5 Oklahoma Paycheck Tips

Understanding Oklahoma Paychecks

When it comes to managing your finances, understanding your paycheck is crucial. In Oklahoma, as in other states, there are specific laws and regulations that govern how employees are paid. Gross income, tax deductions, and net pay are terms you’ll frequently encounter. Knowing how these elements interact can help you better manage your financial obligations and plan for the future.

Oklahoma Paycheck Laws

Oklahoma paycheck laws are designed to protect both employees and employers. These laws cover aspects such as minimum wage, overtime pay, and the frequency of payments. For instance, Oklahoma’s minimum wage is aligned with the federal minimum wage, which is $7.25 per hour. Employers must also provide employees with a written statement of earnings for each pay period, detailing hours worked, wages earned, and deductions made.

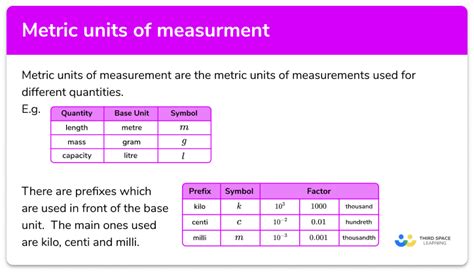

Calculating Your Net Pay

Calculating your net pay involves subtracting all deductions from your gross income. Deductions can include: - Federal income taxes - State income taxes (in this case, Oklahoma state taxes) - Social Security taxes - Medicare taxes - Health insurance premiums - 401(k) contributions - Other deductions as applicable

To calculate your net pay, you start with your gross income and then subtract each deduction. For example, if your gross income is 1,000 and your total deductions amount to 200, your net pay would be $800.

Managing Your Paycheck

Effective management of your paycheck is essential for financial stability. Here are some tips: - Budgeting: Create a budget that accounts for all your expenses, savings, and debt payments. - Emergency Fund: Allocate a portion of your net pay towards building an emergency fund to cover unexpected expenses. - Debt Management: Use the snowball method or avalanche method to pay off debts, starting with either the smallest balance or the highest interest rate, respectively. - Investments: Consider investing a portion of your income in a retirement plan or other investment vehicles.

Tax Considerations in Oklahoma

Oklahoma has a progressive income tax system, with rates ranging from 0.87% to 5%. Understanding how Oklahoma state taxes impact your paycheck can help you plan your finances more effectively. It’s also important to be aware of any tax credits or deductions you might be eligible for, such as the Earned Income Tax Credit (EITC) for low-to-moderate income working individuals and families.

| Taxable Income | Tax Rate |

|---|---|

| $0 - $1,000 | 0.87% |

| $1,001 - $2,500 | 1.0% |

| $2,501 - $3,750 | 1.1% |

| $3,751 - $4,900 | 1.25% |

| $4,901 and over | 5% |

📝 Note: Tax rates and brackets are subject to change, so it's essential to check the latest information from the Oklahoma Tax Commission.

In summary, understanding and managing your paycheck in Oklahoma involves being aware of the state’s payroll laws, calculating your net pay, managing your finances effectively, and considering tax implications. By following these steps and staying informed, you can make the most of your income and plan for a secure financial future.

What is the minimum wage in Oklahoma?

+

Oklahoma’s minimum wage is $7.25 per hour, aligning with the federal minimum wage.

How do I calculate my net pay?

+

To calculate your net pay, subtract all deductions (taxes, insurance, etc.) from your gross income.

What are some key financial management tips for paycheck recipients in Oklahoma?

+

Key tips include budgeting, building an emergency fund, managing debt, and considering investments and tax implications.