MN Payroll Calculator Tool

Introduction to Payroll Calculators

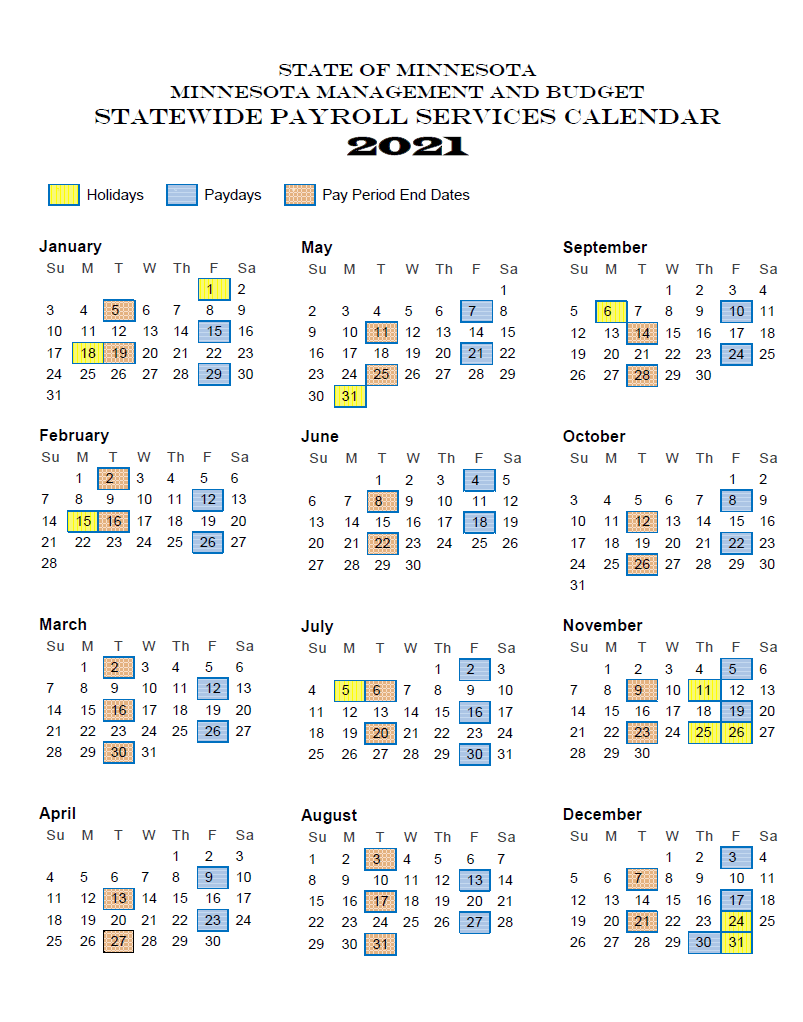

Payroll calculators are essential tools for businesses and individuals to calculate the net pay of employees after deducting taxes and other deductions. In the state of Minnesota, payroll calculators can help in determining the correct amount of taxes to be withheld from an employee’s paycheck. The MN Payroll Calculator Tool is designed to simplify the process of calculating payroll taxes and net pay for employees in Minnesota.

How Payroll Calculators Work

Payroll calculators work by taking into account various factors such as the employee’s gross pay, tax filing status, number of allowances, and other deductions. The calculator then applies the relevant tax rates and formulas to calculate the net pay. In Minnesota, the calculator must also consider the state income tax rates, which range from 5.35% to 9.85%. The calculator will also take into account other deductions such as social security tax, Medicare tax, and any other applicable deductions.

Benefits of Using a Payroll Calculator

Using a payroll calculator can have several benefits for businesses and individuals. Some of the benefits include: * Accuracy: Payroll calculators can help ensure accuracy in calculating payroll taxes and net pay, reducing the risk of errors and penalties. * Time-saving: Payroll calculators can save time and effort in calculating payroll taxes and net pay, allowing businesses to focus on other important tasks. * Compliance: Payroll calculators can help businesses comply with tax laws and regulations, reducing the risk of non-compliance and penalties. * Cost-effective: Payroll calculators can be a cost-effective solution for businesses, reducing the need for manual calculations and minimizing the risk of errors.

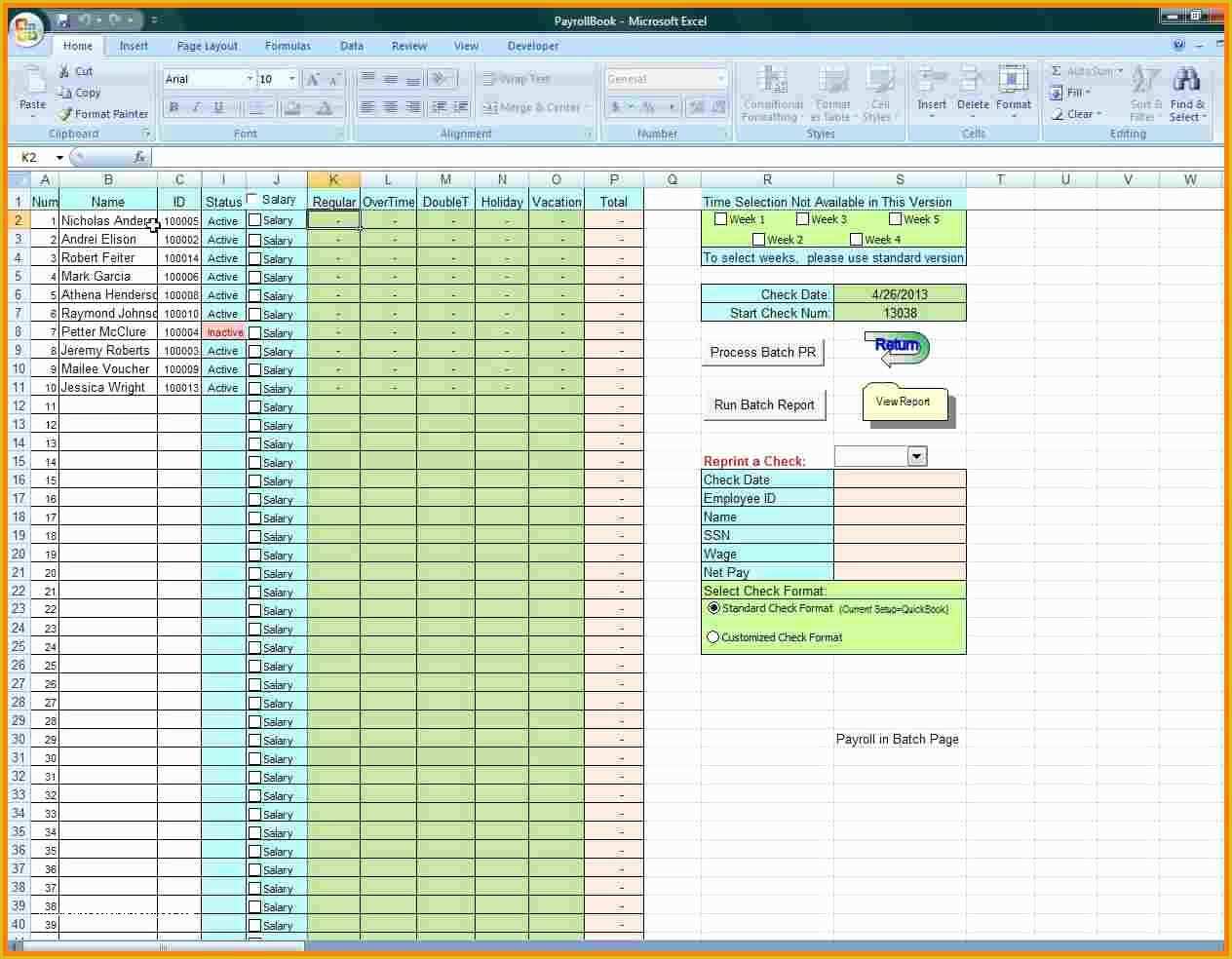

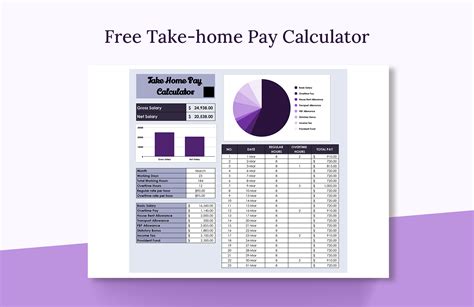

Features of the MN Payroll Calculator Tool

The MN Payroll Calculator Tool has several features that make it an essential tool for businesses and individuals in Minnesota. Some of the features include: * Gross pay calculator: The tool allows users to calculate the gross pay of employees based on their hourly wage or annual salary. * Tax calculator: The tool calculates the federal and state income taxes, social security tax, and Medicare tax based on the employee’s tax filing status and number of allowances. * Net pay calculator: The tool calculates the net pay of employees after deducting taxes and other deductions. * Deductions calculator: The tool allows users to calculate other deductions such as health insurance premiums, retirement contributions, and other benefits.

How to Use the MN Payroll Calculator Tool

Using the MN Payroll Calculator Tool is easy and straightforward. Here are the steps to follow: * Enter the employee’s gross pay or hourly wage * Select the employee’s tax filing status and number of allowances * Enter any other deductions such as health insurance premiums or retirement contributions * Click the calculate button to get the net pay and tax withholding amounts

📝 Note: The MN Payroll Calculator Tool is for estimation purposes only and should not be used as a substitute for professional tax advice.

Common Payroll Taxes in Minnesota

In Minnesota, there are several payroll taxes that employers must withhold from an employee’s paycheck. Some of the common payroll taxes include: * Federal income tax: The federal government requires employers to withhold federal income tax from an employee’s paycheck. * State income tax: Minnesota requires employers to withhold state income tax from an employee’s paycheck. * Social security tax: The federal government requires employers to withhold social security tax from an employee’s paycheck. * Medicare tax: The federal government requires employers to withhold Medicare tax from an employee’s paycheck.

| Tax Type | Tax Rate |

|---|---|

| Federal income tax | 10% - 37% |

| State income tax | 5.35% - 9.85% |

| Social security tax | 6.2% |

| Medicare tax | 1.45% |

In summary, the MN Payroll Calculator Tool is a useful tool for businesses and individuals in Minnesota to calculate payroll taxes and net pay. The tool takes into account various factors such as gross pay, tax filing status, and other deductions to provide an accurate calculation of net pay and tax withholding amounts. By using the MN Payroll Calculator Tool, businesses can ensure compliance with tax laws and regulations, reduce the risk of errors and penalties, and save time and effort in calculating payroll taxes and net pay.

What is the purpose of the MN Payroll Calculator Tool?

+

The MN Payroll Calculator Tool is designed to simplify the process of calculating payroll taxes and net pay for employees in Minnesota.

How does the MN Payroll Calculator Tool work?

+

The MN Payroll Calculator Tool works by taking into account various factors such as gross pay, tax filing status, and other deductions to calculate the net pay and tax withholding amounts.

What are the benefits of using the MN Payroll Calculator Tool?

+

The benefits of using the MN Payroll Calculator Tool include accuracy, time-saving, compliance, and cost-effectiveness.

Related Terms:

- Payroll calculator mn weekly

- Free payroll calculator mn

- Paycheck calculator MN hourly

- Payroll calculator mn gov

- Payroll calculator mn excel

- Minnesota income tax calculator