Military

NC Paycheck Calculator

Introduction to NC Paycheck Calculator

The NC Paycheck Calculator is a tool designed to help employees in North Carolina calculate their take-home pay. Understanding one’s paycheck is essential for managing personal finances effectively. This calculator takes into account various factors that affect net pay, including gross income, tax deductions, and benefits. In this article, we will delve into the details of how the NC Paycheck Calculator works and provide a step-by-step guide on how to use it.

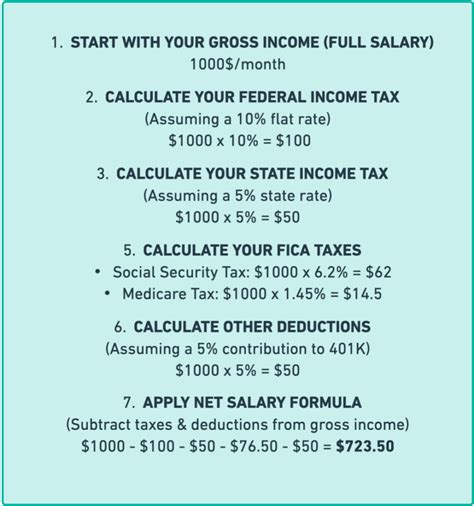

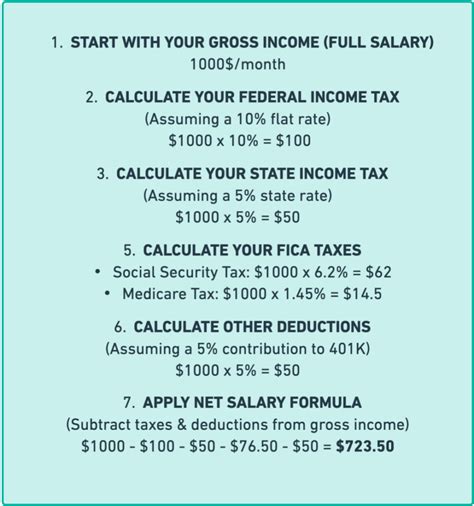

How the NC Paycheck Calculator Works

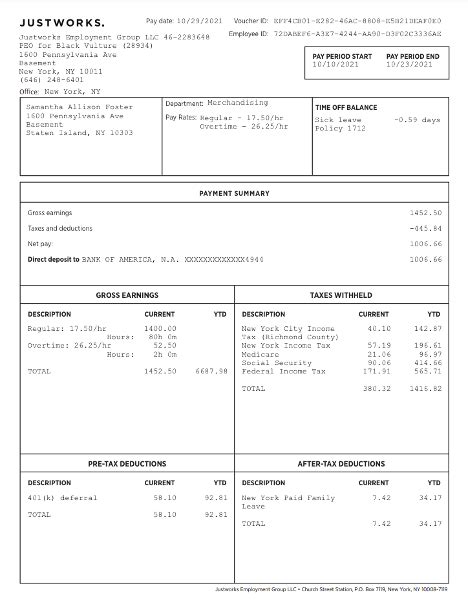

The NC Paycheck Calculator is based on a complex algorithm that considers several factors, including: * Gross income: The total amount of money earned before any deductions. * Federal income tax: The amount of tax withheld from the paycheck based on the employee’s tax filing status and number of allowances. * State income tax: The amount of tax withheld from the paycheck based on North Carolina’s state income tax rates. * Local taxes: Some cities and counties in North Carolina may have additional taxes that are withheld from the paycheck. * Deductions: These include health insurance premiums, 401(k) contributions, and other benefit deductions. * Benefits: These include vacation time, sick leave, and holidays.

Using the NC Paycheck Calculator

To use the NC Paycheck Calculator, follow these steps: * Enter your gross income per pay period. * Select your tax filing status (single, married, head of household, etc.). * Enter the number of allowances you claim on your W-4 form. * Enter any additional income you receive, such as bonuses or commissions. * Enter any deductions you have, such as health insurance premiums or 401(k) contributions. * Select your pay frequency (bi-weekly, monthly, etc.).

📝 Note: It's essential to have your most recent pay stub and tax documents handy when using the NC Paycheck Calculator to ensure accuracy.

Benefits of Using the NC Paycheck Calculator

Using the NC Paycheck Calculator can help you: * Understand your paycheck: By seeing how much of your gross income goes towards taxes and deductions, you can better manage your finances. * Plan for taxes: The calculator can help you estimate how much you’ll owe in taxes or if you’ll receive a refund. * Make informed decisions: By seeing how different scenarios affect your take-home pay, you can make informed decisions about your finances.

Tax Rates in North Carolina

North Carolina has a progressive tax system, with tax rates ranging from 4% to 5.25%. The tax rates are as follows:

| Taxable Income | Tax Rate |

|---|---|

| 0 - 12,750</td> <td>4%</td> </tr> <tr> <td>12,751 - 20,250</td> <td>4.25%</td> </tr> <tr> <td>20,251 - 60,000</td> <td>4.75%</td> </tr> <tr> <td>60,001 and above | 5.25% |

Conclusion and Final Thoughts

In conclusion, the NC Paycheck Calculator is a valuable tool for employees in North Carolina to calculate their take-home pay. By understanding how the calculator works and using it effectively, individuals can make informed decisions about their finances and plan for taxes. Remember to always consult with a tax professional or financial advisor for personalized advice.

What is the NC Paycheck Calculator?

+

The NC Paycheck Calculator is a tool designed to help employees in North Carolina calculate their take-home pay.

How does the NC Paycheck Calculator work?

+

The calculator takes into account various factors, including gross income, tax deductions, and benefits, to estimate the user’s take-home pay.

What are the tax rates in North Carolina?

+

North Carolina has a progressive tax system, with tax rates ranging from 4% to 5.25%.