Oregon Wage Calculator Tool

Oregon Wage Calculator Tool: An Overview

The Oregon Wage Calculator Tool is a valuable resource for employees and employers in the state of Oregon. This tool helps to calculate the minimum wage, overtime pay, and other wage-related information. In this article, we will explore the features and benefits of the Oregon Wage Calculator Tool, and how it can be used to ensure compliance with Oregon’s wage laws.

Features of the Oregon Wage Calculator Tool

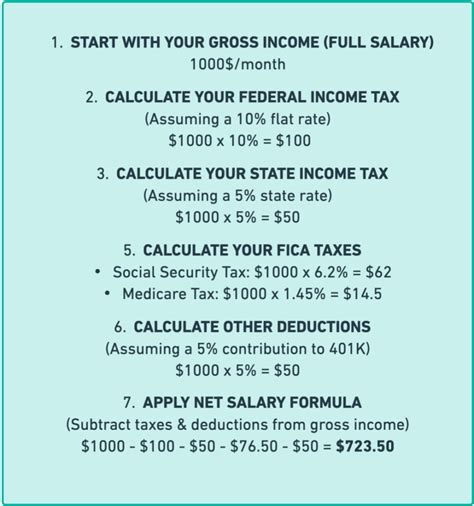

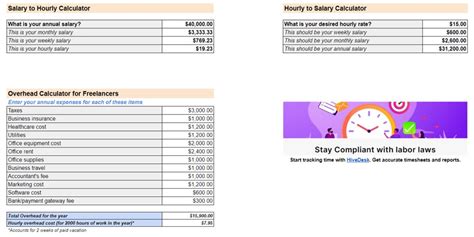

The Oregon Wage Calculator Tool is a user-friendly online resource that provides a range of features, including: * Calculation of minimum wage, overtime pay, and other wage-related information * Determination of exempt and non-exempt employee status * Calculation of wage deductions, such as taxes and benefits * Provision of information on Oregon’s wage laws and regulations * Availability of resources and FAQs for employers and employees

Some of the key benefits of using the Oregon Wage Calculator Tool include: * Ensuring compliance with Oregon’s wage laws and regulations * Reducing the risk of wage-related disputes and lawsuits * Providing accurate and up-to-date information on wage rates and calculations * Saving time and effort in calculating wages and overtime pay * Helping to maintain positive employer-employee relationships

How to Use the Oregon Wage Calculator Tool

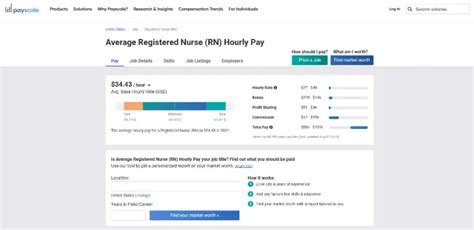

Using the Oregon Wage Calculator Tool is straightforward and easy. To get started, simply follow these steps: * Visit the Oregon Wage Calculator Tool website * Enter the employee’s hourly wage or annual salary * Select the employee’s occupation or job title * Choose the pay frequency (e.g. weekly, biweekly, monthly) * Calculate the minimum wage, overtime pay, and other wage-related information * Review and print the results

It’s also important to note that the Oregon Wage Calculator Tool is regularly updated to reflect changes in Oregon’s wage laws and regulations. This ensures that users have access to the most accurate and up-to-date information.

📝 Note: The Oregon Wage Calculator Tool is not intended to provide legal advice, and users should consult with an attorney or HR expert if they have specific questions or concerns about wage laws and regulations.

Oregon Wage Laws and Regulations

Oregon has a range of wage laws and regulations that employers must comply with. Some of the key laws and regulations include: * Minimum wage: $12.75 per hour (as of 2022) * Overtime pay: 1.5 times the regular rate of pay for hours worked over 40 in a workweek * Exempt and non-exempt employees: certain employees, such as executives, managers, and professionals, are exempt from overtime pay and other wage laws * Wage deductions: employers can deduct certain amounts from an employee’s wages, such as taxes and benefits, but must follow specific rules and regulations

Here is a summarizing some of the key Oregon wage laws and regulations:

| Law/Regulation | Description |

|---|---|

| Minimum Wage | $12.75 per hour (as of 2022) |

| Overtime Pay | 1.5 times the regular rate of pay for hours worked over 40 in a workweek |

| Exempt and Non-Exempt Employees | Certain employees, such as executives, managers, and professionals, are exempt from overtime pay and other wage laws |

| Wage Deductions | Employers can deduct certain amounts from an employee’s wages, such as taxes and benefits, but must follow specific rules and regulations |

Benefits of Compliance with Oregon Wage Laws

Compliance with Oregon wage laws and regulations is essential for employers. Some of the benefits of compliance include: * Avoiding lawsuits and fines * Maintaining positive employer-employee relationships * Ensuring fair and equitable treatment of employees * Reducing the risk of wage-related disputes and audits * Enhancing the reputation of the business

In summary, the Oregon Wage Calculator Tool is a valuable resource for employers and employees in the state of Oregon. By using this tool, employers can ensure compliance with Oregon’s wage laws and regulations, and employees can ensure that they are being paid fairly and accurately.

In final thoughts, the key to success lies in understanding and complying with Oregon’s wage laws and regulations. By using the Oregon Wage Calculator Tool and following the steps outlined in this article, employers and employees can work together to create a positive and equitable work environment.

What is the Oregon Wage Calculator Tool?

+

The Oregon Wage Calculator Tool is a user-friendly online resource that helps to calculate the minimum wage, overtime pay, and other wage-related information.

How do I use the Oregon Wage Calculator Tool?

+

To use the Oregon Wage Calculator Tool, simply visit the website, enter the employee’s hourly wage or annual salary, select the employee’s occupation or job title, choose the pay frequency, and calculate the minimum wage, overtime pay, and other wage-related information.

What are the benefits of using the Oregon Wage Calculator Tool?

+

The benefits of using the Oregon Wage Calculator Tool include ensuring compliance with Oregon’s wage laws and regulations, reducing the risk of wage-related disputes and lawsuits, providing accurate and up-to-date information on wage rates and calculations, saving time and effort in calculating wages and overtime pay, and helping to maintain positive employer-employee relationships.