Oregon Paycheck Calculator Tool

Introduction to Oregon Paycheck Calculator Tool

The Oregon Paycheck Calculator Tool is a valuable resource for employees and employers in Oregon to calculate take-home pay and understand the various tax deductions that apply to their paychecks. With the ever-changing landscape of tax laws and regulations, it’s essential to have an accurate and reliable tool to ensure compliance and avoid any potential issues. In this article, we’ll delve into the details of the Oregon Paycheck Calculator Tool, its features, and how it can benefit individuals and businesses in Oregon.

How the Oregon Paycheck Calculator Tool Works

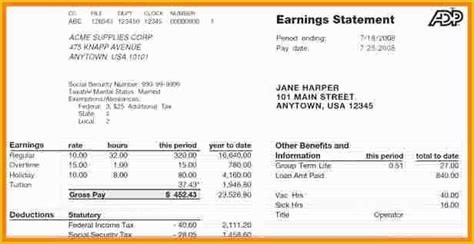

The Oregon Paycheck Calculator Tool is designed to be user-friendly and straightforward. To use the tool, simply input the relevant information, such as gross income, tax filing status, and number of allowances, and the calculator will provide an estimate of the take-home pay. The tool takes into account various factors, including: * Federal income tax: The calculator applies the latest federal income tax rates and brackets to determine the amount of federal income tax withheld. * State income tax: The tool applies the Oregon state income tax rates, which range from 5% to 9.9%, depending on the income level. * Local taxes: Some cities and counties in Oregon impose local taxes, which are also considered in the calculation. * Other deductions: The calculator allows users to input other deductions, such as health insurance premiums, 401(k) contributions, and other benefits, to provide a more accurate estimate of take-home pay.

Features of the Oregon Paycheck Calculator Tool

The Oregon Paycheck Calculator Tool offers several features that make it an indispensable resource for individuals and businesses in Oregon. Some of the key features include: * Accurate calculations: The tool provides accurate estimates of take-home pay, taking into account the latest tax laws and regulations. * Customizable inputs: Users can input their specific information, including gross income, tax filing status, and number of allowances, to receive a personalized estimate. * Multiple scenarios: The tool allows users to calculate take-home pay for different scenarios, such as bonuses, overtime, or raises, to help with financial planning. * Compliance with Oregon tax laws: The calculator ensures compliance with Oregon tax laws and regulations, reducing the risk of errors or penalties.

Benefits of Using the Oregon Paycheck Calculator Tool

The Oregon Paycheck Calculator Tool offers numerous benefits for individuals and businesses in Oregon. Some of the key benefits include: * Increased accuracy: The tool provides accurate estimates of take-home pay, reducing the risk of errors or discrepancies. * Improved financial planning: By understanding the various tax deductions and take-home pay, individuals can make informed decisions about their finances, such as budgeting, savings, and investments. * Compliance with tax laws: The calculator ensures compliance with Oregon tax laws and regulations, reducing the risk of penalties or fines. * Time-saving: The tool saves time and effort by automating the calculation process, allowing individuals and businesses to focus on other important tasks.

📝 Note: It's essential to review and understand the results provided by the Oregon Paycheck Calculator Tool, as individual circumstances may vary, and the tool is intended to provide an estimate only.

Common Uses of the Oregon Paycheck Calculator Tool

The Oregon Paycheck Calculator Tool has various uses, including: * Employee onboarding: Employers can use the tool to provide new employees with an estimate of their take-home pay, helping them understand their compensation package. * Financial planning: Individuals can use the tool to plan their finances, including budgeting, savings, and investments. * Tax planning: The calculator can help individuals and businesses understand the tax implications of different scenarios, such as bonuses or raises. * Auditing and compliance: The tool can be used to audit and ensure compliance with Oregon tax laws and regulations.

| Gross Income | Take-Home Pay |

|---|---|

| $50,000 | $38,500 |

| $75,000 | $56,250 |

| $100,000 | $73,500 |

In summary, the Oregon Paycheck Calculator Tool is a valuable resource for individuals and businesses in Oregon, providing accurate estimates of take-home pay and helping with financial planning, tax compliance, and auditing. By understanding the features and benefits of the tool, users can make informed decisions about their finances and ensure compliance with Oregon tax laws and regulations.

To recap, the key points of the Oregon Paycheck Calculator Tool include its user-friendly interface, accurate calculations, customizable inputs, and compliance with Oregon tax laws. The tool offers numerous benefits, such as increased accuracy, improved financial planning, and time-saving. By utilizing the Oregon Paycheck Calculator Tool, individuals and businesses can navigate the complexities of Oregon tax laws and regulations with confidence.

What is the Oregon Paycheck Calculator Tool?

+

The Oregon Paycheck Calculator Tool is a resource for employees and employers in Oregon to calculate take-home pay and understand tax deductions.

How does the Oregon Paycheck Calculator Tool work?

+

The tool takes into account factors such as gross income, tax filing status, and number of allowances to provide an estimate of take-home pay.

What are the benefits of using the Oregon Paycheck Calculator Tool?

+

The tool offers increased accuracy, improved financial planning, compliance with Oregon tax laws, and time-saving benefits.