5 Illinois Paycheck Tips

Understanding Illinois Paycheck Laws

When it comes to managing your finances, understanding the laws that govern your paycheck is essential. In Illinois, there are specific regulations that employers must follow to ensure that employees are paid fairly and on time. In this article, we will explore five key Illinois paycheck tips that you need to know.

Tip 1: Minimum Wage Requirements

Illinois has a minimum wage law that requires employers to pay employees at least 12 per hour for most employees over 18 years old. However, this rate may vary depending on the location and the type of employer. For example, employers in Chicago are required to pay a higher minimum wage of 15 per hour. It’s essential to understand the minimum wage requirements in your area to ensure that you are being paid fairly.

Tip 2: Overtime Pay

In Illinois, employees are entitled to overtime pay if they work more than 40 hours in a workweek. The overtime pay rate is 1.5 times the employee’s regular rate of pay. For example, if an employee earns 12 per hour, their overtime pay rate would be 18 per hour. Employers are required to pay overtime pay for all hours worked over 40 hours in a workweek, unless the employee is exempt from overtime pay under Illinois law.

Tip 3: Pay Frequency and Payday Requirements

Illinois law requires employers to pay employees at least twice a month, with no more than 16 days between paydays. Employers must also pay employees on a regular payday, which is designated in advance. Employees must receive their pay on the designated payday, unless the employer has a valid reason for delaying payment.

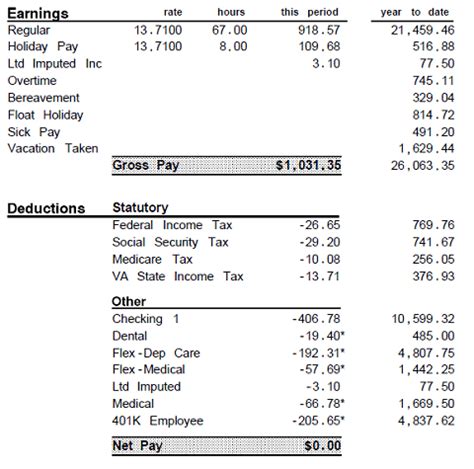

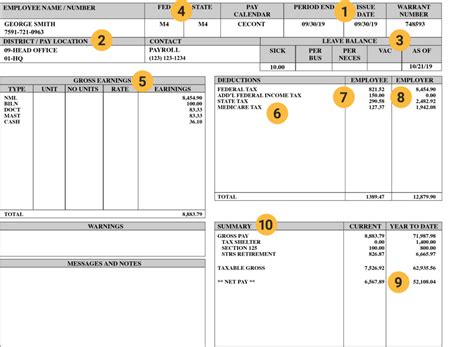

Tip 4: Deductions from Pay

In Illinois, employers are allowed to make certain deductions from an employee’s pay, but only if the employee has given their written consent. Examples of permissible deductions include deductions for taxes, insurance premiums, and 401(k) contributions. However, employers are not allowed to make deductions for things like cash shortages or property damage, unless the employee has given their written consent.

Tip 5: Final Paycheck Requirements

When an employee leaves their job, either voluntarily or involuntarily, the employer is required to pay the employee their final paycheck on the next regular payday. The final paycheck must include all wages earned by the employee, including any accrued vacation time or other benefits. Employers are also required to provide employees with a written statement of their final pay, which includes the amount of wages paid and any deductions made.

📝 Note: If you believe that your employer has violated Illinois paycheck laws, you may want to consider filing a complaint with the Illinois Department of Labor.

In terms of paycheck management, it’s essential to keep track of your pay stubs and any other relevant documentation. This can help you identify any errors or discrepancies in your pay, and ensure that you are being paid fairly and on time. You can also use online tools and resources to help you manage your paycheck and stay on top of your finances.

Some additional tips for managing your paycheck include: * Reviewing your pay stubs carefully to ensure that you are being paid correctly * Keeping track of your hours worked and any overtime pay you are entitled to * Understanding your employer’s pay frequency and payday requirements * Reviewing your employee handbook or contract to understand your rights and responsibilities * Seeking assistance from a financial advisor or accountant if you have questions or concerns about your paycheck

| Illinois Paycheck Law | Requirement |

|---|---|

| Minimum Wage | $12 per hour |

| Overtime Pay | 1.5 times regular rate of pay |

| Pay Frequency | At least twice a month |

| Final Paycheck | Next regular payday |

To summarize, Illinois paycheck laws are in place to protect employees and ensure that they are paid fairly and on time. By understanding these laws and taking steps to manage your paycheck, you can help ensure that you are being paid correctly and that your finances are in order. Whether you’re a new employee or a seasoned professional, it’s essential to stay informed about Illinois paycheck laws and to seek assistance if you have any questions or concerns.

What is the minimum wage in Illinois?

+

The minimum wage in Illinois is $12 per hour for most employees over 18 years old.

How often must employers pay employees in Illinois?

+

Employers in Illinois must pay employees at least twice a month, with no more than 16 days between paydays.

What is the overtime pay rate in Illinois?

+

The overtime pay rate in Illinois is 1.5 times the employee’s regular rate of pay.