5 Essential Sections for Your Printable Estate Inventory Worksheet

When embarking on the monumental task of organizing your estate, a well-structured estate inventory worksheet can become your most valuable tool. This isn't just about keeping a list of what you own, but ensuring that your assets are accounted for, managed, and distributed as you wish after you're gone. Here are five essential sections that every printable estate inventory worksheet should have to help you navigate this process smoothly.

Section 1: Personal Information

Your estate inventory begins with you. Start with a clear, bold section header to detail your personal information:

- Name:

- Address:

- Date of Birth:

- Marital Status:

- Executor/Administrator Details: Include their name, contact information, and relationship to you.

🗒 Note: This section is crucial for identification and to establish the legal chain of command regarding your estate.

Section 2: Financial Assets

Next, we delve into your financial world, where clarity and detail are paramount:

| Asset Type | Institution | Account Number | Approximate Value |

|---|---|---|---|

| Savings Accounts | XYZ Bank | 12345678 | 50,000</td> </tr> <tr> <td>Retirement Accounts (401k, IRA, etc.)</td> <td>ABC Financial</td> <td>87654321</td> <td>300,000 |

| Investments (Stocks, Bonds, Mutual Funds) | DEF Investments | 567890 | $200,000 |

💡 Note: Accurately listing your financial assets helps executors and heirs understand your financial status at a glance.

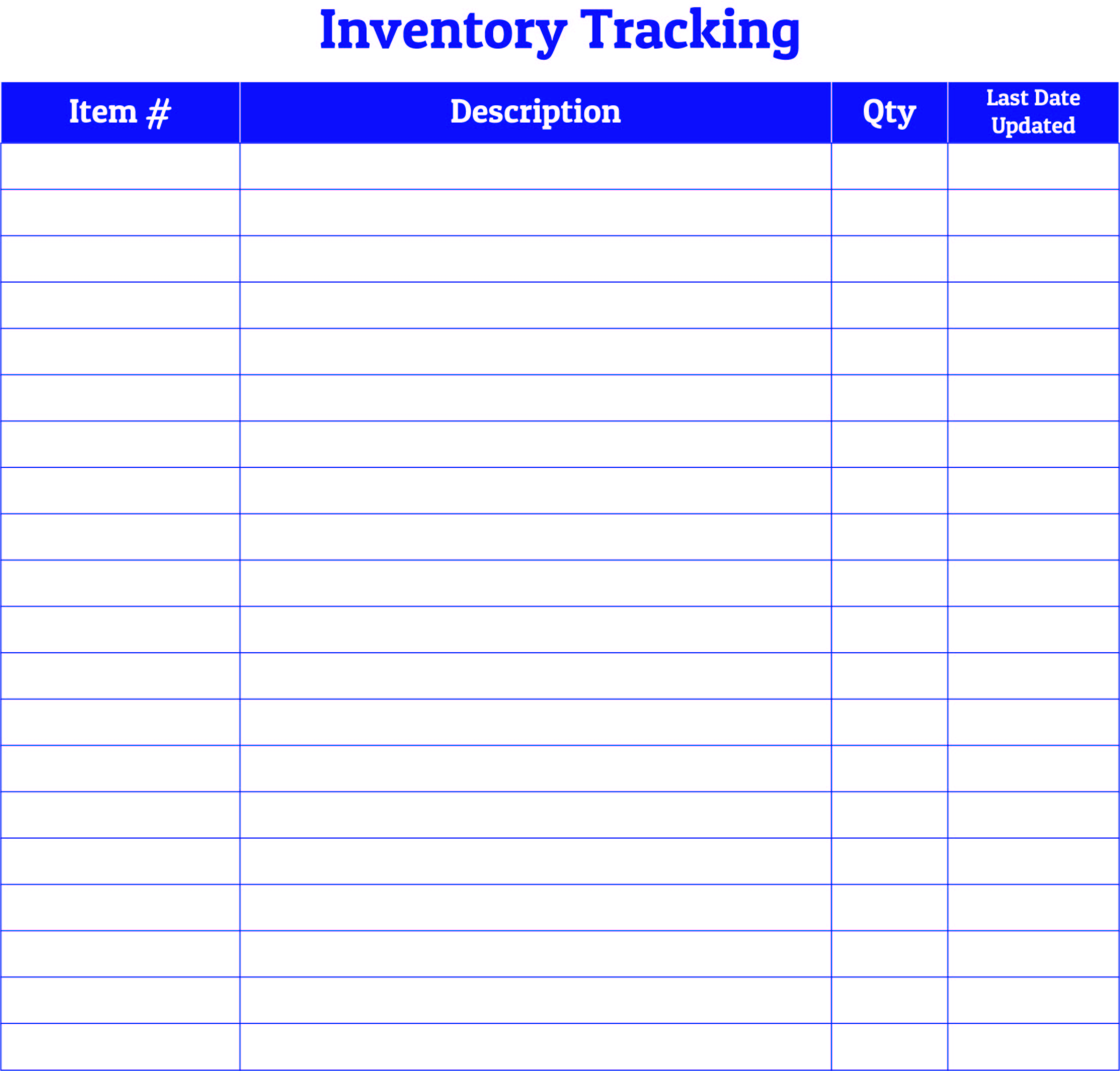

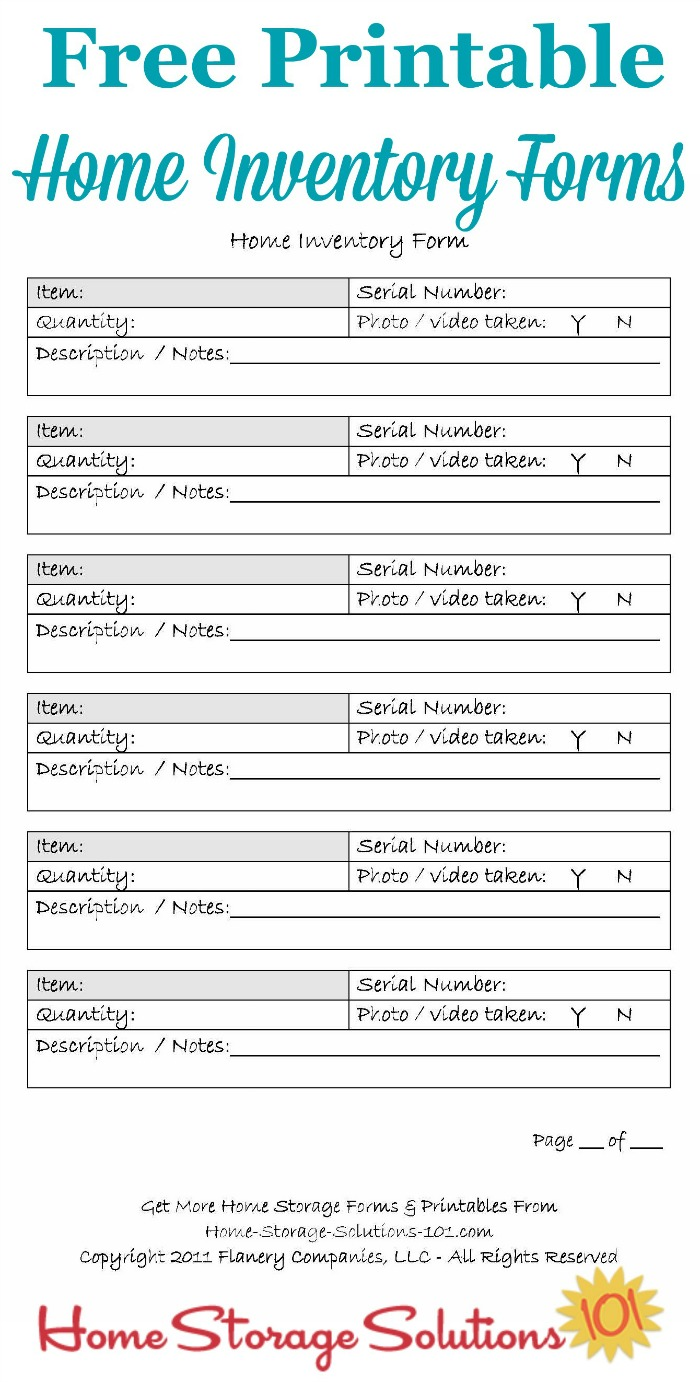

Section 3: Real and Personal Property

Property is often where most people’s wealth is tied up. Break this section down for better organization:

- Real Estate: Address, property type, mortgage details, approximate value.

- Vehicles: Make, model, year, registration, approximate value.

- Jewelry, Art, and Collections: Detailed description, estimated value.

- Household Items: Include valuable furniture, electronics, and heirlooms.

- Other Personal Property: Items like musical instruments or tools.

🎨 Note: Photos or descriptions can greatly assist in identifying these items after your passing.

Section 4: Debts and Liabilities

Understanding your debts is just as important as knowing your assets:

| Creditor | Type of Debt | Account Number | Outstanding Balance |

|---|---|---|---|

| Student Loan | Education Loan | 56473829 | 25,000</td> </tr> <tr> <td>Mortgage</td> <td>Home Loan</td> <td>98765432</td> <td>150,000 |

| Credit Card | Consumer Debt | 111222 | $5,000 |

Section 5: Beneficiaries and Specific Bequests

Arguably the most emotionally significant section, this details who gets what:

- Beneficiaries: Full names, relationship to you, and contact information.

- Specific Bequests: Describe items or money to be given to specific individuals.

- Residuary Clause: Instructions for remaining assets after specific bequests.

❤️ Note: This is where your final wishes are recorded, so be precise to avoid any ambiguity or conflict.

As we reach the end of our journey through creating an estate inventory worksheet, remember that the purpose of this document is to ease the burden on those left behind. By categorizing and detailing your assets, debts, and wishes, you provide clarity and direction to your executor and heirs. This comprehensive document not only helps in managing your estate but also ensures your legacy is carried out as you envision. Whether you're just starting to plan or are well into your estate planning, this worksheet is indispensable for a smooth transition of your estate.

Why is an estate inventory worksheet important?

+

An estate inventory worksheet provides a clear picture of your assets, liabilities, and final wishes, making estate administration easier and less contentious for those left behind.

Can I create an estate inventory worksheet myself?

+

Yes, you can start with templates available online or create one from scratch using basic tools like Microsoft Word or Google Docs, tailoring it to your specific needs.

What should I do if I update my estate?

+

Keep your estate inventory worksheet current. Update it whenever there are changes in your assets, debts, or beneficiary wishes.

Should I share my estate inventory with anyone?

+

Yes, share it with your executor or trusted family members. This helps prevent confusion and disputes after your passing, ensuring your wishes are carried out correctly.