5 Georgia Paycheck Tips

Understanding Your Paycheck in Georgia

When it comes to managing your finances, one of the most critical aspects is understanding your paycheck. For individuals living and working in Georgia, it’s essential to be aware of the various factors that affect your take-home pay. From taxes to deductions, there are several components that can impact your overall earnings. In this article, we’ll delve into five key tips to help you navigate the complexities of your Georgia paycheck.

Tip 1: Familiarize Yourself with Georgia State Income Tax

Georgia state income tax is a significant factor in determining your take-home pay. The state has a progressive income tax system, with six tax brackets ranging from 1% to 5.99%. It’s crucial to understand which tax bracket you fall into and how it affects your paycheck. You can use online tax calculators to estimate your state income tax and plan your finances accordingly. Additionally, consider consulting with a tax professional to ensure you’re taking advantage of all eligible deductions and credits.

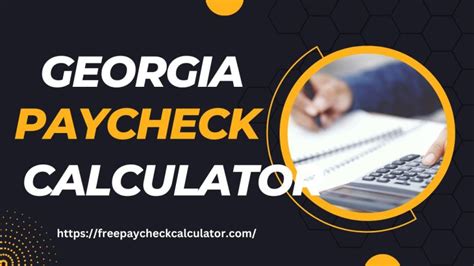

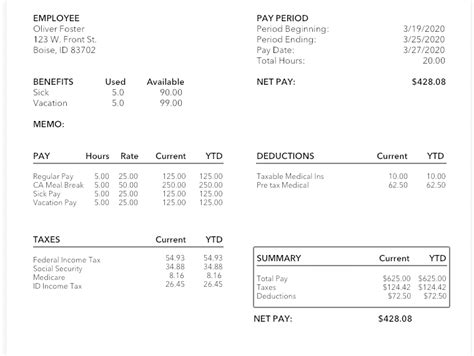

Tip 2: Review Your Pay Stub

Your pay stub is a treasure trove of information, providing valuable insights into your earnings, deductions, and taxes. Take the time to review your pay stub carefully, paying attention to the following: * Gross income: Your total earnings before taxes and deductions * Net income: Your take-home pay after taxes and deductions * Taxes: Federal, state, and local taxes withheld from your paycheck * Deductions: Contributions to retirement accounts, health insurance, and other benefits * Garnishments or other deductions: Any court-ordered or voluntary deductions from your paycheck

By understanding the components of your pay stub, you can better manage your finances and make informed decisions about your money.

Tip 3: Take Advantage of Tax Credits and Deductions

Georgia offers various tax credits and deductions that can help reduce your taxable income. Some of these include: * Earned Income Tax Credit (EITC): A federal tax credit for low-to-moderate income working individuals and families * Child Tax Credit: A federal tax credit for families with qualifying children * Retirement account contributions: Contributions to 401(k), IRA, or other retirement accounts may be tax-deductible * Charitable donations: Donations to qualified charitable organizations may be tax-deductible

It’s essential to consult with a tax professional to ensure you’re taking advantage of all eligible tax credits and deductions.

Tip 4: Manage Your Benefits and Deductions

Benefits and deductions can significantly impact your take-home pay. Consider the following: * Health insurance: Review your health insurance options and choose a plan that best suits your needs and budget * Retirement accounts: Contribute to retirement accounts, such as 401(k) or IRA, to reduce your taxable income and save for the future * Life insurance: Consider purchasing life insurance to provide financial protection for your loved ones * Other benefits: Review other benefits, such as disability insurance, flexible spending accounts, and employee assistance programs

By carefully managing your benefits and deductions, you can optimize your paycheck and achieve your financial goals.

Tip 5: Plan for the Future

Finally, it’s essential to plan for the future by considering the following: * Emergency fund: Save 3-6 months’ worth of living expenses in an easily accessible savings account * Retirement savings: Contribute to retirement accounts and take advantage of employer matching contributions * Long-term goals: Develop a plan to achieve your long-term goals, such as buying a home, paying for education, or starting a business * Tax planning: Consult with a tax professional to develop a tax plan that minimizes your tax liability and maximizes your refunds

By planning for the future, you can ensure a secure financial foundation and achieve your goals.

💡 Note: It's essential to consult with a tax professional or financial advisor to ensure you're taking advantage of all eligible tax credits and deductions and to develop a personalized financial plan.

In summary, understanding your Georgia paycheck requires careful attention to detail and a comprehensive approach to financial planning. By familiarizing yourself with Georgia state income tax, reviewing your pay stub, taking advantage of tax credits and deductions, managing your benefits and deductions, and planning for the future, you can optimize your paycheck and achieve your financial goals.

What is the Georgia state income tax rate?

+

The Georgia state income tax rate ranges from 1% to 5.99%, with six tax brackets.

How can I reduce my taxable income in Georgia?

+

You can reduce your taxable income in Georgia by taking advantage of tax credits and deductions, such as the Earned Income Tax Credit, Child Tax Credit, and retirement account contributions.

What is the importance of reviewing my pay stub?

+

Reviewing your pay stub is essential to understand your earnings, deductions, and taxes, and to ensure you’re being paid correctly.