5 Nevada Paycheck Tips

Understanding Nevada Paycheck Laws

Nevada paycheck laws are designed to protect employees from unfair labor practices, ensuring they receive their rightful earnings. Employers must comply with these regulations to avoid penalties and legal issues. In this article, we will delve into five essential Nevada paycheck tips that both employees and employers should be aware of.

Nevada Paycheck Tip 1: Minimum Wage Requirements

Nevada’s minimum wage is $9.30 per hour for employees who do not receive health benefits, and $8.00 per hour for those who do receive health benefits. Employers must pay their employees at least the minimum wage for all hours worked. It’s crucial for employees to understand their rights regarding minimum wage and for employers to ensure they are meeting these requirements to avoid any potential lawsuits.

Nevada Paycheck Tip 2: Overtime Pay

In Nevada, overtime pay is required for employees who work more than 40 hours in a workweek. The overtime rate is 1.5 times the employee’s regular rate of pay. For example, if an employee earns 10 per hour, their overtime rate would be 15 per hour. Employers must accurately track employee hours and pay the correct overtime rate to comply with Nevada labor laws.

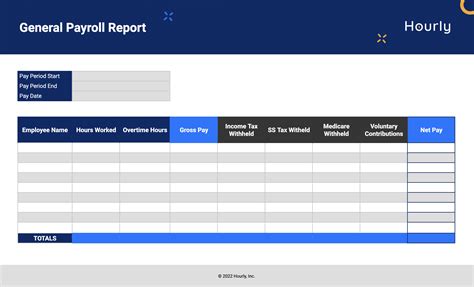

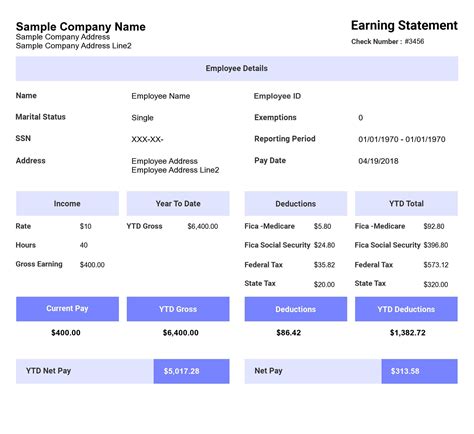

Nevada Paycheck Tip 3: Pay Stub Requirements

Nevada law requires employers to provide employees with itemized pay stubs that include specific information, such as: * Gross earnings * Deductions * Net pay * Hours worked * Rate of pay * Pay period dates * Employer’s name and address * Employee’s name and address Employers must ensure that pay stubs are accurate and include all required information to avoid potential issues.

Nevada Paycheck Tip 4: Final Paycheck Laws

When an employee leaves a job, either due to termination or resignation, Nevada law requires employers to provide the employee with their final paycheck within a certain timeframe. For example, if an employee is terminated, the employer must provide the final paycheck within three days. If an employee resigns, the employer has seven days to provide the final paycheck. Employers must comply with these regulations to avoid penalties.

Nevada Paycheck Tip 5: Record-Keeping Requirements

Employers in Nevada are required to maintain accurate records of employee hours, wages, and other payroll information. These records must be kept for a minimum of three years and be available for inspection by the Nevada Labor Commissioner. Employers should ensure that their record-keeping systems are compliant with Nevada labor laws to avoid potential issues.

📝 Note: Employers should consult with a qualified attorney or HR professional to ensure compliance with all Nevada labor laws and regulations.

To summarize, Nevada paycheck laws are in place to protect employees and ensure they receive fair compensation for their work. Employers must comply with minimum wage requirements, overtime pay laws, pay stub regulations, final paycheck laws, and record-keeping requirements. By understanding and following these laws, employers can avoid potential issues and create a positive work environment for their employees.

What is the minimum wage in Nevada?

+

The minimum wage in Nevada is 9.30 per hour for employees who do not receive health benefits, and 8.00 per hour for those who do receive health benefits.

How often must employers provide employees with pay stubs?

+

Employers must provide employees with itemized pay stubs with each payment of wages.

What is the penalty for not complying with Nevada labor laws?

+

The penalty for not complying with Nevada labor laws can include fines, back pay, and other damages. Employers should consult with a qualified attorney or HR professional to ensure compliance.