Retirement Budget Planner: Fidelity's Worksheet Guide

Retirement planning might seem daunting, but with the right tools, you can navigate this journey with confidence. Fidelity Investments offers a comprehensive worksheet designed to help future retirees plan their finances meticulously. This guide will walk you through the steps of using Fidelity's Retirement Budget Planner worksheet to secure your financial future.

Understanding the Fidelity Retirement Budget Planner Worksheet

Fidelity’s worksheet is a user-friendly tool that helps you estimate your retirement expenses, predict your income sources, and plan for a comfortable retirement. Here’s how you can make the most out of it:

1. Download and Access the Worksheet

- Visit the Fidelity website to download the worksheet in an easily editable format like PDF or Excel.

- Save the file to a location on your computer where you can easily access and update it regularly.

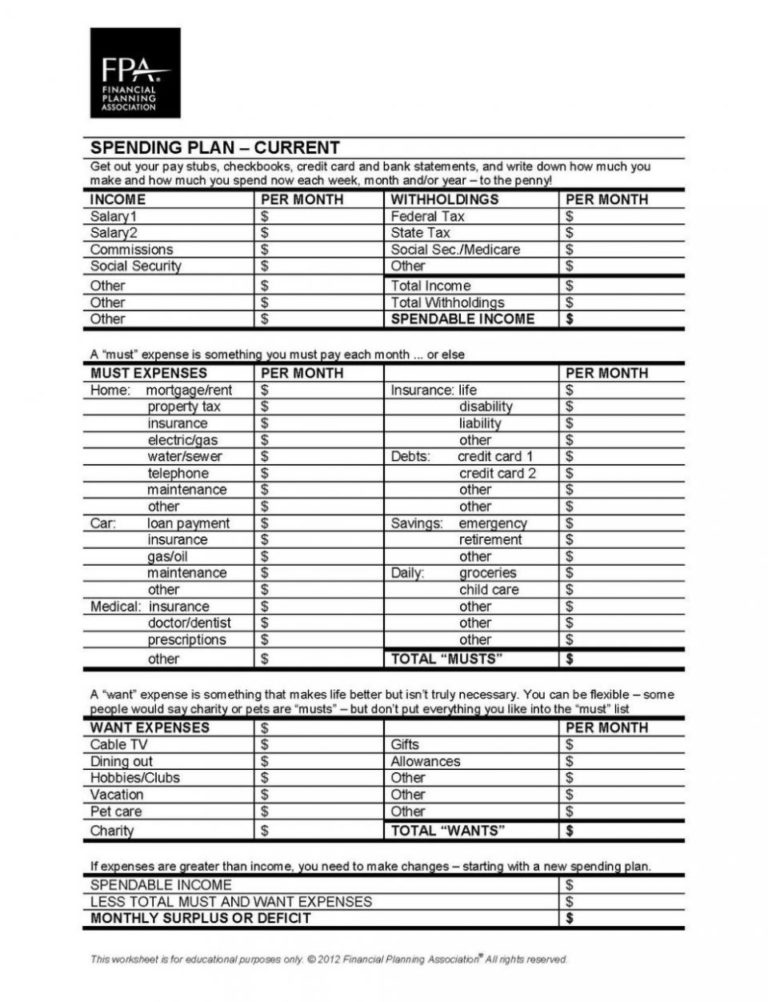

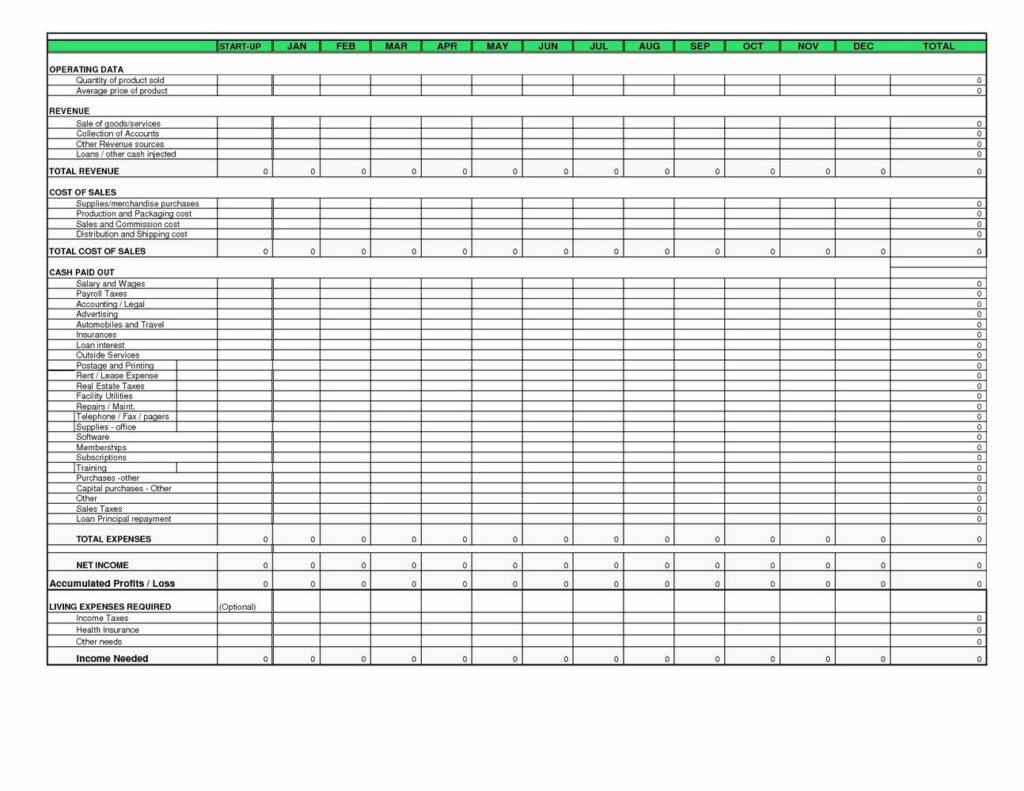

2. Key Sections of the Worksheet

- Pre-Retirement Expenses: Begin by entering your current expenses to establish a baseline.

- Estimated Retirement Expenses: Here, adjust your pre-retirement expenses to reflect changes in lifestyle or needs.

- Income Sources: Document all expected income like Social Security, pensions, retirement account withdrawals, and any other sources.

- Inflation Impact: Account for inflation which could significantly affect your purchasing power over time.

- Net Worth and Savings: Track your current financial health to understand how much you need to save.

💡 Note: Ensure your estimates are as accurate as possible; underestimating expenses or overestimating income could lead to financial strain in retirement.

3. Calculating Your Retirement Expenses

Follow these steps:

- List down your current expenses in various categories.

- Adjust these for retirement, considering:

- Healthcare costs which might increase.

- Travel or hobbies you might pursue.

- Home maintenance, which could decrease or increase depending on your housing choices.

- Potential changes in tax rates.

4. Projecting Your Retirement Income

- Estimate Social Security benefits using tools available on the Social Security Administration website or within Fidelity’s own tools.

- Include pension amounts if you have them.

- Account for withdrawals from retirement accounts like 401(k)s or IRAs, considering tax implications and withdrawal strategies.

💡 Note: Diversify your income sources to mitigate risks associated with one particular income stream drying up.

5. The Role of Inflation and Adjustments

Inflation can erode your retirement savings:

- Use a conservative inflation rate, typically around 2-3%, to calculate how much your expenses might grow annually.

- Adjust your income projections to ensure they keep pace with inflation.

6. Regular Review and Updates

- Revise your worksheet annually or whenever there are significant life changes like health issues, changes in family structure, or unexpected financial windfalls/losses.

- Update income sources as they change, especially retirement account balances.

- Consider consulting with a financial advisor for complex adjustments or when approaching retirement.

By meticulously working through Fidelity's Retirement Budget Planner, you're laying down a financial blueprint for your retirement years. This process not only prepares you for potential financial challenges but also instills confidence in your retirement strategy. Remember, planning for retirement is not a one-time event but an ongoing process that requires regular attention and adjustment to fit your evolving life circumstances.

In the grand scheme of things, your retirement should be a time of enjoyment and fulfillment, not financial stress. Using tools like Fidelity’s worksheet ensures you approach this phase with the preparedness needed to make the most of these years.

How often should I update my retirement budget plan?

+

It’s advisable to review and update your retirement budget plan annually or whenever you experience significant life changes such as marriage, health issues, or shifts in your employment or investment status.

What if my expenses in retirement turn out higher than I’ve planned?

+

If expenses exceed your projections, consider options like working longer, increasing savings now, investing in income-generating assets, or revising your retirement lifestyle to align with your financial reality.

Can the worksheet account for inflation and changes in tax laws?

+

The worksheet itself does not automatically adjust for inflation or tax law changes. However, you can manually incorporate these elements by updating your estimates each year with current inflation rates and adjusting tax rates accordingly.