5 Iowa Paycheck Tips

Introduction to Iowa Paycheck Tips

Managing one’s paycheck is an essential skill for financial stability and security. In the state of Iowa, understanding how paychecks are structured and how taxes are applied can significantly impact an individual’s financial planning. This article aims to provide insightful tips and information regarding paychecks in Iowa, focusing on taxation, deductions, and overall financial management.

Understanding Iowa Income Tax

Iowa has a progressive income tax system, meaning that higher income earners are taxed at a higher rate. The state income tax rates range from 0.36% to 8.98%, with nine tax brackets. It’s essential to understand how Iowa’s income tax system works to better manage your paycheck. Key factors include: - Filing Status: Whether you’re single, married filing jointly, married filing separately, head of household, or qualifying widow(er), your filing status can significantly affect your tax rate. - Taxable Income: This includes income from all sources, such as wages, salaries, tips, and any income from self-employment. - Deductions and Credits: Iowa allows various deductions and credits that can reduce your taxable income or the amount of tax you owe.

Managing Deductions and Credits

Deductions and credits can significantly reduce the amount of income tax you owe. Some key deductions and credits in Iowa include: - Standard Deduction: The standard deduction is a specific amount of income that is exempt from taxation. In Iowa, the standard deduction varies based on filing status. - Itemized Deductions: These are specific expenses that can be deducted from your taxable income, such as medical expenses, state and local taxes, and home mortgage interest. - Earned Income Tax Credit (EITC): This is a refundable tax credit for low-to-moderate-income working individuals and families. - Child and Dependent Care Credit: This credit is available for expenses related to the care of a child or dependent that allows you to work or look for work.

Retirement and Health Savings

In addition to managing income tax, it’s crucial to consider savings for retirement and healthcare expenses. Iowa offers several options for saving for these significant expenses: - 401(k) and Other Retirement Plans: Contributions to these plans are made before taxes, reducing your taxable income. - Health Savings Accounts (HSAs): If you have a high-deductible health plan, you may be eligible for an HSA, which allows you to set aside pre-tax dollars for medical expenses.

Financial Planning Tips

Effective financial planning involves creating a budget, managing debt, and building savings. Here are some tips: - Create a Budget: Start by tracking your income and expenses to understand where your money is going. Then, allocate your income into categories (housing, food, entertainment, savings) based on your priorities. - Manage Debt: High-interest debt, such as credit card balances, can significantly hinder your financial progress. Consider debt consolidation or balance transfer options. - Build an Emergency Fund: Aim to save 3-6 months’ worth of living expenses in an easily accessible savings account to cover unexpected expenses.

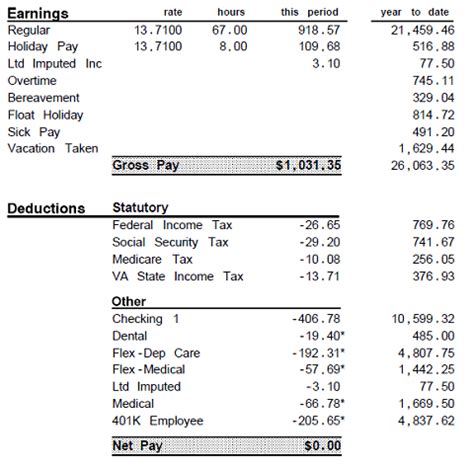

Utilizing Pay Stub Information

Your pay stub contains vital information about your income, taxes, and deductions. Here’s how to make the most of it: - Review Your Pay Stub Regularly: Ensure that your income, deductions, and taxes withheld are correct. - Understand Your Deductions: Familiarize yourself with the deductions listed on your pay stub, including health insurance premiums, 401(k) contributions, and any garnishments. - Adjust Your Withholding: If you’re consistently receiving a large refund or owing a significant amount at tax time, consider adjusting your withholding to better match your tax liability.

📝 Note: Regularly reviewing and adjusting your financial strategy can help ensure you're making the most of your paycheck and setting yourself up for long-term financial success.

In wrapping up, understanding and managing your paycheck effectively is crucial for achieving financial stability and security in Iowa. By grasping the concepts of income tax, deductions, credits, and savings strategies, individuals can better navigate their financial lives. Whether it’s optimizing tax withholding, contributing to retirement and health savings, or simply creating a budget, every step towards financial awareness and planning is a step in the right direction.

What are the income tax brackets in Iowa?

+

Iowa has a progressive income tax system with nine tax brackets, ranging from 0.36% to 8.98%. The specific rates and brackets can change, so it’s essential to check the latest information from the Iowa Department of Revenue.

How do I adjust my tax withholding in Iowa?

+

To adjust your tax withholding, you’ll need to submit a new W-4 form to your employer. You can estimate your tax withholding using the Tax Withholding Estimator on the IRS website and then complete a new W-4 based on that estimate.

What deductions and credits are available in Iowa?

+

Iowa offers various deductions and credits, including the standard deduction, itemized deductions, Earned Income Tax Credit (EITC), and the Child and Dependent Care Credit. The availability and specifics of these can change, so it’s crucial to consult the latest tax information.

Related Terms:

- Paycheck calculator iowa with taxes

- Hourly paycheck calculator Iowa

- Paycheck calculator iowa with dependents

- Iowa income tax calculator

- ADP paycheck calculator iowa

- Take home pay calculator