5 Alabama Paycheck Tips

Understanding Alabama Paychecks

When it comes to managing finances, understanding your paycheck is crucial. In Alabama, as in other states, paychecks are subject to various deductions and regulations. It’s essential to know how these work to make the most of your income. Here are some key points to consider:

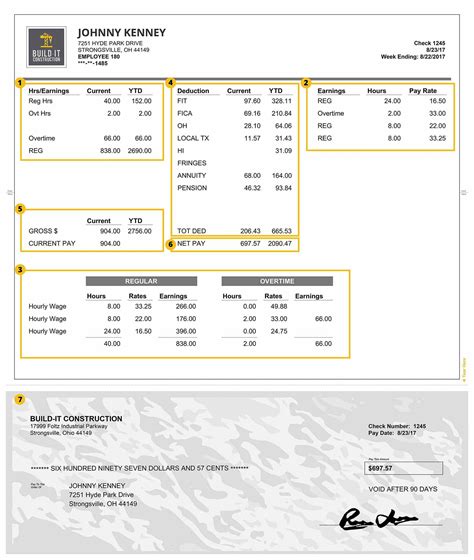

- Gross Income vs. Net Income: Your gross income is the total amount you earn before any deductions, while your net income (or take-home pay) is what you receive after deductions.

- Federal Income Tax: The federal government deducts income tax from your paycheck. The amount deducted depends on your income level and the number of dependents you claim.

- State Income Tax: Alabama also deducts state income tax. The state has a progressive income tax system, with rates ranging from 2% to 5%.

- Other Deductions: Other deductions may include health insurance premiums, 401(k) contributions, and life insurance premiums.

Alabama Paycheck Deductions

Deductions are a significant part of understanding your paycheck. Here are some common deductions you might see:

- Health Insurance: Many employers offer health insurance as a benefit. The premium is often deducted from your paycheck.

- 401(k) Contributions: Contributions to a 401(k) plan are deducted from your paycheck on a pre-tax basis, reducing your taxable income.

- Life Insurance: Some employers offer life insurance as a benefit, with premiums deducted from your paycheck.

- Disability Insurance: Disability insurance premiums may also be deducted, providing income protection in case you become unable to work.

Managing Your Alabama Paycheck

To make the most of your paycheck, consider the following tips:

- Budgeting: Create a budget to track your income and expenses. Allocate your net income into different categories, such as housing, food, and entertainment.

- Savings: Aim to save a portion of your net income each month. Consider setting up an automatic transfer to a savings or investment account.

- Debt Repayment: If you have debts, such as credit card balances or personal loans, consider allocating a portion of your income towards debt repayment.

- Retirement Savings: Take advantage of tax-advantaged retirement accounts, such as a 401(k) or IRA, to save for your future.

Alabama Paycheck Laws

Alabama has laws in place to protect employees and ensure fair labor practices. Here are some key laws to know:

- Minimum Wage: Alabama’s minimum wage is $7.25 per hour, the same as the federal minimum wage.

- Overtime Pay: Employers must pay overtime rates for hours worked over 40 in a workweek.

- Pay Frequency: Alabama law requires employers to pay employees at least once a month, but most employers pay bi-weekly or weekly.

Tax Implications for Alabama Residents

As an Alabama resident, it’s essential to understand the tax implications of your paycheck. Here are some key points to consider:

- State Income Tax: Alabama state income tax rates range from 2% to 5%.

- Federal Income Tax: Federal income tax rates range from 10% to 37%.

- Tax Credits: Alabama offers various tax credits, such as the Earned Income Tax Credit (EITC) and the Child Tax Credit.

| Income Level | State Income Tax Rate |

|---|---|

| $0 - $997 | 2% |

| $998 - $6,000 | 4% |

| $6,001 and above | 5% |

📝 Note: This table provides a general overview of Alabama state income tax rates and is subject to change. Consult the Alabama Department of Revenue for the most up-to-date information.

In summary, understanding your Alabama paycheck requires knowledge of deductions, laws, and tax implications. By managing your paycheck effectively and taking advantage of tax-advantaged accounts, you can make the most of your income and achieve your financial goals.

What is the minimum wage in Alabama?

+

The minimum wage in Alabama is 7.25 per hour, the same as the federal minimum wage.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>How often must employers pay employees in Alabama?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>Alabama law requires employers to pay employees at least once a month, but most employers pay bi-weekly or weekly.</p> </div> </div> <div class="faq-item"> <div class="faq-question"> <h3>What is the highest state income tax rate in Alabama?</h3> <span class="faq-toggle">+</span> </div> <div class="faq-answer"> <p>The highest state income tax rate in Alabama is 5%, applicable to income above 6,000.