New York Payroll Calculator

Introduction to New York Payroll Calculator

In the state of New York, managing payroll can be a complex task, especially for small businesses or individuals who are not familiar with the local laws and regulations. A New York payroll calculator is a useful tool that can help simplify the process of calculating employee wages, taxes, and deductions. This tool can save time and reduce errors, ensuring that employees are paid accurately and on time. In this article, we will explore the features and benefits of using a New York payroll calculator.

Features of a New York Payroll Calculator

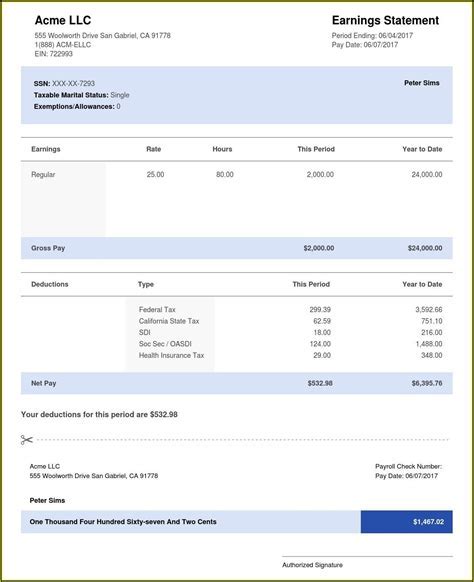

A typical New York payroll calculator will have the following features: * Gross-to-Net Calculation: Calculate the net pay of an employee based on their gross pay, taking into account federal, state, and local taxes. * Tax Rates: Apply the correct tax rates for New York state and local taxes, including the New York State Income Tax and New York City Income Tax. * Deductions: Calculate deductions for benefits, such as health insurance, 401(k), and other pre-tax deductions. * Overtime Pay: Calculate overtime pay based on the employee’s regular pay rate and the number of overtime hours worked. * Compliance: Ensure compliance with New York state and federal labor laws, including minimum wage and overtime regulations.

Benefits of Using a New York Payroll Calculator

Using a New York payroll calculator can have several benefits, including: * Accuracy: Reduce errors and ensure that employees are paid accurately and on time. * Time-Saving: Save time and effort by automating the payroll calculation process. * Compliance: Ensure compliance with New York state and federal labor laws, reducing the risk of fines and penalties. * Flexibility: Easily adjust payroll calculations to accommodate changes in employee pay rates, benefits, or deductions.

How to Use a New York Payroll Calculator

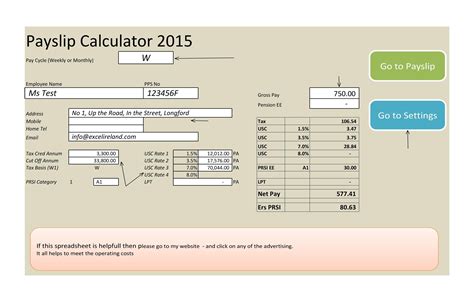

To use a New York payroll calculator, follow these steps: * Enter the employee’s gross pay and pay frequency (e.g., weekly, biweekly, monthly). * Select the correct tax rates for New York state and local taxes. * Enter any deductions or benefits, such as health insurance or 401(k) contributions. * Calculate the net pay and review the results to ensure accuracy.

📝 Note: It's essential to keep accurate records of payroll calculations and employee data to ensure compliance with labor laws and regulations.

Common Payroll Taxes in New York

In New York, employers are required to withhold and pay several types of taxes, including: * New York State Income Tax: Withheld from employee wages and paid to the state. * New York City Income Tax: Withheld from employee wages and paid to the city (only applies to employees working in New York City). * Federal Income Tax: Withheld from employee wages and paid to the federal government. * Federal Insurance Contributions Act (FICA) Tax: Withheld from employee wages and paid to the federal government to fund Social Security and Medicare.

| Tax Type | Tax Rate |

|---|---|

| New York State Income Tax | 4% - 8.82% |

| New York City Income Tax | 2.907% - 3.648% |

| Federal Income Tax | 10% - 37% |

| FICA Tax | 6.2% (Social Security) + 1.45% (Medicare) |

Conclusion and Final Thoughts

In conclusion, a New York payroll calculator is an essential tool for any business or individual managing payroll in the state of New York. By using a payroll calculator, employers can ensure accuracy, compliance, and efficiency in their payroll processing. It’s crucial to stay up-to-date with the latest tax rates and regulations to avoid errors and penalties. By following the steps outlined in this article and using a reliable payroll calculator, employers can simplify their payroll process and focus on growing their business.

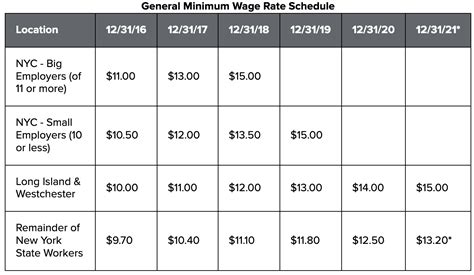

What is the minimum wage in New York State?

+

The minimum wage in New York State varies by location and industry. As of 2022, the minimum wage is $12.50 per hour in most areas, but it’s higher in New York City and some surrounding counties.

Do I need to withhold New York City Income Tax from my employees’ wages?

+

Yes, if your employees work in New York City, you are required to withhold New York City Income Tax from their wages. The tax rate ranges from 2.907% to 3.648%, depending on the employee’s income level.

Can I use a payroll calculator to calculate overtime pay?

+

Yes, a payroll calculator can help you calculate overtime pay based on the employee’s regular pay rate and the number of overtime hours worked. Make sure to select the correct overtime pay rate and rules for New York State.