5 Indiana Payroll Tips

Introduction to Indiana Payroll

Managing payroll in Indiana requires a thorough understanding of the state’s specific laws and regulations. As an employer, it’s crucial to stay compliant with these rules to avoid penalties and ensure a smooth payroll process. In this article, we’ll explore five essential Indiana payroll tips to help you navigate the complexities of payroll management in the state.

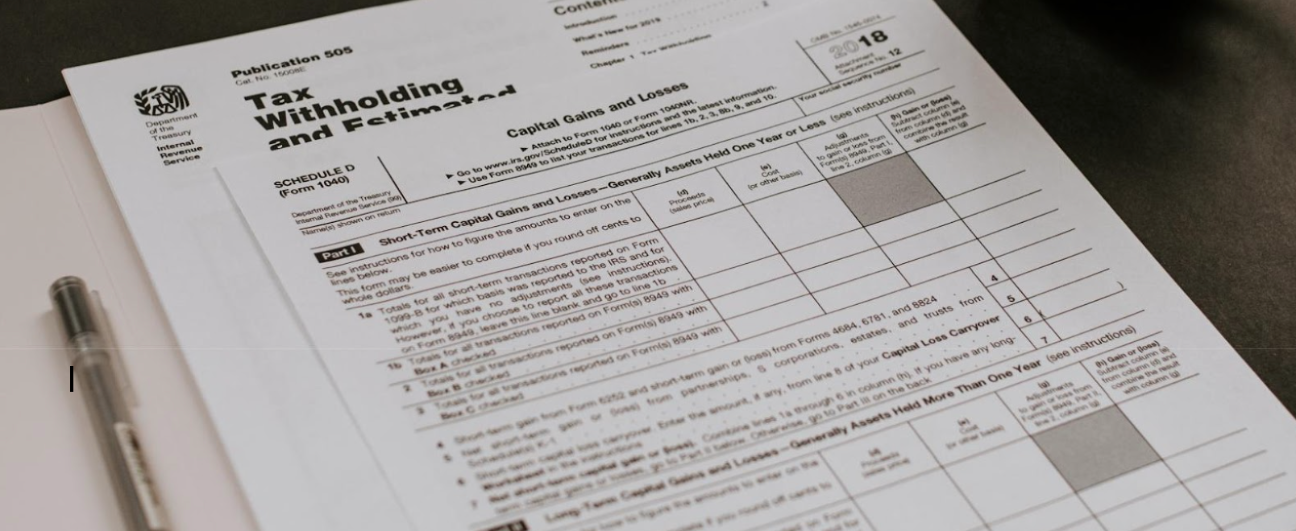

Tip 1: Understand Indiana Income Tax Withholding

Indiana requires employers to withhold state income tax from employees’ wages. The state has a flat income tax rate of 3.23%, which applies to all taxable income. Employers must also take into account any local income taxes, which can range from 0.1% to 3.38% depending on the location. It’s essential to familiarize yourself with the specific tax rates and regulations in your area to ensure accurate withholding.

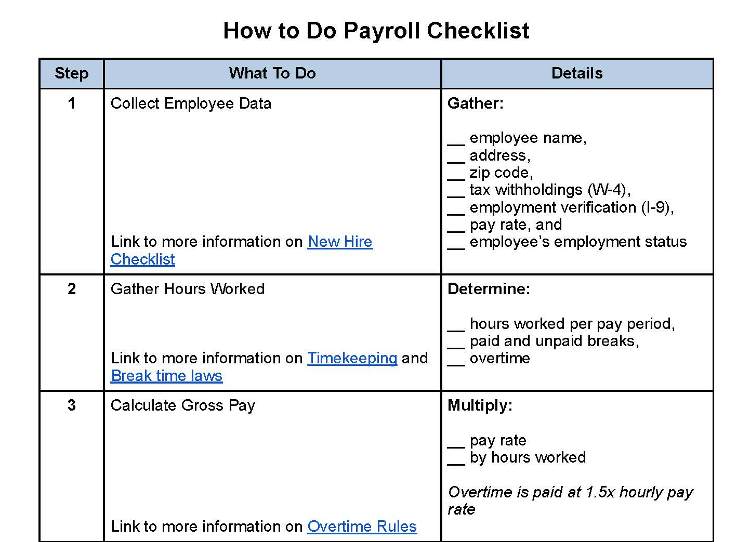

Tip 2: Familiarize Yourself with Indiana Labor Laws

Indiana labor laws dictate various aspects of employment, including minimum wage, overtime pay, and child labor laws. As of 2022, the minimum wage in Indiana is $7.25 per hour, which is the same as the federal minimum wage. Employers must also comply with overtime regulations, which require paying employees 1.5 times their regular rate for hours worked over 40 in a workweek. Understanding these laws is vital to maintaining a compliant and fair work environment.

Tip 3: Manage Unemployment Insurance and Workers’ Compensation

Indiana employers are required to contribute to the state’s unemployment insurance fund, which provides financial assistance to eligible employees who lose their jobs. The contribution rate varies depending on the employer’s experience rating, ranging from 2.5% to 9.5% of taxable wages. Additionally, employers must provide workers’ compensation insurance to cover work-related injuries and illnesses. It’s essential to understand the requirements and regulations surrounding these programs to ensure compliance and protect your business.

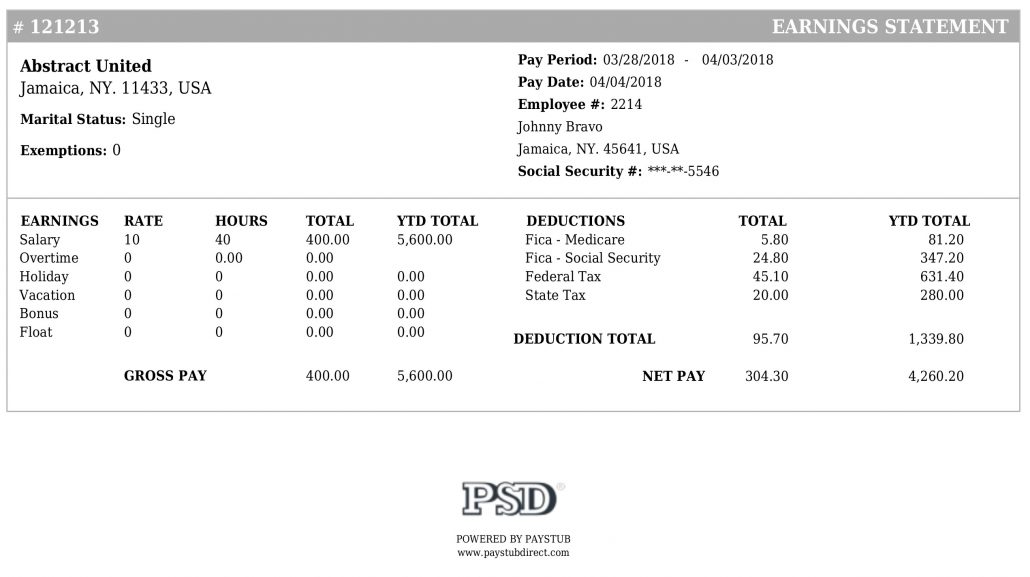

Tip 4: Stay Compliant with Payroll Record-Keeping Requirements

Indiana requires employers to maintain accurate and detailed payroll records, including: * Employee names, addresses, and Social Security numbers * Wage and hour information, including pay rates, hours worked, and deductions * Tax withholding and payment records * Benefit and leave information, including vacation, sick leave, and workers’ compensation Employers must retain these records for at least three years and make them available for inspection by state and federal authorities upon request.

Tip 5: Leverage Payroll Technology and Professional Services

To streamline your payroll process and ensure compliance with Indiana regulations, consider leveraging payroll technology and professional services. These solutions can help you: * Automate payroll calculations and tax withholding * Generate accurate and timely payroll reports * Stay up-to-date with changing regulations and laws * Reduce the risk of errors and penalties

| Payroll Task | Indiana Requirement |

|---|---|

| Income Tax Withholding | 3.23% state income tax rate, plus local taxes |

| Minimum Wage | $7.25 per hour |

| Overtime Pay | 1.5 times regular rate for hours worked over 40 |

| Unemployment Insurance | 2.5% to 9.5% of taxable wages |

| Workers' Compensation | Required for all employers |

📝 Note: It's essential to consult with a payroll professional or attorney to ensure compliance with all Indiana payroll regulations and laws.

In summary, managing payroll in Indiana requires a deep understanding of the state’s unique laws and regulations. By following these five tips, you can ensure compliance, reduce the risk of errors and penalties, and maintain a smooth and efficient payroll process. Remember to stay up-to-date with changing regulations and leverage payroll technology and professional services to streamline your operations.

What is the minimum wage in Indiana?

+

The minimum wage in Indiana is $7.25 per hour, which is the same as the federal minimum wage.

Do Indiana employers need to withhold state income tax?

+

Yes, Indiana employers are required to withhold state income tax from employees’ wages, with a flat rate of 3.23% plus any local taxes.

What is the purpose of workers’ compensation insurance in Indiana?

+

Workers’ compensation insurance provides financial assistance to eligible employees who suffer work-related injuries or illnesses, and is required for all Indiana employers.