Kansas Paycheck Calculator

Introduction to Kansas Paycheck Calculator

When it comes to managing finances, understanding how much you take home from your paycheck is crucial. In Kansas, like in many other states, calculating your take-home pay involves considering various factors such as your gross income, tax deductions, and other possible deductions like health insurance premiums or retirement plan contributions. A Kansas paycheck calculator can be an invaluable tool for both employees and employers to estimate net pay accurately.

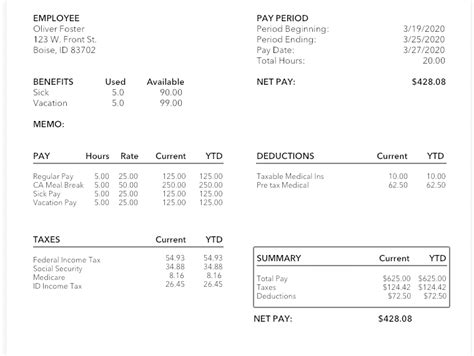

Understanding Gross Income and Net Pay

Your gross income is the total amount of money you earn before any deductions are made. This can include your salary, wages, tips, and any other form of income you receive from your job. On the other hand, your net pay or take-home pay is what you receive after all deductions have been subtracted from your gross income. These deductions can include federal, state, and local taxes, social security taxes, Medicare taxes, health insurance premiums, retirement plan contributions, and any other deductions your employer might make.

Kansas State Income Tax

Kansas has a progressive income tax system, meaning the more you earn, the higher tax rate you pay. The state income tax rates in Kansas range from 3.1% to 5.2%. To calculate your state income tax, you’ll need to know which tax bracket you fall into based on your gross income and filing status. A Kansas paycheck calculator will take these factors into account to provide a more accurate estimate of your net pay.

Federal Income Tax

In addition to state income tax, you’ll also need to consider federal income tax. The federal income tax system is also progressive, with tax rates ranging from 10% to 37%. Your federal income tax rate depends on your taxable income and filing status. A paycheck calculator will help you estimate both your state and federal income taxes based on your income level and other factors.

Other Deductions

Besides taxes, there are other deductions that might be taken out of your paycheck. These can include: - Health Insurance Premiums: If you’re enrolled in a health insurance plan through your employer, a portion of your premium might be deducted from your paycheck. - Retirement Plan Contributions: Contributions to a 401(k), 403(b), or other retirement plans are often made pre-tax, reducing your taxable income. - Social Security and Medicare Taxes: These are usually deducted at a flat rate of 6.2% for Social Security and 1.45% for Medicare, though high-income earners may pay more in Medicare taxes.

How to Use a Kansas Paycheck Calculator

Using a Kansas paycheck calculator is relatively straightforward. Here are the steps you can follow: - Enter Your Gross Income: Start by entering how much you earn per year or per pay period. - Select Your Filing Status: Choose your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)). - Enter Number of Dependents: If you have dependents, enter how many you claim on your taxes. - Choose Your Pay Frequency: Select how often you’re paid (weekly, bi-weekly, monthly, etc.). - Input Other Deductions: If you have other deductions like health insurance premiums or retirement plan contributions, enter those as well. - Calculate: Once you’ve entered all the necessary information, click the calculate button to see an estimate of your net pay.

Benefits of Using a Paycheck Calculator

Using a Kansas paycheck calculator offers several benefits: - Accurate Estimates: It provides a more accurate estimate of your take-home pay, helping you budget better. - Tax Planning: It helps you understand how changes in income or deductions can affect your net pay, useful for tax planning. - Financial Planning: By knowing exactly how much you take home, you can make more informed decisions about spending, saving, and investing.

📝 Note: Always review your actual pay stubs to ensure the calculator's estimates align with your real-world deductions and income.

Conclusion and Final Thoughts

In conclusion, a Kansas paycheck calculator is a handy tool for anyone looking to understand their paycheck better. By considering gross income, state and federal taxes, and other deductions, it provides a comprehensive view of your financial situation. Whether you’re trying to budget more effectively, plan for taxes, or simply want to know how much you’ll take home from your next paycheck, a Kansas paycheck calculator can be an indispensable resource.

What is the purpose of a Kansas paycheck calculator?

+

The purpose of a Kansas paycheck calculator is to help individuals estimate their net pay after deductions, providing a clearer picture of their financial situation.

How do I calculate my state income tax in Kansas?

+

To calculate your state income tax in Kansas, you need to know your gross income, filing status, and the number of dependents. You can use a Kansas paycheck calculator or consult the Kansas state income tax brackets to estimate your tax liability.

What factors affect my net pay?

+

Several factors can affect your net pay, including your gross income, state and federal income taxes, social security and Medicare taxes, health insurance premiums, retirement plan contributions, and other deductions.