5 Essential Tax Deductions for Realtors 2023

Are you a real estate agent looking to maximize your savings on taxes for the year 2023? Understanding the deductions available to you can significantly reduce your taxable income. Let's delve into the 5 Essential Tax Deductions that realtors can claim, ensuring you keep more of your hard-earned money in your pocket.

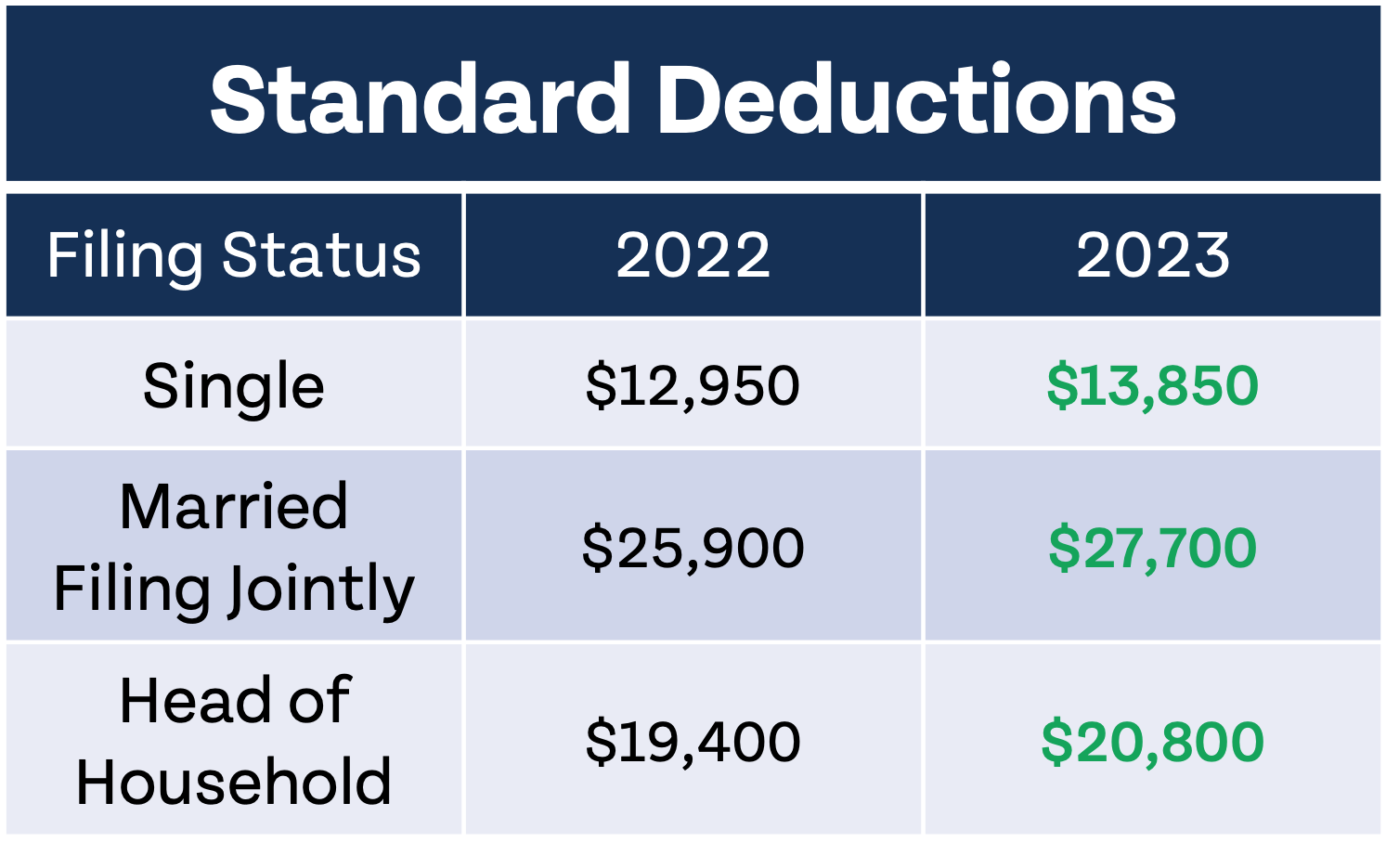

The Self-Employment Tax Deduction

As a self-employed realtor, you are responsible for both the employee and employer portion of social security and Medicare taxes. However, there's a deduction in place to help:

- Self-Employment Tax Deduction: You can deduct half of the self-employment tax you pay, effectively reducing your taxable income by this amount.

Home Office Deduction

Working from home comes with its perks, including tax savings:

- Regular and Exclusive Use: The space must be used regularly and exclusively for business.

- Home Office Expenses: Deductible expenses include mortgage interest, insurance, utilities, repairs, and depreciation.

To calculate this deduction:

- Measure the square footage of your office space and divide it by the total square footage of your home to get the percentage.

- Use this percentage to determine your deduction from allowable home expenses.

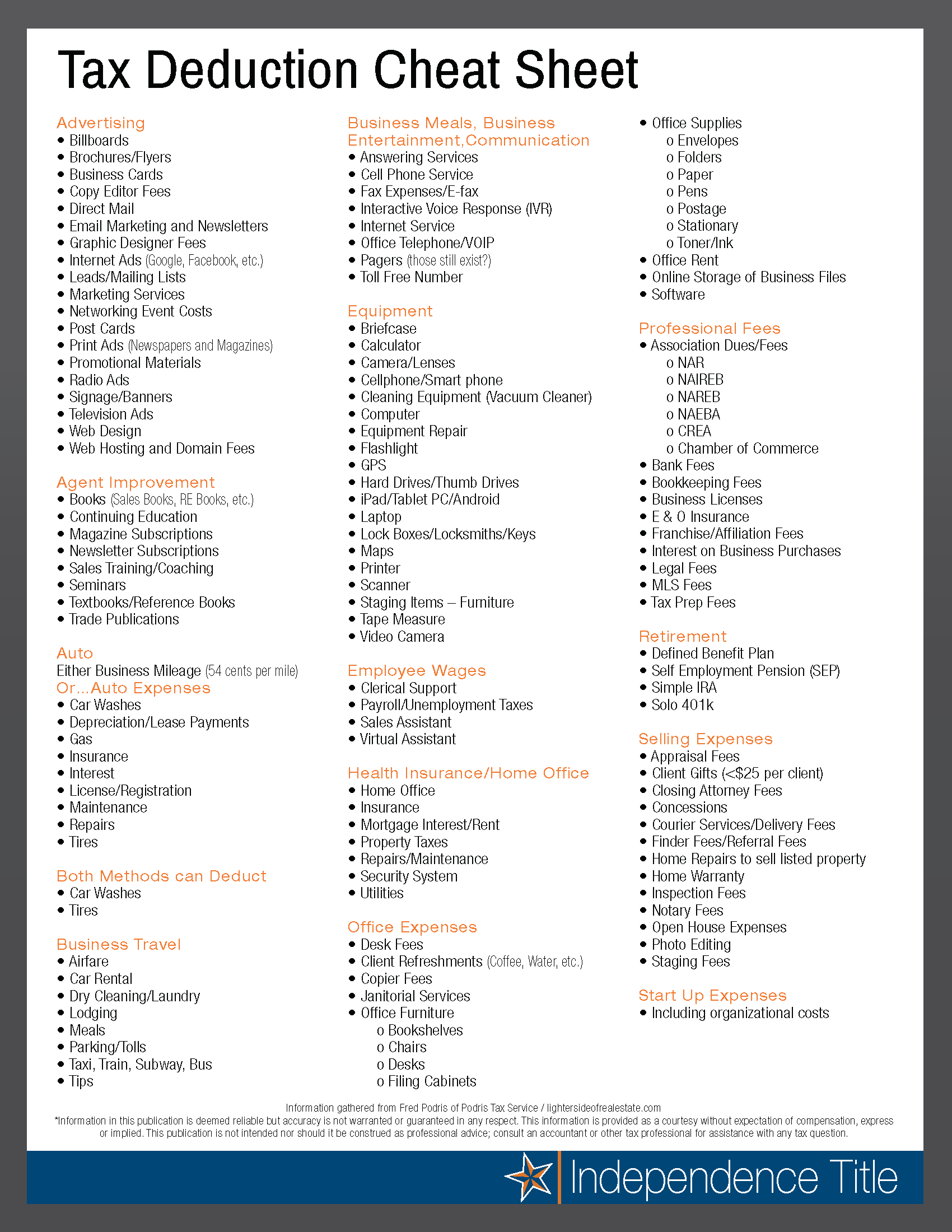

Marketing and Advertising Expenses

Realtors often spend a significant amount on marketing. Here's what you can claim:

- Advertising and Marketing Materials: Including business cards, signs, flyers, digital ads, and website development.

- Photography and Videography: For property listings.

- Commission on Sales: Paid to other agents for referrals.

💡 Note: Keep detailed records of these expenses as they are subject to scrutiny by the IRS.

Travel and Vehicle Expenses

Your vehicle plays a crucial role in your work as a realtor:

- Vehicle Expenses: You can deduct either actual expenses (including gas, maintenance, insurance, etc.) or use the standard mileage rate for business travel.

- Travel Expenses: Deductible travel costs include airfare, car rentals, lodging, and meals while away from your tax home on business.

| Expense Type | Deductible Amount |

|---|---|

| Mileage (2023) | $0.655 per mile |

| Meals | 50% of cost |

Professional Development and Education

Staying updated in the real estate industry often involves ongoing education:

- Education Costs: Expenses for courses, seminars, and workshops related to your real estate business.

- Licenses and Certifications: Fees for maintaining your real estate license or obtaining new certifications.

📌 Note: Keep track of all educational materials, receipts, and time spent learning, as these can add up for significant deductions.

Understanding and leveraging these deductions can make a substantial difference in your tax liability. Ensure you document everything meticulously, as the IRS requires substantiation for all claims. Remember, consulting a tax professional is always wise to optimize your tax strategy and ensure compliance with current tax laws. These deductions not only help in reducing your tax burden but also encourage you to reinvest in your business, ultimately fostering growth and sustainability.

Can I deduct my cell phone if I use it for business?

+

Yes, if you use your cell phone primarily for business, you can deduct the business-related portion of its expenses.

Is there a limit to the home office deduction?

+

The deduction is limited by the percentage of your home used for business, and the total amount of your home expenses that you’re claiming. Also, if your home office is your principal place of business, there’s no limit other than your actual expenses.

Can I write off clothing expenses if I wear suits for work?

+

No, general business attire that can be worn outside of work is not deductible. However, special uniforms or protective clothing required for your job can be claimed.