5 Paycheck Tips

Introduction to Paycheck Management

Managing one’s paycheck effectively is a crucial aspect of personal finance. It involves understanding how to allocate income wisely, save for the future, and avoid unnecessary expenses. In this article, we will delve into five essential paycheck tips designed to help individuals optimize their financial management skills.

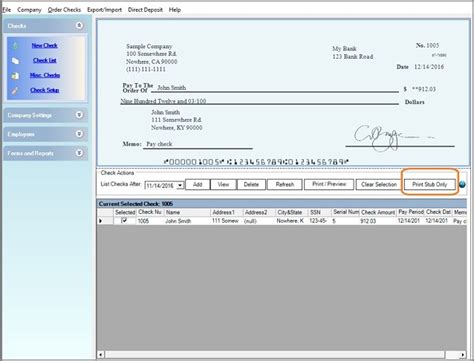

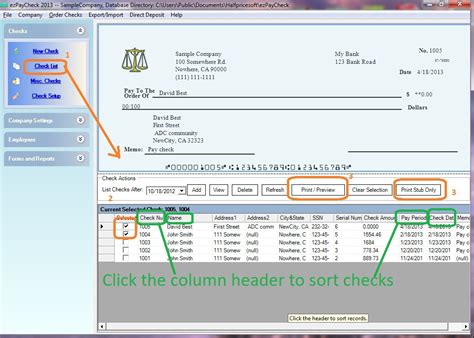

Understanding Your Paycheck

Before we dive into the tips, it’s essential to understand the components of a paycheck. A typical paycheck includes gross income, taxes, deductions, and net income. Gross income is the total amount earned before any deductions, while net income is the amount taken home after all deductions have been made. Taxes and deductions can significantly impact the net income, so it’s crucial to understand how they work.

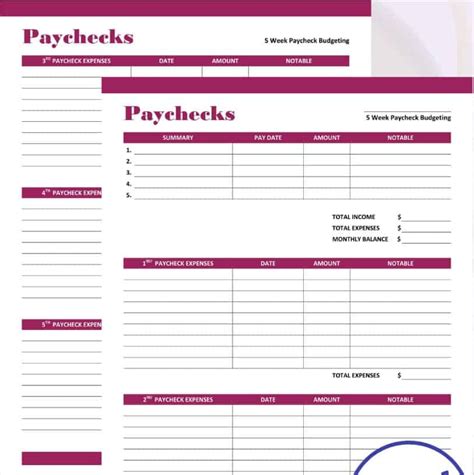

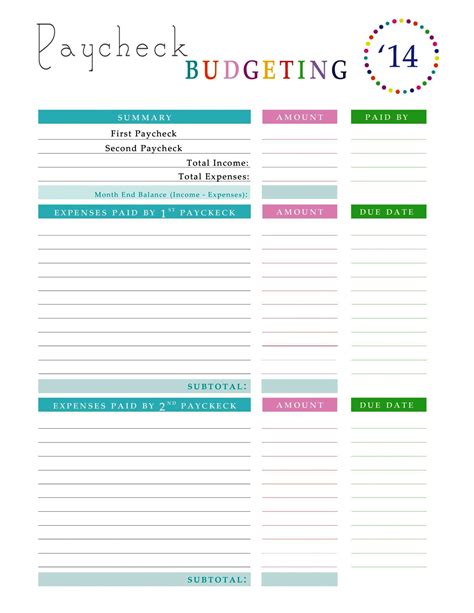

Tip 1: Create a Budget

The first step in managing your paycheck is to create a budget. A budget helps you allocate your income into different categories, such as rent, utilities, food, and entertainment. To create an effective budget, follow these steps: * Calculate your net income * List all your expenses * Categorize your expenses into needs and wants * Allocate your income accordingly A well-planned budget will help you prioritize your spending and ensure that you’re saving enough for the future.

Tip 2: Prioritize Needs Over Wants

It’s essential to differentiate between needs and wants when allocating your income. Needs include essential expenses like rent, utilities, and food, while wants include discretionary expenses like entertainment and hobbies. Prioritizing needs over wants will help you avoid unnecessary expenses and ensure that you’re saving enough for the future.

Tip 3: Save for Emergencies

Saving for emergencies is a crucial aspect of paycheck management. It’s recommended to save at least 3-6 months’ worth of expenses in an easily accessible savings account. This fund will help you cover unexpected expenses, such as car repairs or medical bills, without going into debt.

Tip 4: Take Advantage of Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k) or IRA, can help you save for retirement while reducing your taxable income. Contributing to these accounts can also help you save on taxes, which can increase your net income. It’s essential to understand the rules and regulations surrounding these accounts and to contribute as much as possible.

Tip 5: Review and Adjust Your Budget Regularly

Finally, it’s essential to review and adjust your budget regularly. This will help you stay on track with your financial goals and make adjustments as needed. You can use the 50/30/20 rule as a guideline, where 50% of your income goes towards needs, 30% towards wants, and 20% towards saving and debt repayment.

💡 Note: It's essential to avoid lifestyle inflation, where your spending increases as your income increases. Instead, focus on saving and investing your money to achieve long-term financial goals.

To summarize, managing your paycheck effectively requires understanding your income, creating a budget, prioritizing needs over wants, saving for emergencies, taking advantage of tax-advantaged accounts, and reviewing and adjusting your budget regularly. By following these tips, you can optimize your financial management skills and achieve long-term financial stability.

What is the 50/30/20 rule?

+

The 50/30/20 rule is a guideline for allocating your income, where 50% goes towards needs, 30% towards wants, and 20% towards saving and debt repayment.

Why is it essential to save for emergencies?

+

Saving for emergencies helps you cover unexpected expenses without going into debt, ensuring that you can maintain your financial stability.

How can I prioritize needs over wants?

+

To prioritize needs over wants, make a list of your expenses and categorize them into needs and wants. Then, allocate your income accordingly, ensuring that you’re covering all your essential expenses before spending on discretionary items.