5 Essential Tips for Out of State Tax Credits

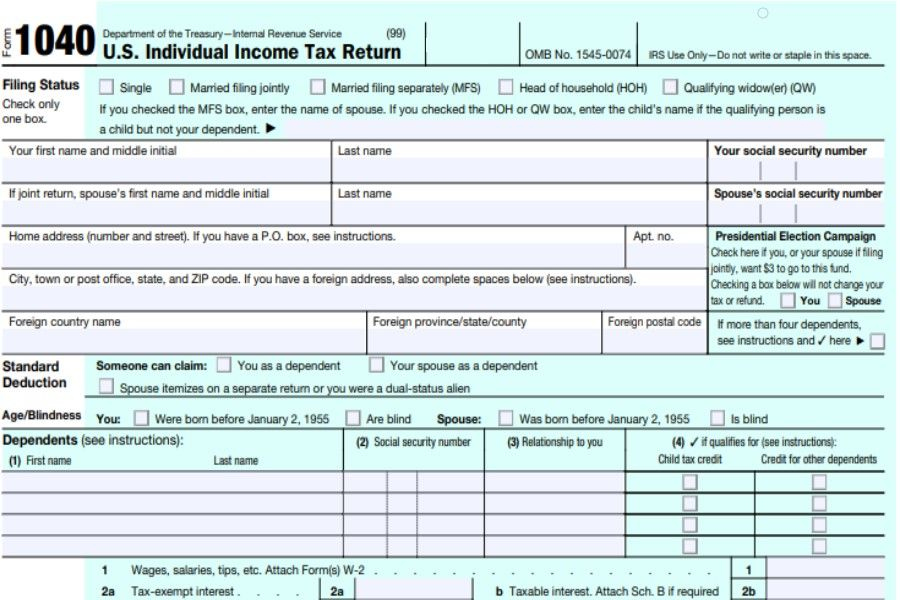

Are you moving to a new state or investing in out-of-state properties? If so, understanding out of state tax credits can significantly reduce your tax burden. Out-of-state tax credits can seem daunting at first, but with the right knowledge, you can navigate through these complexities seamlessly. Here are five essential tips to help you maximize your tax benefits and maintain compliance with various state tax laws.

1. Understand the Basics of Out of State Tax Credits

Tax credits are incentives that directly reduce the tax you owe, unlike deductions which only reduce the amount of income subject to tax. Each state has different rules regarding out-of-state tax credits:

- Residency status: Your tax home plays a critical role in determining what you can claim.

- Income source: Whether your income is from wages, rental properties, or capital gains can affect your eligibility.

- Reciprocity agreements: Some states have agreements to avoid double taxation for cross-border workers.

2. Keep Meticulous Records

Documentation is crucial for claiming out-of-state tax credits:

- Keep records of all financial transactions related to the state where you're seeking credits.

- Retain travel logs if you're required to file in multiple states due to business or work.

- Secure receipts, invoices, and proofs of payment for property or investment-related expenses.

📝 Note: Good record-keeping is not just about tax compliance; it's also about leveraging opportunities for tax savings.

3. Familiarize Yourself with Reciprocal Agreements

Many states have tax treaties with neighboring states to prevent double taxation:

- Check if the state you're investing in or moving to has reciprocity with your home state.

- If there is a reciprocal agreement, you might only need to file taxes in your state of residence, regardless of where you work or earn income.

| State | Reciprocal States |

|---|---|

| New Jersey | New York, Pennsylvania |

| Maryland | Pennsylvania, Virginia, West Virginia, Washington DC |

| Ohio | Indiana, Kentucky, Michigan, Pennsylvania, West Virginia |

🔄 Note: Reciprocal agreements are dynamic, and states might enter or exit these agreements, so stay updated.

4. Consult Tax Professionals

The tax landscape can be labyrinthine, especially when it crosses state lines. Here's why professional consultation is invaluable:

- Tax professionals can interpret complex state tax laws.

- They help in identifying credits and deductions specific to out-of-state situations.

- Advisors ensure compliance, reducing the risk of audits or penalties.

5. Maximize Credits Through Strategic Planning

Strategic planning can enhance the benefits you receive from out-of-state tax credits:

- Timing of Income: Adjust when you realize income to take advantage of different tax years.

- Investment Decisions: Understand how different types of investments are treated in various states.

- Location of Business or Rental Property: Consider the tax implications of where you establish your business or buy property.

By following these tips, you can make informed decisions about how to navigate the intricacies of out of state tax credits, ensuring you pay only what you must while capitalizing on available savings. Remember, a smart approach to taxes not only keeps you compliant but can also provide significant financial relief.

What if I work in one state but live in another?

+

If the states have a reciprocal agreement, you generally file and pay taxes only in your state of residence. Otherwise, you might have to file in both states, potentially using a credit in one state against taxes paid to another.

Can I claim out-of-state rental property expenses?

+

Yes, expenses related to maintaining or managing rental properties can often be claimed as deductions or credits against state taxes. Ensure you keep detailed records of all expenses.

How do I handle state taxes if I’m a digital nomad or remote worker?

+

You generally file in the state where you are physically located the most. If you’re constantly on the move, look into domicile rules, and consider consulting with a tax advisor for a personalized approach.