5 Ways PA Pay Calculator

Introduction to PA Pay Calculator

The Pennsylvania pay calculator is a tool designed to help individuals calculate their take-home pay or gross income based on various factors such as their annual salary, deductions, and taxes. Understanding how to use a PA pay calculator is essential for managing personal finances effectively. In this article, we will explore the 5 ways a PA pay calculator can be beneficial and how it works.

What is a PA Pay Calculator?

A PA pay calculator is an online tool that calculates an individual’s net pay based on their gross income, deductions, and taxes. It takes into account the tax laws and regulations of the state of Pennsylvania, including the state income tax rate and other deductions such as federal income tax, Social Security tax, and Medicare tax. The calculator provides an accurate estimate of an individual’s take-home pay, which can help them plan their finances and make informed decisions about their budget.

5 Ways to Use a PA Pay Calculator

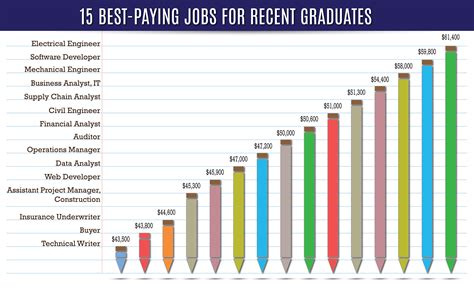

Here are 5 ways a PA pay calculator can be beneficial: * Calculating Take-Home Pay: The most obvious use of a PA pay calculator is to calculate an individual’s take-home pay. By entering their gross income, deductions, and taxes, individuals can get an estimate of their net pay, which can help them plan their finances and make informed decisions about their budget. * Comparing Job Offers: When considering multiple job offers, a PA pay calculator can help individuals compare the total compensation packages of each offer. By calculating the take-home pay of each offer, individuals can make a more informed decision about which job to accept. * Planning Taxes: A PA pay calculator can also help individuals plan their taxes. By calculating their estimated tax liability, individuals can make informed decisions about their tax strategy and plan accordingly. * Creating a Budget: A PA pay calculator can help individuals create a budget by providing an accurate estimate of their take-home pay. By knowing how much money they have available each month, individuals can create a budget that accounts for all their expenses and savings goals. * Negotiating Salary: Finally, a PA pay calculator can be used to negotiate salary. By calculating the total compensation package of a job offer, individuals can make a stronger case for why they deserve a higher salary.

How to Use a PA Pay Calculator

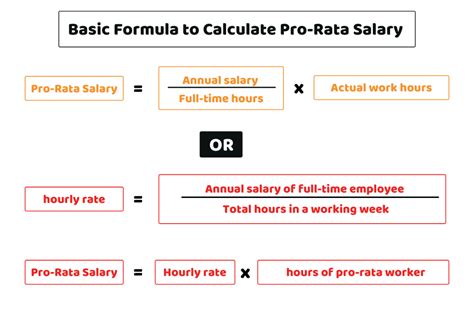

Using a PA pay calculator is relatively straightforward. Here are the steps to follow: * Enter your gross income: This is your annual salary before any deductions or taxes. * Enter your deductions: This includes any pre-tax deductions such as 401(k) contributions or health insurance premiums. * Enter your taxes: This includes your federal income tax, state income tax, Social Security tax, and Medicare tax. * Calculate your take-home pay: The calculator will provide an estimate of your net pay based on the information you entered.

💡 Note: It's essential to keep in mind that a PA pay calculator is only an estimate and actual take-home pay may vary depending on individual circumstances.

Benefits of Using a PA Pay Calculator

There are several benefits to using a PA pay calculator, including: * Accurate estimates: A PA pay calculator provides an accurate estimate of an individual’s take-home pay, which can help them plan their finances and make informed decisions about their budget. * Convenience: PA pay calculators are typically online tools that can be accessed from anywhere, making it convenient to calculate take-home pay at any time. * Free: Many PA pay calculators are free to use, making it a cost-effective way to estimate take-home pay. * Easy to use: PA pay calculators are relatively straightforward to use, requiring only basic information such as gross income, deductions, and taxes.

| Gross Income | Deductions | Taxes | Take-Home Pay |

|---|---|---|---|

| $50,000 | $5,000 | $10,000 | $35,000 |

In summary, a PA pay calculator is a valuable tool for individuals who want to estimate their take-home pay or gross income based on various factors such as their annual salary, deductions, and taxes. By understanding how to use a PA pay calculator, individuals can make informed decisions about their finances and plan their budget accordingly.

As we have explored the benefits and uses of a PA pay calculator, it is clear that this tool can be a powerful resource for managing personal finances. By taking the time to understand how to use a PA pay calculator, individuals can gain a better understanding of their financial situation and make informed decisions about their future.

What is a PA pay calculator?

+

A PA pay calculator is an online tool that calculates an individual’s net pay based on their gross income, deductions, and taxes.

How do I use a PA pay calculator?

+

To use a PA pay calculator, simply enter your gross income, deductions, and taxes, and the calculator will provide an estimate of your take-home pay.

What are the benefits of using a PA pay calculator?

+

The benefits of using a PA pay calculator include accurate estimates, convenience, free use, and ease of use.