5 Ways Missouri Paycheck Calculator

Understanding the Importance of a Missouri Paycheck Calculator

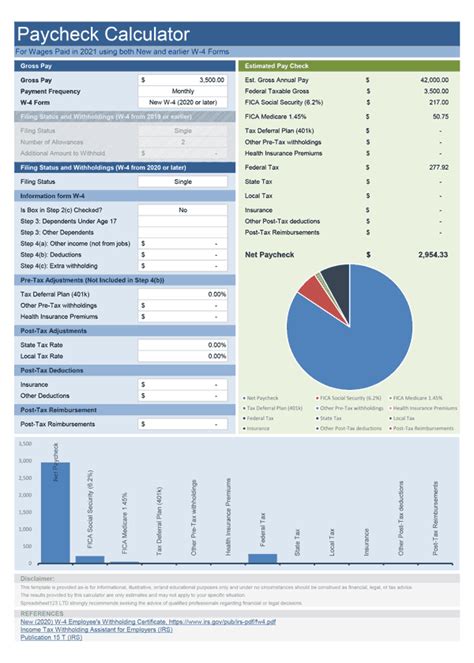

When it comes to managing finances, having the right tools can make a significant difference. For individuals living in Missouri, a paycheck calculator can be an invaluable resource. A Missouri paycheck calculator is designed to help individuals calculate their take-home pay, considering various factors such as gross income, tax deductions, and benefits. In this article, we will explore five ways a Missouri paycheck calculator can be beneficial for individuals and businesses alike.

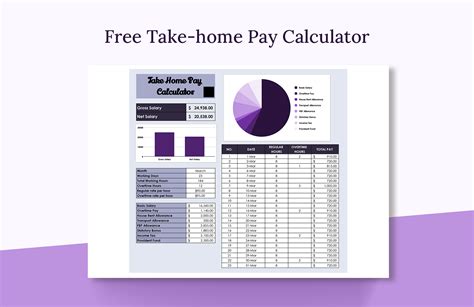

1. Accurate Calculation of Take-Home Pay

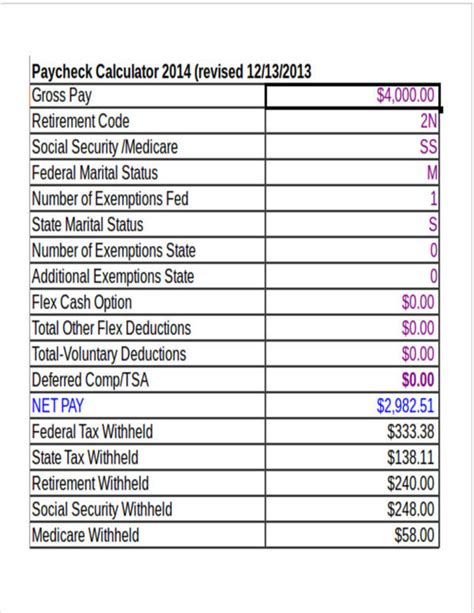

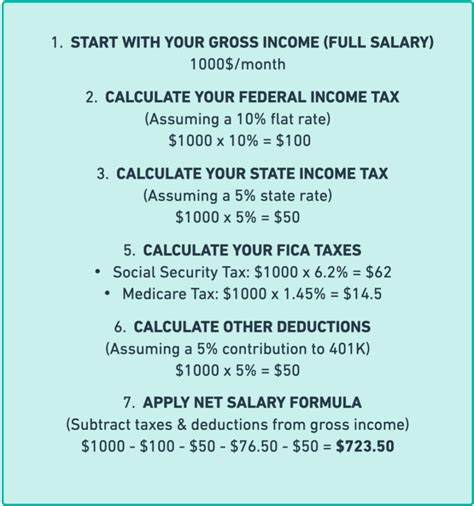

One of the primary benefits of using a Missouri paycheck calculator is that it provides an accurate calculation of take-home pay. By considering factors such as federal income tax, state income tax, and local taxes, the calculator can give individuals a clear understanding of their net income. This information can be useful for creating a personal budget and making informed financial decisions. For example, an individual can use the calculator to determine how much of their paycheck will go towards taxes and other deductions, allowing them to plan accordingly.

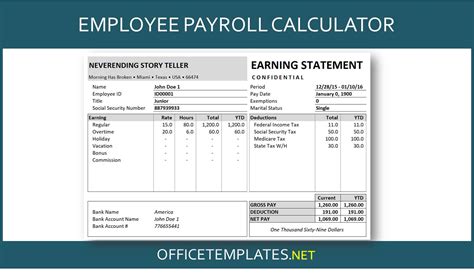

2. Simplifying Payroll Processing for Businesses

For businesses operating in Missouri, a paycheck calculator can simplify the payroll processing procedure. By using a calculator, employers can quickly and accurately determine the net pay for each employee, taking into account various deductions and benefits. This can help reduce errors and ensure compliance with tax laws and regulations. Additionally, a Missouri paycheck calculator can help businesses save time and resources, allowing them to focus on other aspects of their operations.

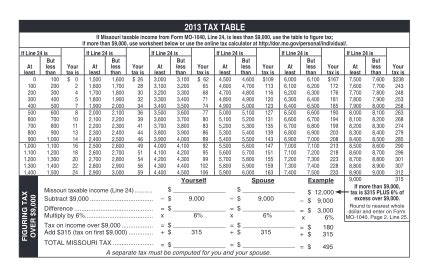

3. Estimating Taxes and Deductions

A Missouri paycheck calculator can also be used to estimate taxes and deductions. By inputting their gross income and other relevant information, individuals can get an estimate of their tax liability and other deductions. This can be useful for tax planning and making informed decisions about their finances. For instance, an individual can use the calculator to determine how much they will owe in taxes and plan accordingly, avoiding any potential tax penalties.

4. Comparing Salary Offers

When considering job offers, a Missouri paycheck calculator can be a valuable tool. By using the calculator to compare the take-home pay of different job offers, individuals can make informed decisions about which offer is best for them. This can be particularly useful when comparing offers from different states or regions, as tax rates and laws can vary significantly. For example, an individual can use the calculator to compare the take-home pay of a job offer in Missouri to one in a neighboring state, taking into account the different tax rates and laws.

5. Budgeting and Financial Planning

Finally, a Missouri paycheck calculator can be a useful tool for budgeting and financial planning. By accurately calculating take-home pay and estimating taxes and deductions, individuals can create a personal budget that takes into account their unique financial situation. This can help individuals prioritize their spending, save for the future, and achieve their long-term financial goals. For instance, an individual can use the calculator to determine how much they can afford to spend on housing, transportation, and other expenses, ensuring that they stay within their means.

💡 Note: When using a Missouri paycheck calculator, it's essential to ensure that the calculator is up-to-date and takes into account the latest tax laws and regulations.

To further illustrate the benefits of a Missouri paycheck calculator, consider the following table:

| Gross Income | Federal Income Tax | State Income Tax | Net Pay |

|---|---|---|---|

| $50,000 | $10,000 | $2,500 | $37,500 |

| $75,000 | $15,000 | $3,750 | $56,250 |

In summary, a Missouri paycheck calculator is a valuable tool for individuals and businesses alike. By providing accurate calculations of take-home pay, simplifying payroll processing, estimating taxes and deductions, comparing salary offers, and aiding in budgeting and financial planning, the calculator can help individuals make informed financial decisions and achieve their long-term goals.

What is a Missouri paycheck calculator?

+

A Missouri paycheck calculator is a tool used to calculate an individual’s take-home pay, considering factors such as gross income, tax deductions, and benefits.

How can a Missouri paycheck calculator benefit businesses?

+

A Missouri paycheck calculator can benefit businesses by simplifying payroll processing, reducing errors, and ensuring compliance with tax laws and regulations.

Can a Missouri paycheck calculator be used for tax planning?

+

Yes, a Missouri paycheck calculator can be used to estimate taxes and deductions, making it a useful tool for tax planning and making informed financial decisions.