5 KY Paycheck Tips

Understanding Your Paycheck

When it comes to managing your finances, one of the most critical aspects is understanding your paycheck. Your paycheck is not just about the amount of money you take home but also about the various deductions and contributions that are made from your salary. In this blog post, we will discuss five key paycheck tips that will help you make the most of your hard-earned money.

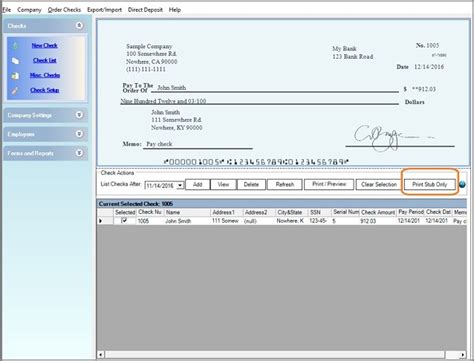

Tip 1: Review Your Pay Stub

The first step to understanding your paycheck is to review your pay stub. Your pay stub is a document that provides a detailed breakdown of your salary, deductions, and contributions. It’s essential to review your pay stub regularly to ensure that all the information is accurate and up-to-date. Some of the key things to look out for on your pay stub include: * Gross income: This is the total amount of money you earn before any deductions are made. * Net income: This is the amount of money you take home after all deductions have been made. * Taxes: This includes federal, state, and local taxes that are deducted from your salary. * Benefits: This includes contributions to health insurance, retirement plans, and other benefits. * Deductions: This includes any other deductions that are made from your salary, such as garnishments or court-ordered payments.

Tip 2: Understand Your Tax Withholding

Tax withholding is an essential aspect of your paycheck. The amount of taxes that are withheld from your salary depends on your tax filing status, the number of allowances you claim, and your income level. It’s crucial to understand how tax withholding works and to review your withholding regularly to ensure that you’re not overpaying or underpaying your taxes. Some of the key things to consider when it comes to tax withholding include: * Tax brackets: This refers to the different levels of income that are subject to different tax rates. * Tax deductions: This refers to the various expenses that can be deducted from your taxable income. * Tax credits: This refers to the various credits that can be claimed against your tax liability.

Tip 3: Take Advantage of Benefits

Many employers offer various benefits to their employees, such as health insurance, retirement plans, and flexible spending accounts. These benefits can provide significant tax savings and help you manage your finances more effectively. Some of the key benefits to consider include: * Health insurance: This provides coverage for medical expenses and can help you avoid significant out-of-pocket costs. * Retirement plans: This includes 401(k), IRA, and other plans that allow you to save for retirement on a tax-deferred basis. * Flexible spending accounts: This allows you to set aside pre-tax dollars for expenses such as childcare, education, and medical expenses.

Tip 4: Manage Your Deductions

Deductions can have a significant impact on your take-home pay. It’s essential to manage your deductions carefully to ensure that you’re not overpaying or underpaying your taxes. Some of the key deductions to consider include: * Garnishments: This refers to court-ordered payments that are deducted from your salary. * Child support: This refers to payments that are made to support a child or children. * Student loan payments: This refers to payments that are made to repay student loans.

Tip 5: Review and Adjust

Finally, it’s essential to review and adjust your paycheck regularly to ensure that you’re making the most of your hard-earned money. This includes reviewing your pay stub, tax withholding, benefits, and deductions to ensure that everything is accurate and up-to-date. Some of the key things to consider when reviewing and adjusting your paycheck include: * Changes in income: This can impact your tax withholding and deductions. * Changes in benefits: This can impact your take-home pay and tax liability. * Changes in deductions: This can impact your take-home pay and tax liability.

💡 Note: It's essential to review and adjust your paycheck regularly to ensure that you're making the most of your hard-earned money.

In summary, understanding your paycheck is crucial to managing your finances effectively. By reviewing your pay stub, understanding your tax withholding, taking advantage of benefits, managing your deductions, and reviewing and adjusting your paycheck regularly, you can make the most of your hard-earned money and achieve your financial goals.

What is the difference between gross income and net income?

+

Gross income refers to the total amount of money you earn before any deductions are made, while net income refers to the amount of money you take home after all deductions have been made.

How do I review and adjust my tax withholding?

+

You can review and adjust your tax withholding by completing a new W-4 form and submitting it to your employer. You can also use the IRS’s Tax Withholding Estimator tool to help you determine the correct amount of tax withholding.

What are the benefits of taking advantage of employer-sponsored benefits?

+

Taking advantage of employer-sponsored benefits can provide significant tax savings and help you manage your finances more effectively. Benefits such as health insurance, retirement plans, and flexible spending accounts can help you reduce your taxable income and increase your take-home pay.