5 Tips OK Payroll Calculator

Introduction to Payroll Calculators

Payroll calculators are essential tools for businesses and individuals to manage their payroll systems efficiently. With the increasing complexity of payroll laws and regulations, it’s crucial to have a reliable and accurate payroll calculator. In this article, we will discuss the importance of payroll calculators, their benefits, and provide 5 tips on how to use an OK payroll calculator effectively.

What is a Payroll Calculator?

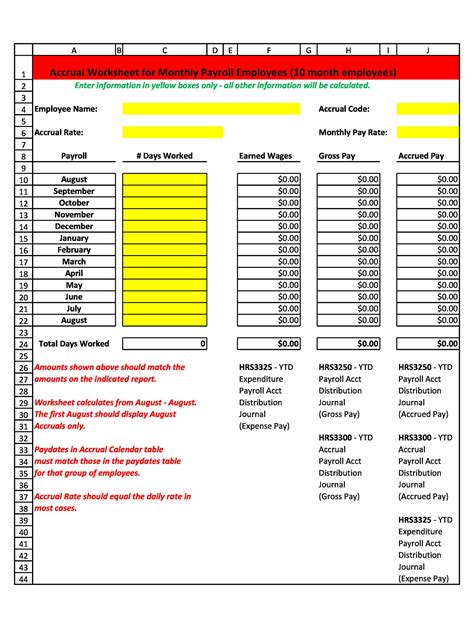

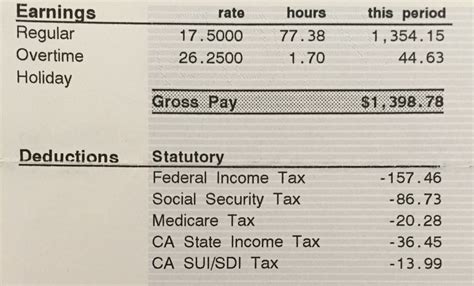

A payroll calculator is a software or tool designed to calculate employee wages, taxes, and other deductions. It helps businesses to process payroll accurately and on time, ensuring compliance with labor laws and regulations. Payroll calculators can be used for various purposes, including calculating gross pay, net pay, taxes, and benefits.

Benefits of Using a Payroll Calculator

Using a payroll calculator offers several benefits, including: * Accuracy: Payroll calculators minimize errors and ensure accurate calculations. * Efficiency: Payroll calculators save time and reduce the workload of payroll processing. * Compliance: Payroll calculators help businesses comply with labor laws and regulations. * Cost-effective: Payroll calculators reduce the need for manual calculations and minimize the risk of errors.

5 Tips for Using an OK Payroll Calculator

Here are 5 tips to help you use an OK payroll calculator effectively: * Tip 1: Understand the Calculator’s Features: Familiarize yourself with the calculator’s features and functions to ensure you’re using it correctly. * Tip 2: Input Accurate Data: Enter accurate and up-to-date employee data, including wages, hours worked, and deductions. * Tip 3: Use the Correct Tax Rates: Ensure you’re using the correct tax rates and laws applicable to your business and location. * Tip 4: Regularly Update the Calculator: Regularly update the calculator with new tax rates, laws, and regulations to ensure compliance and accuracy. * Tip 5: Review and Verify Calculations: Review and verify calculations to ensure accuracy and detect any errors or discrepancies.

Common Payroll Calculator Mistakes to Avoid

When using a payroll calculator, it’s essential to avoid common mistakes, including: * Inaccurate data entry * Using outdated tax rates and laws * Failing to update the calculator regularly * Not reviewing and verifying calculations

💡 Note: Regularly reviewing and updating your payroll calculator can help prevent errors and ensure compliance with labor laws and regulations.

Best Practices for Payroll Calculator Management

To ensure effective payroll calculator management, follow these best practices: * Assign a dedicated payroll administrator * Establish a regular update schedule * Use secure and reliable data storage * Provide training and support for payroll administrators

| Payroll Calculator Feature | Benefits |

|---|---|

| Gross pay calculation | Accurate employee wage calculation |

| Tax calculation | Compliance with labor laws and regulations |

| Benefits calculation | Accurate employee benefits calculation |

In summary, payroll calculators are essential tools for businesses to manage their payroll systems efficiently. By following the 5 tips provided and avoiding common mistakes, you can ensure accurate and compliant payroll processing. Regularly reviewing and updating your payroll calculator, as well as following best practices for payroll calculator management, can help prevent errors and ensure effective payroll management.

What is the purpose of a payroll calculator?

+

A payroll calculator is used to calculate employee wages, taxes, and other deductions, ensuring accurate and compliant payroll processing.

How often should I update my payroll calculator?

+

You should regularly update your payroll calculator with new tax rates, laws, and regulations to ensure compliance and accuracy.

What are the benefits of using a payroll calculator?

+

The benefits of using a payroll calculator include accuracy, efficiency, compliance, and cost-effectiveness.