Florida Payroll Calculator

Introduction to Florida Payroll Calculator

When it comes to managing payroll in Florida, employers need to consider various factors, including federal and state income taxes, deductions, and compliance with labor laws. A Florida Payroll Calculator can be a valuable tool for businesses to accurately calculate employee wages, taxes, and benefits. In this article, we will explore the features and benefits of using a Florida Payroll Calculator, as well as provide guidance on how to choose the right one for your business.

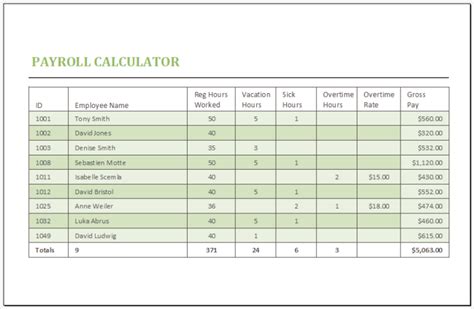

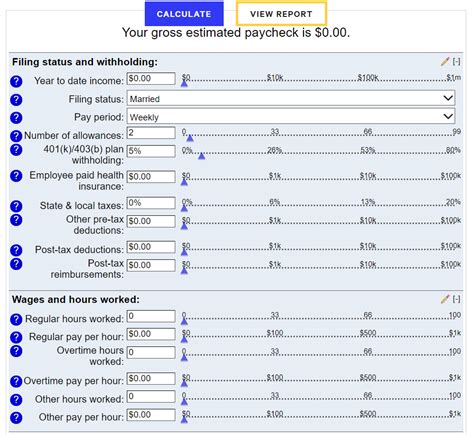

Key Features of a Florida Payroll Calculator

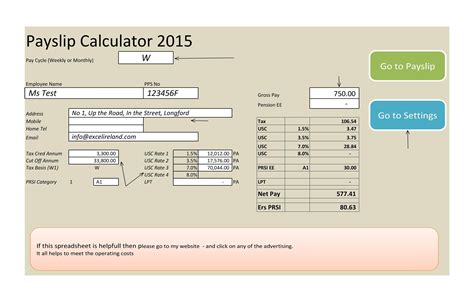

A reliable Florida Payroll Calculator should include the following key features: * Gross-to-Net Calculation: The ability to calculate take-home pay based on gross income, deductions, and taxes. * Federal and State Tax Withholding: Accurate calculation of federal and state income taxes, including Florida state income tax, which is 0% since Florida is one of the few states with no state income tax. * Deductions and Benefits: Calculation of deductions for health insurance, 401(k), and other benefits. * Compliance with Labor Laws: Ensures compliance with federal and state labor laws, including minimum wage, overtime, and paid time off. * Pay Stub Generation: The ability to generate pay stubs and other payroll reports.

Benefits of Using a Florida Payroll Calculator

Using a Florida Payroll Calculator can provide numerous benefits to employers, including: * Accuracy and Efficiency: Reduces errors and saves time in calculating payroll. * Compliance: Ensures compliance with federal and state labor laws, reducing the risk of penalties and fines. * Cost Savings: Can help reduce costs associated with manual payroll processing and minimize the risk of overpayment or underpayment of taxes. * Improved Employee Satisfaction: Provides accurate and timely payment to employees, improving satisfaction and reducing turnover.

How to Choose the Right Florida Payroll Calculator

When selecting a Florida Payroll Calculator, consider the following factors: * Ease of Use: A user-friendly interface that is easy to navigate and understand. * Accuracy and Reliability: A proven track record of accuracy and reliability in calculating payroll. * Customization: The ability to customize the calculator to meet the specific needs of your business. * Integration: The ability to integrate with other payroll software and systems. * Support and Training: Availability of support and training to ensure smooth implementation and use.

📝 Note: When choosing a Florida Payroll Calculator, it's essential to consider the specific needs of your business and ensure the calculator meets those needs.

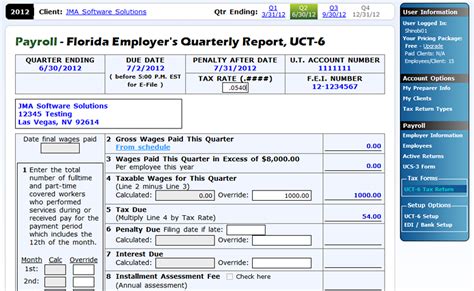

Common Payroll Taxes and Deductions in Florida

In Florida, employers must consider the following common payroll taxes and deductions: * Federal Income Tax: Withholding federal income tax from employee wages. * Social Security Tax: Withholding Social Security tax from employee wages. * Medicare Tax: Withholding Medicare tax from employee wages. * Health Insurance Premiums: Deducting health insurance premiums from employee wages. * 401(k) Contributions: Deducting 401(k) contributions from employee wages.

| Tax/Deduction | Rate |

|---|---|

| Federal Income Tax | Varies based on income level |

| Social Security Tax | 6.2% ( employer portion) |

| Medicare Tax | 1.45% (employer portion) |

| Health Insurance Premiums | Varies based on insurance plan |

| 401(k) Contributions | Varies based on employee contribution |

Best Practices for Using a Florida Payroll Calculator

To get the most out of a Florida Payroll Calculator, follow these best practices: * Regularly Update Employee Information: Ensure employee information, including wages, deductions, and benefits, is up-to-date and accurate. * Verify Calculations: Double-check calculations to ensure accuracy and catch any errors. * Comply with Labor Laws: Ensure compliance with federal and state labor laws, including minimum wage, overtime, and paid time off. * Provide Clear Communication: Provide clear and timely communication to employees regarding their pay, benefits, and deductions.

In summary, a Florida Payroll Calculator is an essential tool for employers to accurately calculate employee wages, taxes, and benefits. By choosing the right calculator and following best practices, employers can ensure compliance with labor laws, reduce errors, and improve employee satisfaction.

What is the purpose of a Florida Payroll Calculator?

+

The purpose of a Florida Payroll Calculator is to accurately calculate employee wages, taxes, and benefits, ensuring compliance with federal and state labor laws.

What are the key features of a Florida Payroll Calculator?

+

The key features of a Florida Payroll Calculator include gross-to-net calculation, federal and state tax withholding, deductions and benefits, compliance with labor laws, and pay stub generation.

How do I choose the right Florida Payroll Calculator for my business?

+

When choosing a Florida Payroll Calculator, consider factors such as ease of use, accuracy and reliability, customization, integration, and support and training.