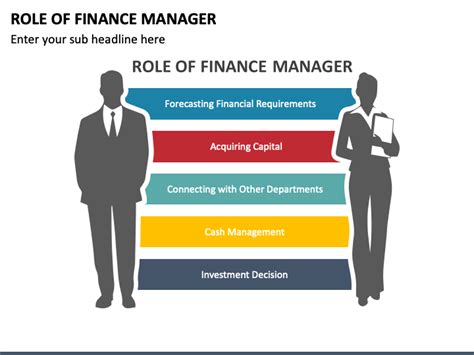

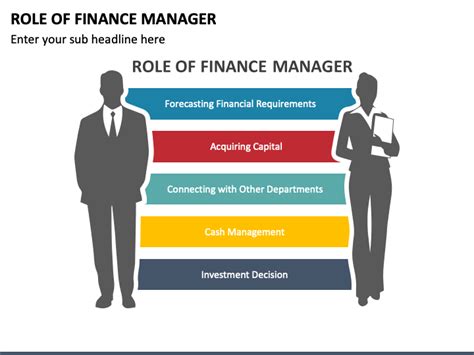

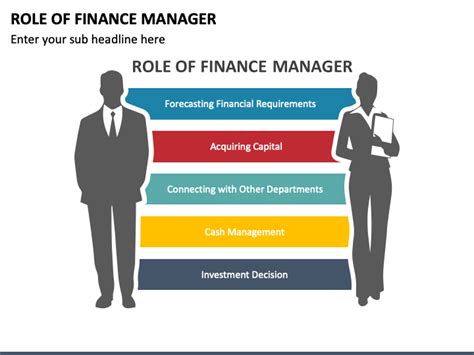

5 Key Roles of a Financial Manager

The Backbone of an Organization: 5 Key Roles of a Financial Manager

In any organization, a financial manager plays a vital role in ensuring the financial health and stability of the company. They are responsible for making strategic financial decisions, managing financial resources, and guiding the organization towards achieving its goals. In this blog post, we will discuss the 5 key roles of a financial manager and how they contribute to the success of an organization.

Role 1: Financial Planning and Budgeting

One of the primary roles of a financial manager is to create a comprehensive financial plan that aligns with the organization’s overall strategy. This involves:

- Analyzing historical financial data and market trends

- Identifying areas of cost reduction and improvement

- Developing financial models and forecasts

- Creating a budget that allocates resources effectively

A well-crafted financial plan enables the organization to make informed decisions, manage risk, and achieve its financial objectives.

📊 Note: A financial manager must have a deep understanding of financial modeling and budgeting techniques to create a realistic and achievable financial plan.

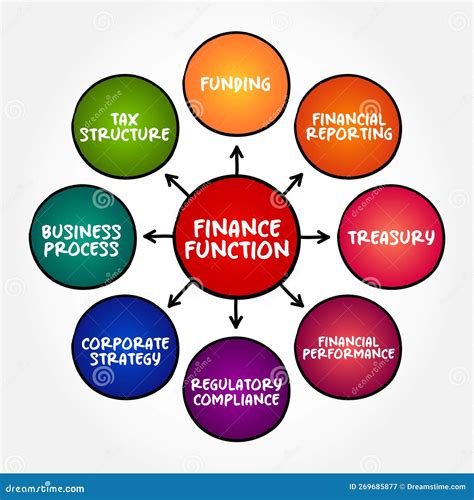

Role 2: Financial Reporting and Analysis

A financial manager is responsible for preparing and presenting financial reports to stakeholders, including management, investors, and regulatory bodies. This involves:

- Preparing financial statements, such as balance sheets and income statements

- Analyzing financial data to identify trends and areas for improvement

- Providing insights and recommendations to management

- Ensuring compliance with financial regulations and standards

Accurate and timely financial reporting enables stakeholders to make informed decisions and helps the organization to identify areas for improvement.

Role 3: Risk Management

Financial managers must identify and mitigate financial risks that could impact the organization. This includes:

- Identifying potential risks, such as market risk, credit risk, and operational risk

- Developing risk management strategies, such as hedging and diversification

- Implementing risk management policies and procedures

- Monitoring and reviewing risk management performance

Effective risk management enables the organization to minimize losses and maximize returns.

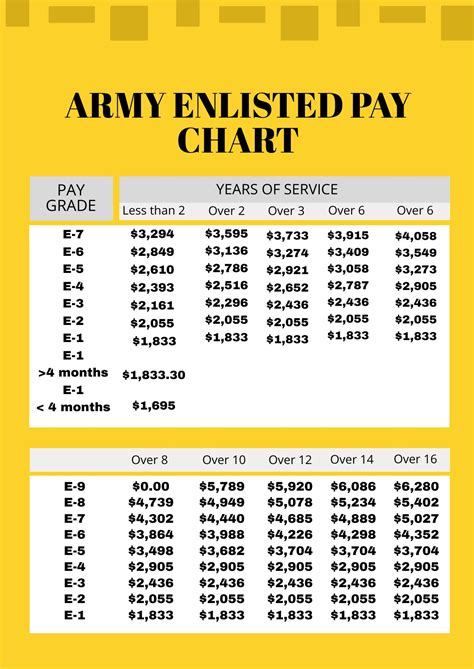

Role 4: Fundraising and Capital Management

A financial manager is responsible for raising capital and managing the organization’s funding requirements. This involves:

- Identifying funding sources, such as loans, investments, and grants

- Preparing funding proposals and pitches

- Negotiating funding terms and conditions

- Managing cash flow and ensuring liquidity

Access to capital is critical for an organization’s growth and development. A financial manager must be able to secure funding and manage it effectively.

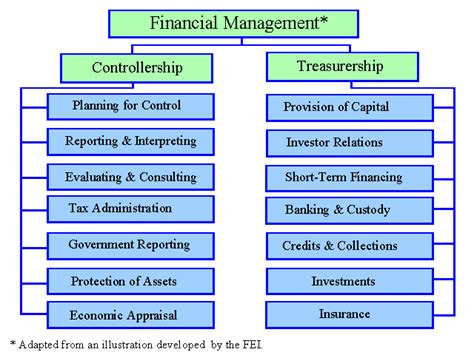

Role 5: Financial Governance and Compliance

A financial manager must ensure that the organization complies with financial regulations and standards. This includes:

- Ensuring compliance with financial laws and regulations

- Implementing financial policies and procedures

- Maintaining accurate and transparent financial records

- Conducting internal audits and reviews

Strong financial governance and compliance are essential for maintaining stakeholder trust and avoiding reputational damage.

Key Skills and Qualities of a Financial Manager

To be successful, a financial manager must possess a range of skills and qualities, including:

- Strong analytical and problem-solving skills

- Excellent communication and presentation skills

- Ability to think strategically and make informed decisions

- Strong leadership and management skills

- Ability to work under pressure and manage risk

A financial manager who possesses these skills and qualities can add significant value to an organization and help drive its success.

In summary, a financial manager plays a critical role in ensuring the financial health and stability of an organization. Their key roles include financial planning and budgeting, financial reporting and analysis, risk management, fundraising and capital management, and financial governance and compliance. By possessing the necessary skills and qualities, a financial manager can drive an organization’s success and achieve its financial objectives.

What is the primary role of a financial manager?

+

The primary role of a financial manager is to create a comprehensive financial plan that aligns with the organization’s overall strategy.

What are the key skills and qualities of a financial manager?

+

A financial manager must possess strong analytical and problem-solving skills, excellent communication and presentation skills, ability to think strategically, strong leadership and management skills, and ability to work under pressure and manage risk.

Why is financial governance and compliance important?

+

Strong financial governance and compliance are essential for maintaining stakeholder trust and avoiding reputational damage.