5 Texas Paycheck Tips

Understanding Texas Paycheck Laws

In Texas, paycheck laws are designed to protect employees from unfair labor practices, ensuring they receive fair compensation for their work. Employers must adhere to these laws to avoid penalties and legal issues. Texas paycheck laws cover various aspects, including minimum wage, overtime pay, and paycheck frequency. It’s essential for both employers and employees to understand these laws to maintain a positive and compliant work environment.

Minimum Wage and Overtime Pay

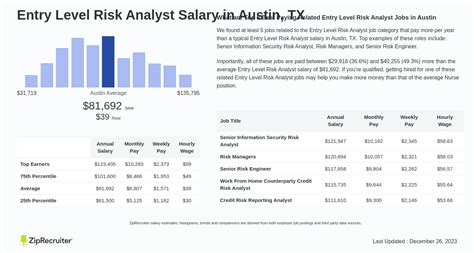

The minimum wage in Texas is $7.25 per hour, which is the same as the federal minimum wage. Employers must pay their employees at least this amount for all hours worked. However, some employees, such as those who receive tips, may be paid a lower minimum wage, as long as their tips make up the difference. Overtime pay is also an essential aspect of Texas paycheck laws. Employers must pay their employees 1.5 times their regular rate for all hours worked over 40 in a workweek.

Paycheck Frequency and Methods

In Texas, employers are not required to pay their employees on a specific schedule, such as weekly or biweekly. However, they must pay their employees at least once a month, and the pay period must be consistent. Paycheck methods also vary, and employers can pay their employees using cash, check, or direct deposit. However, employees must agree to any method other than cash or check.

Tips for Employees

Here are some tips for employees to ensure they receive fair compensation: * Keep track of your hours worked and pay rate to ensure you’re being paid correctly. * Understand your employer’s payroll policies and procedures. * Report any errors or discrepancies in your pay to your employer promptly. * Know your rights under Texas paycheck laws and don’t hesitate to seek help if you feel you’re being taken advantage of.

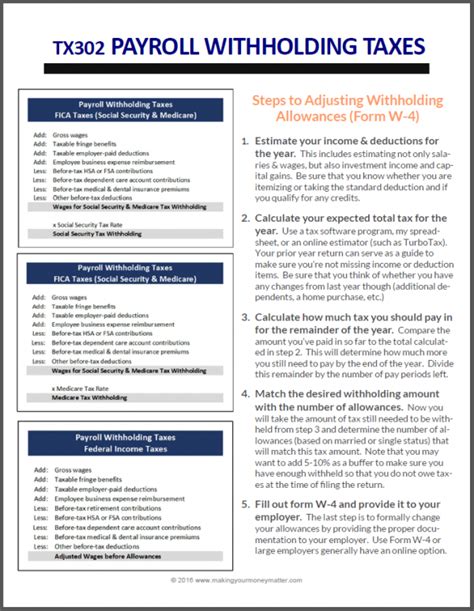

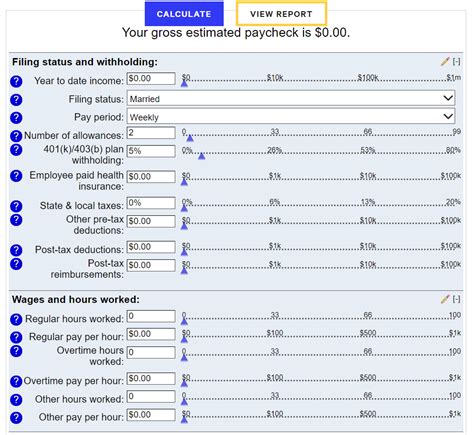

Tips for Employers

Here are some tips for employers to ensure they’re complying with Texas paycheck laws: * Develop a clear and consistent payroll policy. * Keep accurate records of employee hours worked and pay rates. * Ensure you’re paying your employees at least the minimum wage and overtime pay when required. * Provide your employees with a clear understanding of their pay and any deductions.

📝 Note: Employers should always consult with a legal expert or HR professional to ensure they're complying with all applicable laws and regulations.

Common Paycheck Errors

Here are some common paycheck errors that employers should avoid: * Underpaying or overpaying employees * Failing to pay overtime * Making incorrect deductions * Not providing employees with a clear understanding of their pay

To avoid these errors, employers should: * Use a reliable payroll system * Double-check calculations and deductions * Provide employees with a clear and concise explanation of their pay * Regularly review and update payroll policies and procedures

| Paycheck Error | Consequence |

|---|---|

| Underpaying employees | Legal penalties and damage to employer-employee relationships |

| Failing to pay overtime | Legal penalties and financial losses |

| Making incorrect deductions | Legal penalties and financial losses |

As the workplace continues to evolve, it’s essential for both employers and employees to stay informed about Texas paycheck laws and best practices. By doing so, they can maintain a positive and compliant work environment, avoid legal issues, and ensure fair compensation for all employees.

In summary, understanding and complying with Texas paycheck laws is crucial for both employers and employees. By following the tips and guidelines outlined above, employers can ensure they’re providing fair compensation and avoiding legal issues, while employees can protect their rights and receive the pay they deserve. Ultimately, a positive and compliant work environment benefits everyone involved.

What is the minimum wage in Texas?

+

The minimum wage in Texas is $7.25 per hour, which is the same as the federal minimum wage.

How often must employers pay their employees in Texas?

+

Employers in Texas must pay their employees at least once a month, and the pay period must be consistent.

What are some common paycheck errors that employers should avoid?

+

Common paycheck errors that employers should avoid include underpaying or overpaying employees, failing to pay overtime, making incorrect deductions, and not providing employees with a clear understanding of their pay.