5 Tips Paycheck Estimator GA

Introduction to Paycheck Estimator in Georgia

When it comes to managing your finances, understanding how much you can expect from your paycheck is crucial. This is where a paycheck estimator comes into play, particularly for those living in Georgia. A paycheck estimator is a tool designed to calculate your take-home pay based on your gross income, deductions, and other factors such as tax rates and benefits. For individuals in Georgia, utilizing a paycheck estimator can help in planning expenses, saving, and making informed financial decisions. Here are five tips on how to effectively use a paycheck estimator in GA.

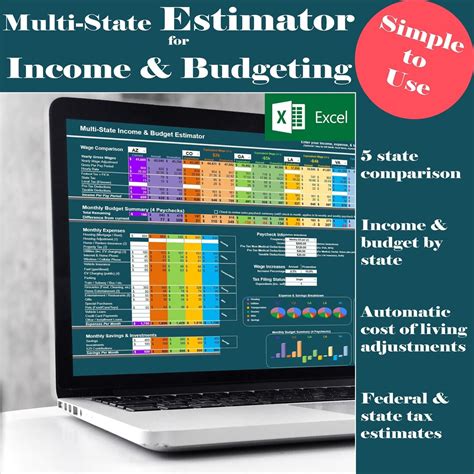

Understanding Your Gross Income

To start using a paycheck estimator, you first need to understand your gross income, which is the total amount of money you earn before any deductions. This includes your salary, wages, tips, and any other form of income. For Georgia residents, it’s essential to know that the state has a progressive income tax system, with rates ranging from 1% to 5.75%. Accurately inputting your gross income into a paycheck estimator will give you a more precise calculation of your net pay.

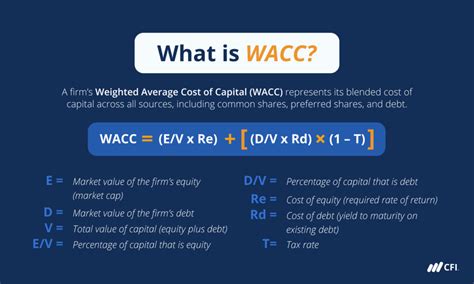

Considering Deductions and Benefits

Next, consider all the deductions and benefits that apply to your situation. Deductions can include federal and state taxes, social security taxes, health insurance premiums, and 401(k) contributions. Benefits might encompass items like health insurance, life insurance, and retirement plans. In Georgia, you might also want to account for any local taxes or specific deductions related to the state. A paycheck estimator will help you calculate how these deductions and benefits affect your take-home pay.

Utilizing Online Tools

There are numerous online paycheck estimators available, both from the state of Georgia and from private financial institutions. These tools are designed to be user-friendly, allowing you to input your income, deductions, and other relevant information to get an estimate of your net pay. Some popular options include the IRS Tax Withholding Estimator and paycheck calculators offered by financial institutions. When using these tools, ensure you have all necessary information at hand to get the most accurate estimate.

Adjusting Withholding

Another crucial aspect of using a paycheck estimator in GA is adjusting your withholding. If you find that you’re consistently getting a large refund, you might consider reducing your withholding to increase your take-home pay throughout the year. Conversely, if you owe taxes at the end of the year, you might need to increase your withholding to avoid penalties. A paycheck estimator can help you find the right balance, ensuring you’re not overpaying or underpaying your taxes.

Regularly Reviewing and Updating

Lastly, it’s essential to regularly review and update your paycheck estimates. Changes in income, job status, marital status, or the number of dependents can all impact your tax situation and, consequently, your take-home pay. By periodically using a paycheck estimator, you can adjust your financial plans accordingly, ensuring you’re always on top of your finances.

📝 Note: Always consult with a financial advisor or tax professional for personalized advice, as individual circumstances can significantly affect the accuracy of paycheck estimates.

In summary, a paycheck estimator is a valuable tool for anyone looking to manage their finances effectively in Georgia. By understanding your gross income, considering all deductions and benefits, utilizing online tools, adjusting your withholding, and regularly reviewing and updating your estimates, you can make informed decisions about your financial future.

What is the purpose of a paycheck estimator?

+

The purpose of a paycheck estimator is to calculate your take-home pay based on your gross income, deductions, and other factors, helping you plan your expenses and make informed financial decisions.

How do I use a paycheck estimator effectively?

+

To use a paycheck estimator effectively, you should accurately input your gross income, consider all deductions and benefits, utilize online tools, adjust your withholding as necessary, and regularly review and update your estimates.

What factors can affect the accuracy of a paycheck estimate?

+

Factors that can affect the accuracy of a paycheck estimate include changes in income, job status, marital status, the number of dependents, tax rates, and benefits. It’s essential to periodically update your estimates to reflect any changes in your financial situation.