5 Oregon Payroll Tips

Oregon Payroll Overview

Oregon payroll processing involves several steps and requirements that employers must follow to ensure compliance with state and federal laws. From calculating wages and taxes to reporting and paying payroll taxes, the process can be complex and time-consuming. In this article, we will provide 5 Oregon payroll tips to help employers navigate the process and avoid common mistakes.

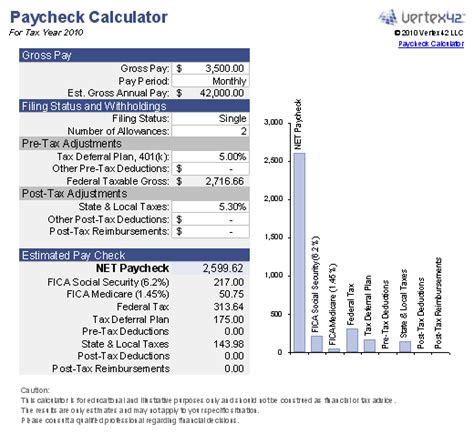

Tip 1: Understand Oregon Payroll Taxes

Oregon has a state income tax, which ranges from 5% to 9.9%, depending on the employee’s income level. Employers must withhold state income taxes from employee wages and report them to the Oregon Department of Revenue. Additionally, Oregon has a transit tax, which is a payroll tax used to fund transportation projects. The transit tax rate is 0.01% of the employee’s wages. Employers must also pay federal payroll taxes, including Social Security and Medicare taxes.

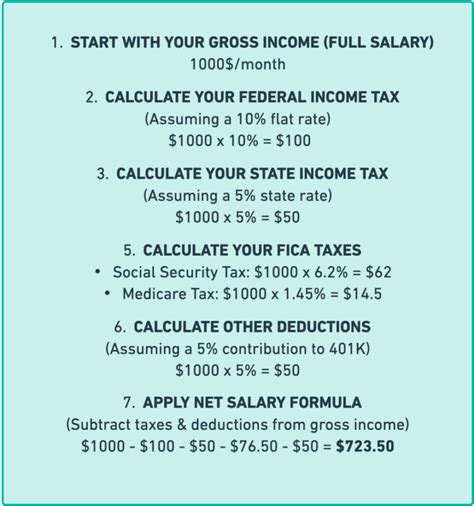

Tip 2: Calculate Wages and Overtime Correctly

Calculating wages and overtime correctly is crucial to avoid underpayment or overpayment of employees. Oregon law requires employers to pay employees at least minimum wage, which is $12.75 per hour for most employees. Employers must also pay overtime wages to employees who work more than 40 hours in a workweek. The overtime rate is 1.5 times the employee’s regular rate of pay. Employers can use the following formula to calculate overtime pay:

| Regular Hours | Overtime Hours | Overtime Pay |

|---|---|---|

| 40 hours or less | 0 hours | Regular pay rate x hours worked |

| More than 40 hours | Hours worked over 40 | Regular pay rate x 1.5 x overtime hours |

Tip 3: Report and Pay Payroll Taxes on Time

Employers must report and pay payroll taxes to the Oregon Department of Revenue and the Internal Revenue Service (IRS) on time to avoid penalties and interest. The due date for reporting and paying payroll taxes varies depending on the tax type and the employer’s filing frequency. For example, employers who file quarterly must report and pay payroll taxes by the last day of the month following the end of the quarter. Employers can use the following deadlines to ensure timely reporting and payment:

- Quarterly filing: Last day of the month following the end of the quarter

- Monthly filing: 15th day of the following month

- Annual filing: January 31st of the following year

Tip 4: Maintain Accurate Payroll Records

Maintaining accurate payroll records is essential to ensure compliance with Oregon and federal laws. Employers must keep payroll records for at least three years, including:

- Employee identification and contact information

- Wage and hour records, including regular and overtime pay

- Tax withholding and payment records

- Payroll tax returns and payments

Tip 5: Stay Up-to-Date with Oregon Payroll Law Changes

Oregon payroll laws and regulations can change frequently, and employers must stay up-to-date to ensure compliance. Employers can visit the Oregon Department of Revenue website or consult with a payroll professional to stay informed about law changes and updates. Some recent changes to Oregon payroll law include:

- Increased minimum wage rates

- Changes to overtime pay requirements

- Updated payroll tax rates and deadlines

📝 Note: Employers should regularly review and update their payroll policies and procedures to ensure compliance with Oregon and federal laws.

In final thoughts, Oregon payroll processing requires attention to detail and compliance with state and federal laws. By following these 5 Oregon payroll tips, employers can ensure accurate and timely payment of wages and taxes, maintain compliant payroll records, and stay up-to-date with law changes. Whether you are a small business owner or a large corporation, understanding Oregon payroll laws and regulations is crucial to avoiding penalties and ensuring a smooth payroll process.

What is the current minimum wage rate in Oregon?

+

The current minimum wage rate in Oregon is $12.75 per hour for most employees.

How often must employers report and pay payroll taxes in Oregon?

+

Employers must report and pay payroll taxes quarterly, monthly, or annually, depending on their filing frequency.

What payroll records must employers keep in Oregon?

+

Employers must keep payroll records for at least three years, including employee identification and contact information, wage and hour records, tax withholding and payment records, and payroll tax returns and payments.