of the Georgia Salary Calculator Tool, as well as provide a step-by-step guide on how to use it.

Features of the Georgia Salary Calculator Tool

The Georgia Salary Calculator Tool offers several features that make it an essential tool for individuals living in Georgia. Some of the key features include: * Gross-to-Net Calculation: The tool calculates the net salary based on the gross income, taking into account federal and state taxes, as well as other deductions. * Tax Rates and Exemptions: The tool uses the latest tax rates and exemptions to ensure accurate calculations. * Customizable Deductions: Users can input their own deductions, such as health insurance premiums or retirement contributions, to get a more accurate estimate of their net salary. * User-Friendly Interface: The tool has a simple and intuitive interface, making it easy for users to input their information and get results quickly.

Benefits of Using the Georgia Salary Calculator Tool

Using the Georgia Salary Calculator Tool can have several benefits for individuals living in Georgia. Some of the benefits include: * Accurate Net Salary Estimate: The tool provides an accurate estimate of the net salary, helping users plan their finances and make informed decisions. * Time-Saving: The tool saves time and effort, as users do not have to manually calculate their net salary or consult with a tax professional. * Informed Decision-Making: The tool provides users with a clear picture of their take-home pay, enabling them to make informed decisions about their finances, such as budgeting and investing. * Peace of Mind: The tool gives users peace of mind, knowing that they have an accurate estimate of their net salary and can plan their finances accordingly.

How to Use the Georgia Salary Calculator Tool

Using the Georgia Salary Calculator Tool is straightforward and easy. Here are the steps to follow: * Step 1: Input Gross Income: Users input their gross income, which is the total amount of money they earn before taxes and deductions. * Step 2: Select Tax Filing Status: Users select their tax filing status, such as single, married, or head of household. * Step 3: Input Deductions: Users input their deductions, such as health insurance premiums or retirement contributions. * Step 4: Calculate Net Salary: The tool calculates the net salary based on the input information. * Step 5: Review Results: Users review their results, which include their estimated net salary and a breakdown of their taxes and deductions.

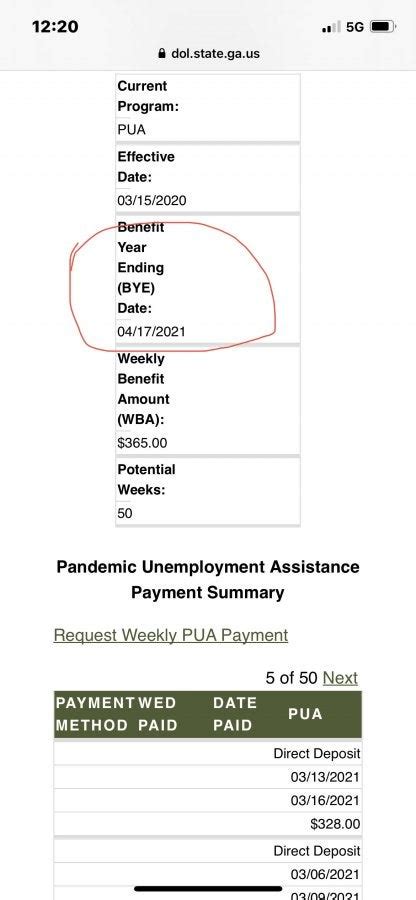

Example of Using the Georgia Salary Calculator Tool

Let’s say John is a single person living in Georgia, with a gross income of 50,000 per year. He has a health insurance premium of 200 per month and contributes 5% of his income to a retirement plan. Using the Georgia Salary Calculator Tool, John can input his information and get an estimate of his net salary.

| Gross Income | Tax Filing Status | Deductions | Net Salary |

|---|---|---|---|

| 50,000</td> <td>Single</td> <td>Health insurance premium: 200/month, Retirement contribution: 5% | 38,500</td>

</tr>

</table>

As shown in the example, the Georgia Salary Calculator Tool provides John with an estimated net salary of 38,500 per year, taking into account his gross income, tax filing status, and deductions.

💡 Note: The Georgia Salary Calculator Tool is for estimation purposes only and should not be considered as tax or financial advice. In summary, the Georgia Salary Calculator Tool is a valuable resource for individuals living in Georgia, providing them with an accurate estimate of their net salary based on their gross income. The tool is easy to use and offers several features, including gross-to-net calculation, tax rates and exemptions, customizable deductions, and a user-friendly interface. By using the Georgia Salary Calculator Tool, individuals can plan their finances and make informed decisions about their money. The main points to take away from this article are that the Georgia Salary Calculator Tool is a useful resource for estimating net salary, it is easy to use, and it provides accurate results. Additionally, the tool can help individuals plan their finances and make informed decisions about their money. Overall, the Georgia Salary Calculator Tool is a valuable tool for anyone living in Georgia who wants to get a better understanding of their take-home pay. What is the Georgia Salary Calculator Tool? + The Georgia Salary Calculator Tool is a resource that provides an accurate estimate of an individual’s net salary based on their gross income, taking into account various factors such as tax rates, deductions, and exemptions. How does the Georgia Salary Calculator Tool work? + The tool works by inputting the user’s gross income, tax filing status, and deductions, and then calculating the net salary based on the latest tax rates and exemptions. What are the benefits of using the Georgia Salary Calculator Tool? + The benefits of using the Georgia Salary Calculator Tool include getting an accurate estimate of net salary, saving time and effort, making informed decisions about finances, and having peace of mind. |