5 Steps to Use Fidelity's Retirement Expense Worksheet

Planning for retirement is a critical step in ensuring financial stability and security later in life. Fidelity, one of the leading financial institutions, offers a comprehensive tool known as the Retirement Expense Worksheet to help individuals map out their retirement expenses. Here's how you can effectively use this resource to prepare for your golden years:

1. Understanding Your Current Expenses

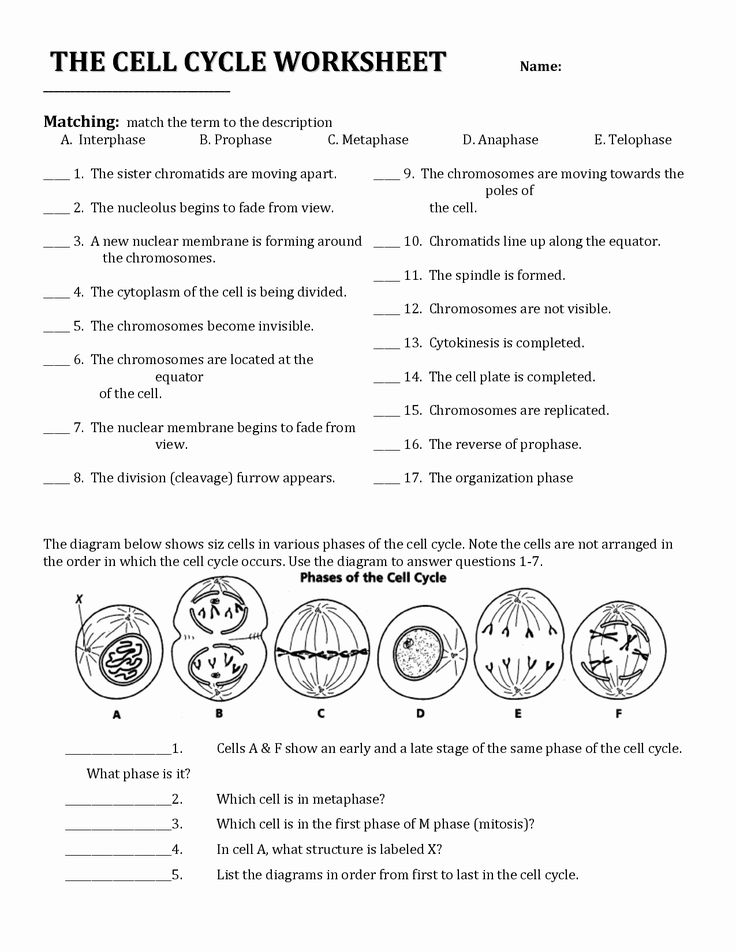

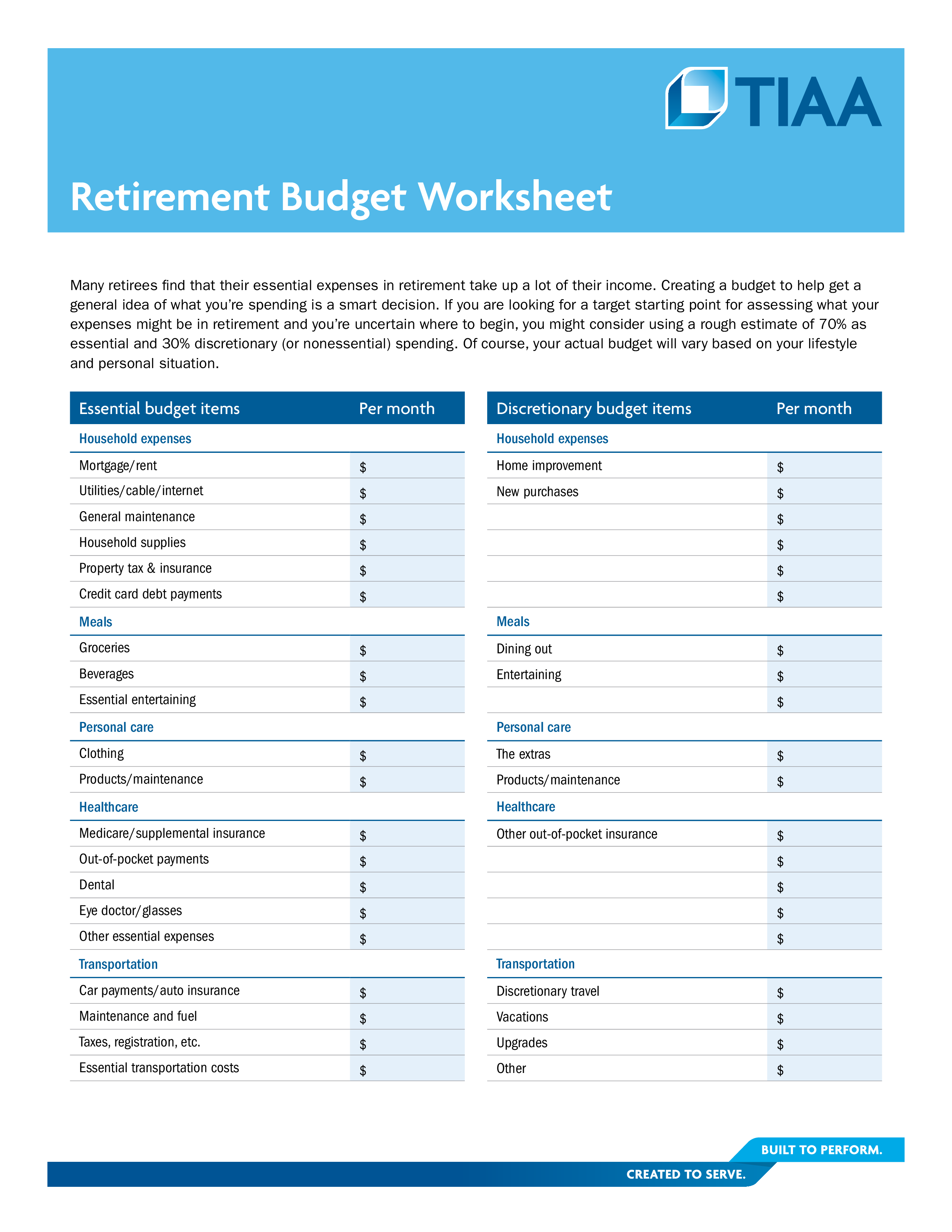

Before diving into the specifics of retirement expenses, start with a clear picture of your current financial situation:

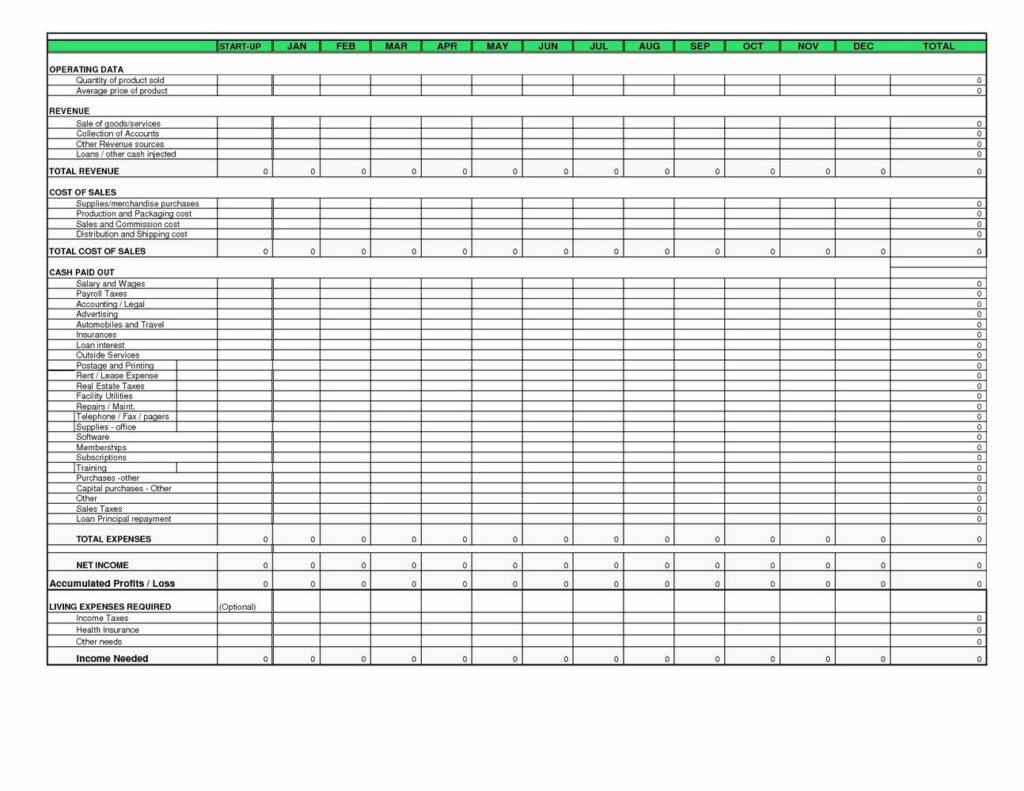

- Income: Document all sources of income including salary, investments, rental income, etc.

- Expenses: Categorize your expenses into housing, utilities, food, transportation, entertainment, healthcare, and more.

Use Fidelity’s expense tracker or your own spreadsheet to gather this information meticulously. Knowing your current spending habits provides a baseline for estimating future needs.

2. Estimate Future Expenses in Retirement

Your spending patterns will change in retirement, but not all expenses will decrease:

- Healthcare: Typically, medical expenses increase significantly in retirement. Consider your current health status and potential future medical needs.

- Housing: Will you stay in your current home, downsize, or rent?

- Lifestyle: Do you plan on traveling, taking up hobbies, or will you lead a more sedentary lifestyle?

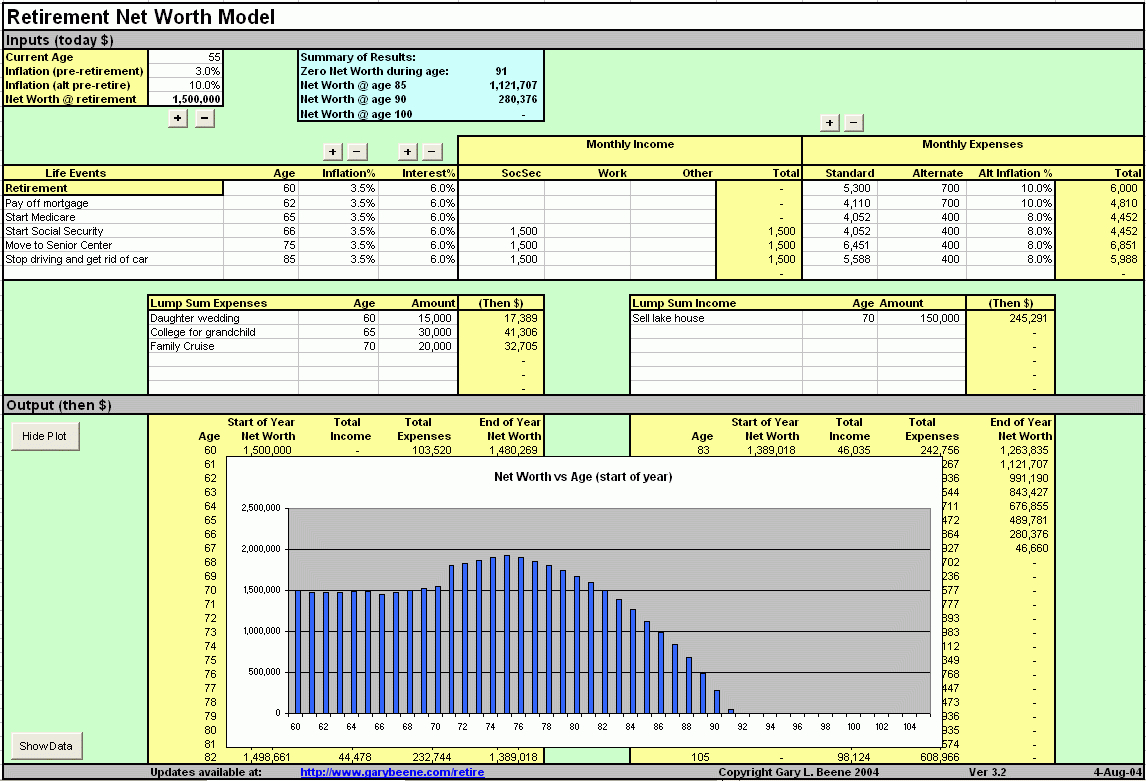

Utilize the worksheet to plug in your estimated expenses for each category. Fidelity’s tool allows you to adjust inflation rates, providing a more realistic estimate over time.

3. Account for Social Security and Other Income Sources

Income during retirement usually includes:

- Social Security: Estimate your future benefits using the tool’s calculator.

- Pensions: If applicable, factor in any pension you might receive.

- Retirement Accounts: Include withdrawals from 401(k)s, IRAs, or other retirement savings vehicles.

- Investments: Consider how much you plan to draw from investments each year.

Fidelity’s worksheet can project how these income sources will support your retirement expenses.

4. Consider Inflation and Taxes

Inflation can erode the purchasing power of your savings:

- Inflation Rates: Use historical data or the worksheet’s built-in assumptions to account for inflation.

- Taxes: Remember to include potential tax liabilities on withdrawals from retirement accounts or on investment income.

By incorporating these factors, you’ll get a more accurate snapshot of your retirement finances.

5. Adjust and Reassess Your Plan

Retirement planning isn’t a one-time activity; it’s an ongoing process:

- Revisit Annually: Your retirement plan should be reviewed at least once a year to reflect changes in income, lifestyle, or expenses.

- Use Scenario Analysis: Fidelity’s tool offers scenario analysis to help you understand how different situations might affect your retirement savings.

This iterative approach ensures your plan remains relevant and achievable.

⚠️ Note: Ensure you factor in changes like healthcare costs rising faster than general inflation rates or adjustments in retirement age for Social Security benefits.

Throughout these steps, keep in mind that the Retirement Expense Worksheet is a tool to guide you, not a crystal ball predicting the future with absolute accuracy. It's about preparing, adjusting, and ensuring financial peace of mind as you approach and enter retirement. While you've mapped out a comprehensive financial plan for your retirement, remember that life's unexpected events can influence even the best-laid plans. Regularly revisiting your retirement strategy ensures it evolves alongside your life circumstances. By following these steps, you're not just planning for retirement; you're securing a financially stable future that allows you to enjoy your later years with confidence.

What if my retirement expenses exceed my savings?

+

If your projected expenses in retirement are higher than your savings, you might need to consider working longer, saving more aggressively, or adjusting your retirement lifestyle expectations. Fidelity’s tool can help explore these scenarios to find a balance that works for you.

How accurate are the inflation estimates in the worksheet?

+

Inflation estimates are based on historical data and current economic forecasts, but they are inherently uncertain. Fidelity uses conservative estimates but recommends reviewing these figures regularly to adjust for unexpected changes in inflation rates.

Can I include long-term care costs in my retirement expense calculations?

+

Yes, you should definitely factor in potential long-term care costs. The worksheet allows for customization where you can add specific expenses related to healthcare, including long-term care scenarios.