Oklahoma Paycheck Calculator

Introduction to Oklahoma Paycheck Calculator

Calculating paychecks can be a complex task, especially when considering the various taxes and deductions that apply to each employee’s paycheck. In Oklahoma, employers must navigate state and federal laws to ensure accurate and compliant payroll processing. A paycheck calculator is a valuable tool for Oklahoma employers, helping them to simplify the payroll process and avoid costly errors. In this article, we will explore the features and benefits of an Oklahoma paycheck calculator, as well as provide guidance on how to use one effectively.

How to Use an Oklahoma Paycheck Calculator

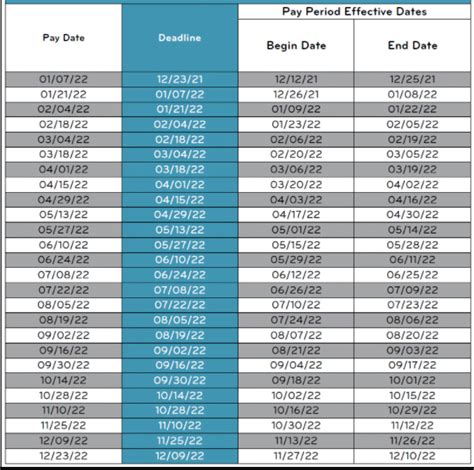

Using an Oklahoma paycheck calculator is a straightforward process that involves entering relevant employee data, such as gross pay, tax withholding, and benefit deductions. The calculator then applies the applicable tax rates and deductions to generate an accurate net pay amount. Here are the steps to follow: * Enter the employee’s gross pay amount, which includes their regular pay, overtime, and any other forms of compensation. * Select the employee’s filing status and number of allowances to determine their federal income tax withholding. * Enter the employee’s state tax withholding amount, if applicable. * Add any benefit deductions, such as health insurance, 401(k), or other pre-tax deductions. * Enter any other deductions, such as garnishments or union dues. * Click the “Calculate” button to generate the employee’s net pay amount.

Features of an Oklahoma Paycheck Calculator

A good Oklahoma paycheck calculator should include the following features: * Tax withholding calculations: The calculator should be able to accurately calculate federal, state, and local tax withholding amounts based on the employee’s filing status, number of allowances, and gross pay amount. * Benefit deductions: The calculator should allow for the entry of pre-tax benefit deductions, such as health insurance, 401(k), and other benefits. * Other deductions: The calculator should also allow for the entry of other deductions, such as garnishments, union dues, and other post-tax deductions. * Gross-to-net calculations: The calculator should be able to generate an accurate net pay amount based on the employee’s gross pay and deductions. * Compliance with Oklahoma laws: The calculator should be compliant with Oklahoma state laws and regulations, including those related to minimum wage, overtime, and tax withholding.

Benefits of Using an Oklahoma Paycheck Calculator

Using an Oklahoma paycheck calculator can provide several benefits to employers, including: * Accuracy: A paycheck calculator can help ensure accurate payroll processing and reduce the risk of errors. * Compliance: A calculator can help employers comply with Oklahoma state laws and regulations, reducing the risk of fines and penalties. * Efficiency: A calculator can simplify the payroll process, saving time and reducing administrative burdens. * Cost savings: A calculator can help employers avoid costly errors and reduce the need for manual calculations.

💡 Note: It's essential to choose a reputable and reliable paycheck calculator to ensure accuracy and compliance with Oklahoma laws and regulations.

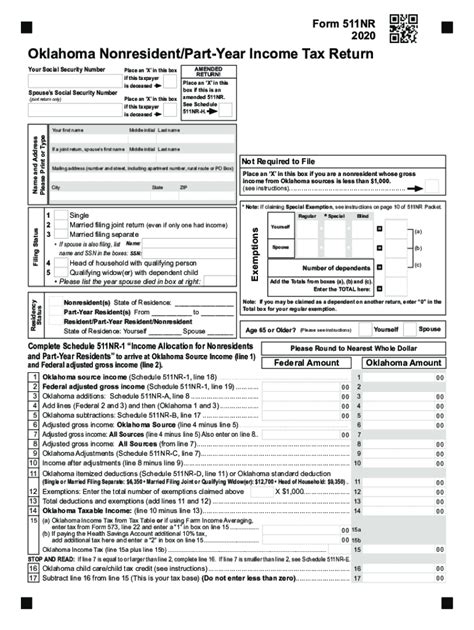

Oklahoma Payroll Taxes and Deductions

Oklahoma employers must navigate a range of payroll taxes and deductions, including: * Federal income tax withholding: Employers must withhold federal income tax from employee paychecks based on their filing status and number of allowances. * State income tax withholding: Oklahoma employers must also withhold state income tax from employee paychecks, if applicable. * Social Security tax: Employers must withhold Social Security tax from employee paychecks and pay a matching amount. * Medicare tax: Employers must also withhold Medicare tax from employee paychecks and pay a matching amount. * Unemployment tax: Oklahoma employers must pay unemployment tax to fund state unemployment programs.

| Tax Type | Tax Rate |

|---|---|

| Federal Income Tax | 10% - 37% |

| Oklahoma State Income Tax | 0.87% - 5% |

| Social Security Tax | 6.2% |

| Medicare Tax | 1.45% |

Common Oklahoma Payroll Mistakes to Avoid

Oklahoma employers should be aware of the following common payroll mistakes to avoid: * Inaccurate tax withholding: Failing to accurately withhold federal, state, and local taxes can result in costly errors and penalties. * Incorrect benefit deductions: Failing to accurately deduct pre-tax benefits, such as health insurance and 401(k), can result in errors and penalties. * Insufficient record-keeping: Failing to maintain accurate and complete payroll records can make it difficult to resolve errors and disputes. * Non-compliance with Oklahoma laws: Failing to comply with Oklahoma state laws and regulations, including those related to minimum wage, overtime, and tax withholding, can result in fines and penalties.

In summary, an Oklahoma paycheck calculator is a valuable tool for employers, helping them to simplify the payroll process, ensure accuracy and compliance, and avoid costly errors. By understanding the features and benefits of a paycheck calculator, as well as the common payroll mistakes to avoid, Oklahoma employers can ensure accurate and compliant payroll processing.

What is the purpose of an Oklahoma paycheck calculator?

+

The purpose of an Oklahoma paycheck calculator is to simplify the payroll process and ensure accurate and compliant payroll processing.

What features should I look for in an Oklahoma paycheck calculator?

+

You should look for features such as tax withholding calculations, benefit deductions, gross-to-net calculations, and compliance with Oklahoma laws and regulations.

How can I avoid common Oklahoma payroll mistakes?

+

You can avoid common Oklahoma payroll mistakes by using a reputable and reliable paycheck calculator, maintaining accurate and complete payroll records, and ensuring compliance with Oklahoma laws and regulations.