5 Proven Ramit Sethi Worksheets for Financial Growth

If you're on the hunt for a transformative journey in personal finance, you might already be familiar with Ramit Sethi, a renowned personal finance advisor, author, and creator of the I Will Teach You To Be Rich blog and podcast. Sethi's unique approach to managing money, rooted in psychological insights and practical steps, has made him a household name among those looking to master their financial lives. Today, we'll delve into five proven Ramit Sethi worksheets that can propel you towards significant financial growth.

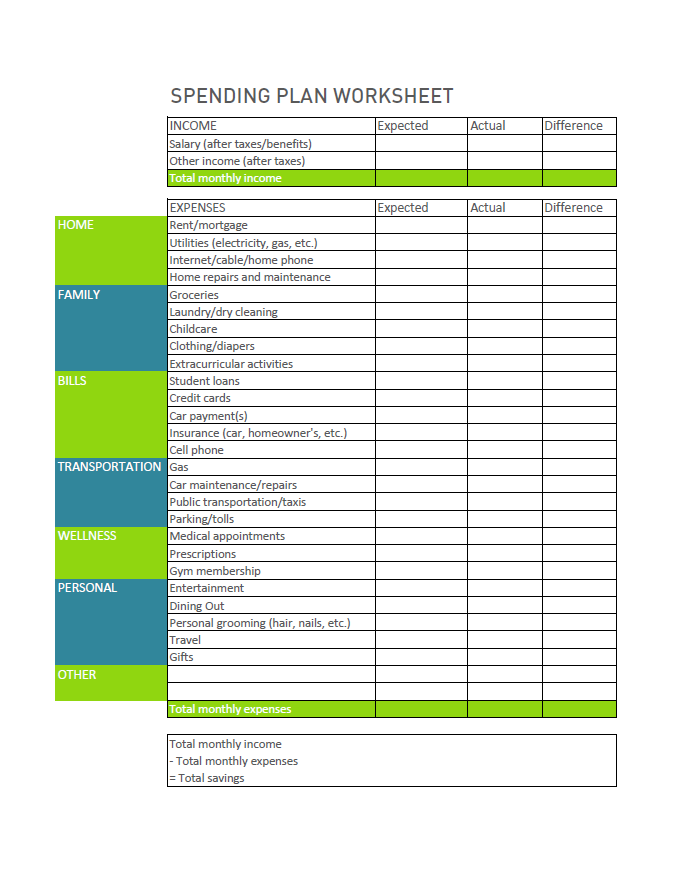

1. The Conscious Spending Plan

Ramit Sethi's Conscious Spending Plan is a pivotal tool for anyone aiming to control their finances rather than letting their finances control them. Here's how it works:

- Fixed Costs: These are your unavoidable monthly expenses like rent, utilities, and loans. Sethi suggests keeping these under 50% of your take-home pay.

- Long-Term Savings: Allocate 10% of your income for retirement, emergency funds, or big-ticket items.

- Investments: This 5%+ segment is for investments outside of retirement, such as stocks or starting a business.

- Guilt-Free Spending: This is where Sethi shines, promoting that around 35-40% of your income should be spent on what you love, guilt-free.

⚠️ Note: Adjust the percentages according to your financial situation and lifestyle goals.

2. The Automated Savings Worksheet

Automation is the secret weapon in Sethi's arsenal. Here's how you can benefit:

- Set up automatic transfers from your checking to savings accounts, retirement funds, and investment portfolios.

- Use tools like direct deposit to allocate funds before you can spend them.

- Schedule recurring bills to be paid automatically to avoid late fees.

3. The Rich Life Habits

The Rich Life Habits worksheet encourages the development of financial habits that ensure long-term wealth:

- Track Your Money: Use apps or spreadsheets to keep tabs on your income and expenditures.

- Invest in Learning: Continuously educate yourself about finance, personal development, and investing.

- Practice Patience: Financial growth is a marathon, not a sprint.

- Create Systems: Develop automated systems for savings, investments, and bill payments.

4. The 6-Week Money Challenge

Designed to jumpstart your financial growth, this worksheet provides weekly goals:

- Week 1: Track your spending to understand your financial habits.

- Week 2: Create a plan for your money using the Conscious Spending Plan.

- Week 3: Automate your finances, reducing the need for manual intervention.

- Week 4: Implement your first investment outside of retirement savings.

- Week 5: Practice a week of guilt-free spending within your allocated budget.

- Week 6: Review, adjust, and set new goals.

5. The Net Worth Tracker

This tool tracks your financial progress:

| Asset/Liability | Amount |

|---|---|

| Bank Accounts | $20,000 |

| Investments | $50,000 |

| Retirement Accounts | $30,000 |

| Mortgage | -$150,000 |

| Student Loans | -$40,000 |

| Total Net Worth | $90,000 |

By regularly updating this worksheet, you'll visually track your financial growth over time.

📈 Note: Regular updates to your Net Worth Tracker can help you spot trends and make strategic financial decisions.

In summary, Ramit Sethi’s worksheets provide a robust framework for anyone looking to enhance their financial literacy and wealth. By combining psychological insights with practical actions, Sethi’s methods foster a guilt-free, enjoyable approach to money management. From the Conscious Spending Plan that teaches you to spend wisely, to the Net Worth Tracker that visualizes your progress, these tools are instrumental in reshaping your financial life. Remember, the key to financial freedom isn’t just about saving; it’s about spending in a way that aligns with your values, automating your wealth growth, and keeping track of your progress to continually adjust your strategy.

What makes Ramit Sethi’s approach unique?

+

Ramit Sethi’s approach combines psychological understanding with practical financial strategies, promoting a life of ‘conscious’ spending where saving doesn’t mean giving up on enjoying life.

Can I really automate my savings?

+

Yes, automation is one of Sethi’s core principles. Tools like automatic transfers, direct deposits, and online banking can streamline your savings and investments.

How often should I review my Net Worth Tracker?

+

It’s advisable to review and update your Net Worth Tracker at least once every three months, or quarterly, to keep abreast of your financial progress.

What if I struggle with the 6-Week Money Challenge?

+

The challenge is a framework; adjust it to your needs. If it feels overwhelming, extend the time frame or focus on one or two steps at a time.