Michigan Payroll Calculator Tool

Introduction to Michigan Payroll Calculator Tool

The Michigan Payroll Calculator Tool is a valuable resource for employers and employees alike, providing an efficient way to calculate payroll taxes, deductions, and net pay. This tool takes into account the unique tax laws and regulations of the state of Michigan, ensuring accuracy and compliance. In this article, we will delve into the features and benefits of the Michigan Payroll Calculator Tool, as well as provide a step-by-step guide on how to use it.

Features of the Michigan Payroll Calculator Tool

The Michigan Payroll Calculator Tool is designed to simplify the payroll calculation process, offering a range of features that cater to the specific needs of Michigan employers and employees. Some of the key features include: * Accurate tax calculations: The tool takes into account Michigan state income tax rates, federal income tax rates, and other deductions to provide an accurate calculation of payroll taxes. * Customizable calculations: Users can input specific details such as gross pay, deductions, and exemptions to receive a personalized calculation. * Compliance with Michigan tax laws: The tool is updated regularly to reflect changes in Michigan tax laws and regulations, ensuring that users remain compliant. * User-friendly interface: The tool is designed to be easy to use, with a simple and intuitive interface that guides users through the calculation process.

Benefits of Using the Michigan Payroll Calculator Tool

The Michigan Payroll Calculator Tool offers numerous benefits to employers and employees, including: * Accuracy and compliance: The tool ensures that payroll calculations are accurate and compliant with Michigan tax laws, reducing the risk of errors and penalties. * Time-saving: The tool streamlines the payroll calculation process, saving users time and effort. * Increased transparency: The tool provides a clear breakdown of payroll taxes, deductions, and net pay, giving users a better understanding of their finances. * Improved budgeting: With accurate calculations, users can better manage their finances and make informed decisions about their budget.

How to Use the Michigan Payroll Calculator Tool

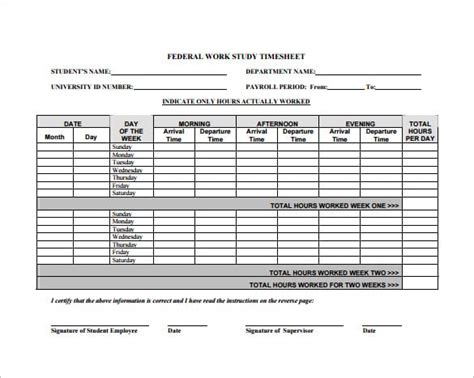

Using the Michigan Payroll Calculator Tool is a straightforward process that requires minimal input from users. Here’s a step-by-step guide: * Enter the employee’s gross pay * Select the pay frequency (e.g., weekly, bi-weekly, monthly) * Input any deductions or exemptions * Choose the correct tax filing status * Click “Calculate” to receive the payroll calculation

💡 Note: It's essential to ensure that all input information is accurate and up-to-date to receive an accurate calculation.

Michigan Tax Rates and Regulations

Michigan has a progressive income tax system, with tax rates ranging from 4.25% to 4.25%. The state also has a number of tax deductions and exemptions, including: * Personal exemption: 4,750 for single filers and 9,500 for joint filers * Standard deduction: 4,750 for single filers and 9,500 for joint filers * Michigan Earned Income Tax Credit (EITC): A refundable tax credit for low-income working individuals and families

| Taxable Income | Tax Rate |

|---|---|

| $0 - $9,999 | 4.25% |

| $10,000 - $19,999 | 4.25% |

| $20,000 and above | 4.25% |

In conclusion, the Michigan Payroll Calculator Tool is a valuable resource for employers and employees in Michigan, providing accurate and compliant payroll calculations. By understanding the features and benefits of the tool, as well as the tax laws and regulations of the state, users can better manage their finances and make informed decisions about their budget.

What is the Michigan Payroll Calculator Tool?

+

The Michigan Payroll Calculator Tool is a resource that provides accurate and compliant payroll calculations for employers and employees in Michigan.

How do I use the Michigan Payroll Calculator Tool?

+

To use the tool, simply enter the employee’s gross pay, select the pay frequency, input any deductions or exemptions, choose the correct tax filing status, and click “Calculate” to receive the payroll calculation.

What are the tax rates in Michigan?

+

Michigan has a progressive income tax system, with tax rates ranging from 4.25% to 4.25%.