5 Essential Tips for Your Opportunity Cost Worksheet

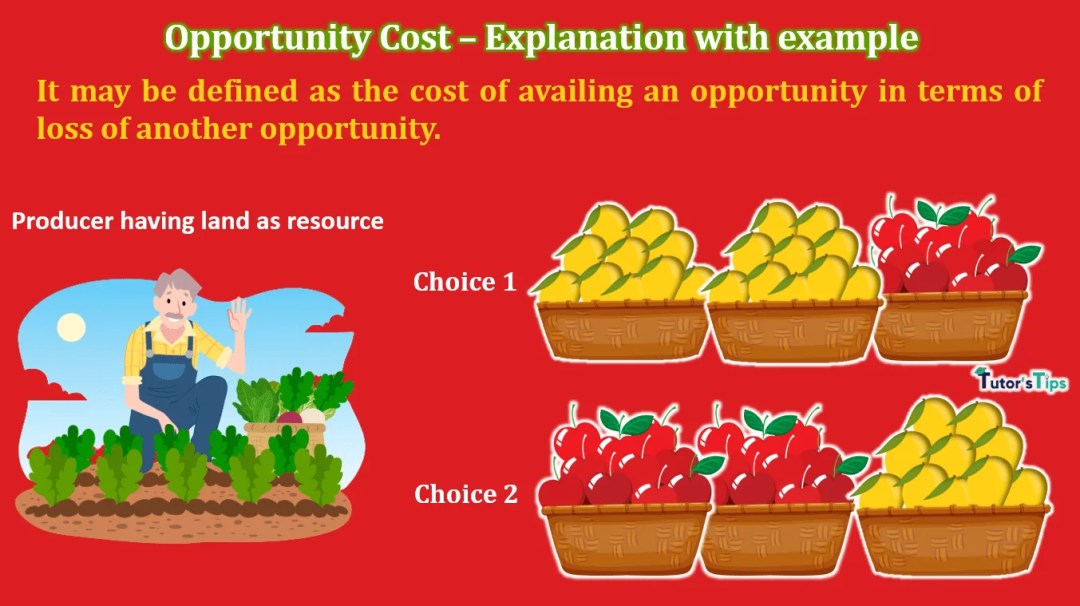

Opportunity cost is an often under-discussed, yet crucial component in decision-making processes, whether in personal finance, business strategies, or daily life choices. Understanding how to accurately evaluate what you must forgo when making a decision can lead to more informed and potentially more profitable outcomes. In this blog post, we'll delve deep into crafting an Opportunity Cost Worksheet, offering you five indispensable tips to make it both effective and user-friendly.

1. Define the Scope Clearly

Before diving into the numbers and comparisons, you need to define the scope of your opportunity cost analysis. This includes:

- Identifying all possible options: List out each alternative you are considering.

- Setting the time frame: Define the period for which you want to analyze the cost.

- Establishing parameters: What factors will you consider? Profit, time, satisfaction, or other qualitative measures?

By setting a clear scope, you ensure that your opportunity cost worksheet is focused and comprehensive, helping you make decisions without getting overwhelmed by irrelevant details.

⚠️ Note: Be as precise as possible when defining the scope. Ambiguity leads to decision paralysis.

2. Use a Logical Framework

Creating a framework for your worksheet is essential:

- Alternatives: List each option you’re considering.

- Direct Costs: What immediate resources (money, time, effort) are required for each option?

- Foregone Benefits: What are the benefits you’ll miss out on if you choose a particular alternative?

- Expected Returns: What’s the expected gain from each alternative?

- Net Opportunity Cost: The total cost of not choosing each option.

| Alternatives | Direct Costs | Foregone Benefits | Expected Returns | Net Opportunity Cost |

|---|---|---|---|---|

| Option A | 500</td> <td>100 in lost opportunities | 800</td> <td>300 | ||

| Option B | 300</td> <td>200 in lost opportunities | 900</td> <td>400 |

Using a structured approach like this ensures all aspects are considered systematically, providing a clear comparison of your choices.

3. Quantify Where Possible

Opportunity costs often include qualitative factors, but where possible, try to quantify:

- Assign monetary values to time and effort where practical.

- Use proxies: If something can’t be easily quantified, look for a quantifiable alternative or proxy.

- Estimate future benefits: Forecast potential gains or savings from each option.

By quantifying what you can, your worksheet will help you weigh decisions more objectively.

📊 Note: Quantification doesn't always have to be precise; rough estimates can be sufficient to illustrate differences in opportunity costs.

4. Consider the Time Value of Money

The principle that money available now is worth more than the same amount in the future due to its potential earning capacity, the time value of money, should not be overlooked in your opportunity cost analysis:

- Calculate Future Value (FV): Use formulas to understand how much money invested today will be worth in the future.

- Adjust for Inflation: Your cost estimations should account for the depreciating purchasing power of money over time.

- Evaluate Investment Returns: Consider what you could earn by investing the same amount of money.

5. Update and Review Regularly

An opportunity cost worksheet isn’t a one-and-done activity. Here are reasons to update it regularly:

- New information: Market changes, personal circumstances, or updated forecasts can alter your decisions.

- Periodic review: Ensures your choices remain optimal over time.

- Reevaluation of values: Your priorities or the worth you assign to different factors might shift.

By continuously revisiting and revising your worksheet, you’re ensuring that your opportunity cost analysis remains current and relevant.

🔄 Note: A static worksheet can lead to outdated decisions; adaptability is key.

Understanding opportunity cost is about recognizing the true trade-offs involved in every decision. By carefully designing your opportunity cost worksheet with the tips outlined above, you'll gain a clearer picture of the potential implications of your choices. Whether you're investing, planning a career move, or just deciding between a movie night out or a quiet evening in, your decision will be better informed, potentially maximizing your outcomes. Remember, every choice has a cost; it's up to you to decide which is worth it.

Why is it important to consider opportunity costs?

+

Considering opportunity costs helps you understand the real cost of your decisions. By evaluating what you give up in favor of what you choose, you can better optimize your resources and decision-making process, potentially leading to more favorable outcomes.

Can opportunity cost analysis be used in personal life decisions?

+

Absolutely! While opportunity cost is commonly used in economic and business contexts, it’s equally applicable in personal life. Whether it’s choosing to study an extra hour or spend time with friends, the principle remains the same.

How often should I update my opportunity cost worksheet?

+

It’s advisable to review your opportunity cost worksheet at least quarterly or whenever significant changes occur in your circumstances or the market conditions affecting your decisions.