5 Ways Army Pay Works

Introduction to Army Pay

When considering a career in the military, one of the most important factors to understand is how army pay works. The compensation system for army personnel is designed to provide a comprehensive package that includes not just the basic salary but also various allowances and benefits. This system is structured to reflect the unique demands and sacrifices that come with military service. Understanding the components of army pay and how they are calculated is essential for both new recruits and seasoned military personnel.

Basic Pay

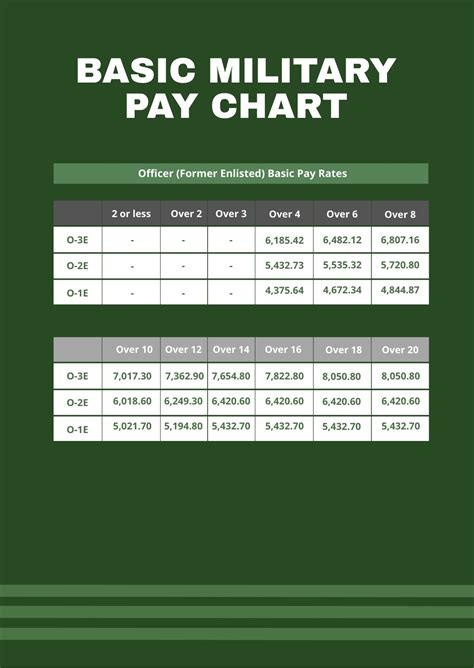

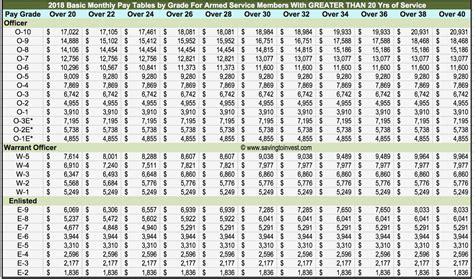

The foundation of army pay is the basic pay, which is determined by the individual’s rank and time in service. The basic pay chart is published annually and outlines the monthly salary for each rank, from the lowest enlisted rank to the highest officer rank. Basic pay is taxable, but it is only one part of the overall compensation package. It’s worth noting that basic pay increases with promotions in rank and with years of service, providing a career progression path that is both challenging and rewarding.

Allowances

In addition to basic pay, army personnel are eligible for various allowances that are intended to offset the costs associated with military service. These can include: - Basic Allowance for Subsistence (BAS): This allowance is meant to help cover the cost of food. It is paid to all personnel and is taxable. - Basic Allowance for Housing (BAH): This allowance is designed to help personnel pay for housing, whether they choose to live on or off base. The amount varies significantly based on location, rank, and whether the individual has dependents. - Special and Incentive Pay: These are additional payments for specific roles, skills, or hazardous duties. Examples include jump pay for paratroopers, special duty pay for certain assignments, and hostile fire pay for those serving in combat zones.

Benefits

Beyond the monetary compensation, army personnel and their families are entitled to a range of benefits that significantly enhance the overall value of their pay package. Some of the key benefits include: - Health Insurance: Through TRICARE, military personnel and their families have access to comprehensive health insurance at a minimal cost. - Education Assistance: The Montgomery GI Bill and other education programs provide financial assistance for personnel pursuing higher education or vocational training. - On-Base Facilities: Access to on-base facilities such as gyms, pools, and shopping centers can offer significant savings and convenience. - Travel Benefits: Space-available flights and discounted rates on lodgings and recreational activities are just a few examples of travel benefits available to military personnel.

Taxes and Army Pay

Understanding how taxes affect army pay is crucial for financial planning. While basic pay is taxable, some allowances are not. For example, Basic Allowance for Housing (BAH) and Basic Allowance for Subsistence (BAS) are taxable, but Special and Incentive Pay for hazardous duties may not be. Additionally, military personnel serving in combat zones may be exempt from taxes on their income earned during that time. It’s essential for military personnel to consult with a tax professional to ensure they are taking advantage of all the tax benefits available to them.

Calculating Total Compensation

To get a true picture of army pay, it’s necessary to calculate the total compensation package, which includes basic pay, allowances, benefits, and any special pays. The following table provides a simplified example of how this might look:

| Component | Monthly Amount |

|---|---|

| Basic Pay | 3,000</td> </tr> <tr> <td>Basic Allowance for Housing (BAH)</td> <td>1,500 |

| Basic Allowance for Subsistence (BAS) | 369</td> </tr> <tr> <td>Special Pay</td> <td>500 |

| Total Monthly Compensation | $5,369 |

This example does not include the value of benefits like health insurance, education assistance, and access to on-base facilities, which can add thousands of dollars to the total compensation package each year.

📝 Note: The values in the table are examples and may vary based on individual circumstances, including rank, time in service, location, and specific duties.

In summary, army pay is a complex system that encompasses more than just the basic salary. It includes a range of allowances and benefits designed to support military personnel and their families throughout their service. By understanding how these components work together, individuals can better appreciate the value of their compensation package and plan their financial futures more effectively.

As we reflect on the intricacies of army pay, it becomes clear that the compensation for military service is multifaceted and designed to recognize the unique challenges and sacrifices made by those who serve. Whether through basic pay, allowances, or the array of benefits provided, the system aims to support military personnel in their careers and personal lives.

What is the primary factor that determines basic pay in the army?

+

The primary factor that determines basic pay in the army is the individual’s rank and time in service.

Are all allowances taxable?

+

No, not all allowances are taxable. Some special and incentive pays, especially those for hazardous duties or service in combat zones, may be tax-exempt.

How do benefits contribute to the total compensation package?

+

Benefits such as health insurance, education assistance, and access to on-base facilities can significantly increase the total value of the compensation package, often by thousands of dollars annually.