Bank Statement Reconciliation: Simplified Worksheet Guide

Reconciling your bank statements is an essential part of financial management, whether you're an individual managing your personal finances or a business owner ensuring accuracy in accounting records. This detailed guide will walk you through the steps to reconcile your bank statements effectively, highlighting why it's beneficial and how you can make the process simpler with a worksheet.

Why Reconcile Bank Statements?

Reconciliation is not just about matching numbers; it’s about:

- Ensuring accuracy in your financial records.

- Detecting any fraudulent activities or unauthorized transactions.

- Verifying bank errors or issues with service.

- Preparing for tax season with precise financial data.

- Maintaining good financial health by keeping cash flows tracked and balanced.

Steps to Reconcile Your Bank Statement

Follow these steps to perform a manual reconciliation:

Collect Necessary Documents

Before you start, ensure you have the following:

- Your most recent bank statement.

- Your checkbook or accounting records.

- A reconciliation worksheet or a blank sheet of paper.

Compare Transactions

Begin by comparing each transaction from your bank statement to your personal or business ledger:

- Tick off each transaction that matches perfectly.

- Note down any discrepancies, such as missing checks or incorrect deposits.

📝 Note: If any transactions don’t match, investigate them before proceeding.

Record Adjustments

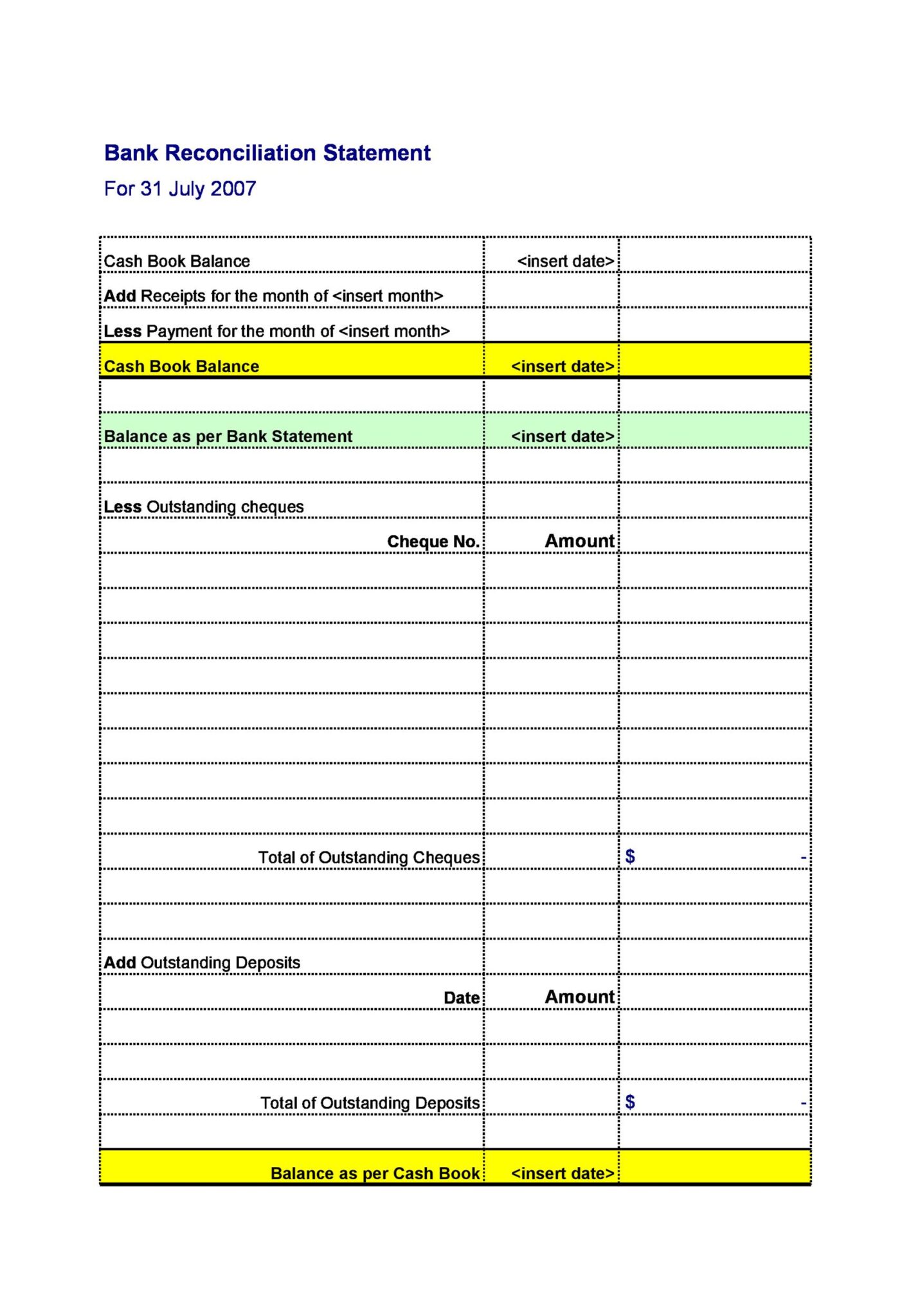

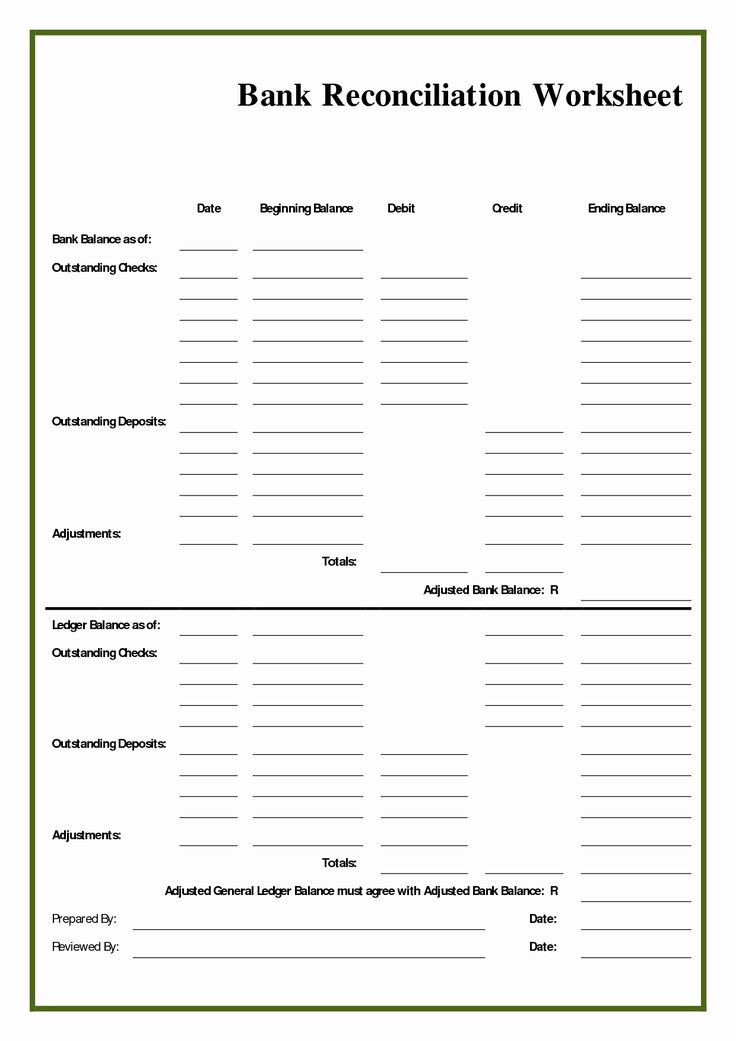

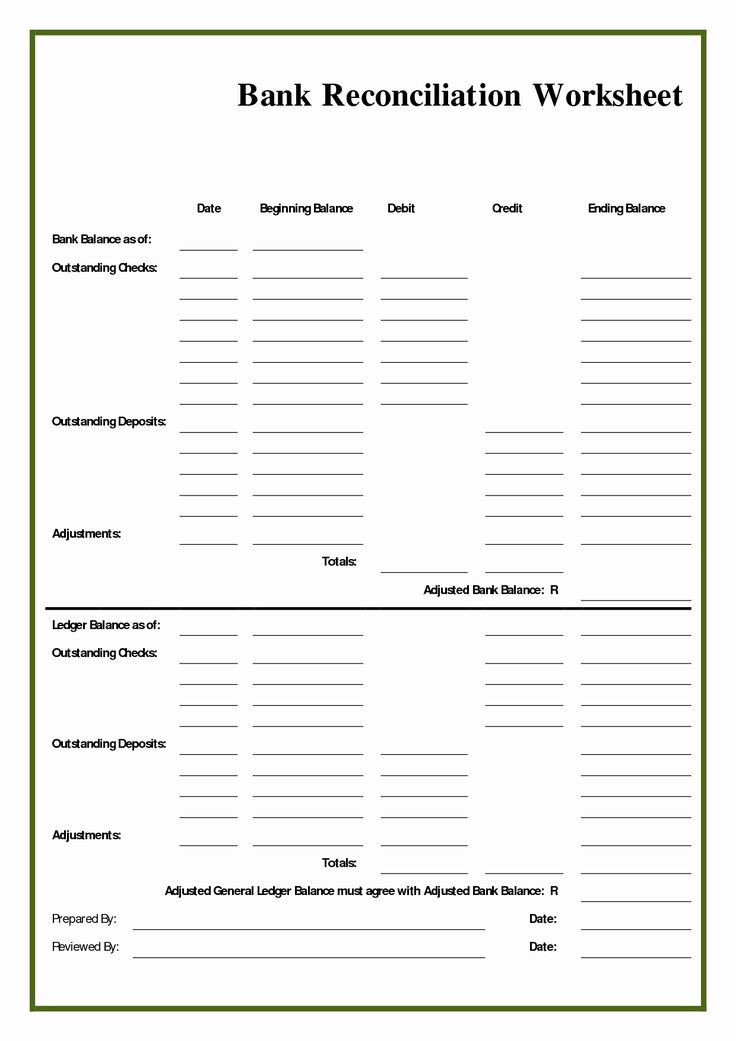

Use your reconciliation worksheet to:

Transaction Type Adjustment Needed Bank Service Fees Subtract from your ledger Interest Earned Add to your ledger Outstanding Checks List separately Deposits in Transit List separately

Account for Outstanding Transactions

List any checks that have not cleared or deposits that have not yet shown in the bank statement:

- Outstanding Checks: Deduct these from your ledger balance.

- Deposits in Transit: Add these to your bank balance.

Calculate Adjusted Balances

Here’s where the worksheet truly helps:

- Subtract any service fees and add interest earned to your ledger balance.

- Subtract outstanding checks and add deposits in transit to your bank balance.

- Ensure these adjusted balances are equal.

Identify and Resolve Discrepancies

If the adjusted balances do not match:

- Double-check your math.

- Review transactions again for any errors or missing items.

Record the Reconciliation

Once everything balances, make a note in your ledger that:

- This statement has been reconciled.

- Include any adjustments made.

Benefits of Using a Reconciliation Worksheet

A reconciliation worksheet offers several advantages:

- Provides a structured approach to ensure no step is missed.

- Keeps a clear record of adjustments made, helping with future audits or inquiries.

- Helps in identifying and resolving discrepancies promptly.

- Can be customized to your specific needs or business type.

💡 Note: Use a spreadsheet tool like Microsoft Excel or Google Sheets to create your worksheet for easier tracking and calculations.

In closing, reconciling your bank statements can be a straightforward process when equipped with the right tools and a methodical approach. Whether you're managing your personal finances or overseeing the books for a business, regular reconciliation ensures your financial records are accurate and your cash flow is well understood. This practice not only helps in detecting errors or fraud but also prepares you for any financial scrutiny, be it from tax authorities or auditors. With a simple reconciliation worksheet, you can streamline this process, ensuring that you stay on top of your financial health without unnecessary stress or complications.

How often should I reconcile my bank statements?

+

Monthly reconciliation is recommended for most individuals and small businesses. However, more frequent reconciliation might be necessary if you deal with numerous transactions or large sums of money.

What if my bank balance does not match my ledger even after adjustments?

+

Recheck all transactions, investigate any discrepancies, and consider contacting your bank for any missing or incorrect transactions. Sometimes, an error might be on the bank’s side, or there could be a timing issue with transactions.

Can I use software for bank reconciliation?

+

Yes, many accounting software tools offer automatic bank reconciliation features, syncing directly with your bank for easier and faster reconciliation. However, a manual check can still be beneficial for thorough oversight.