Ohio Wage Calculator Tool

Introduction to Ohio Wage Calculator Tool

The Ohio Wage Calculator Tool is an innovative online platform designed to help employees and employers in Ohio calculate wages accurately. This tool takes into account various factors such as overtime pay, minimum wage, and tax deductions to provide a comprehensive breakdown of an employee’s wages. With the ever-changing landscape of labor laws, this tool serves as a vital resource for ensuring compliance and fairness in the workplace.

How the Ohio Wage Calculator Tool Works

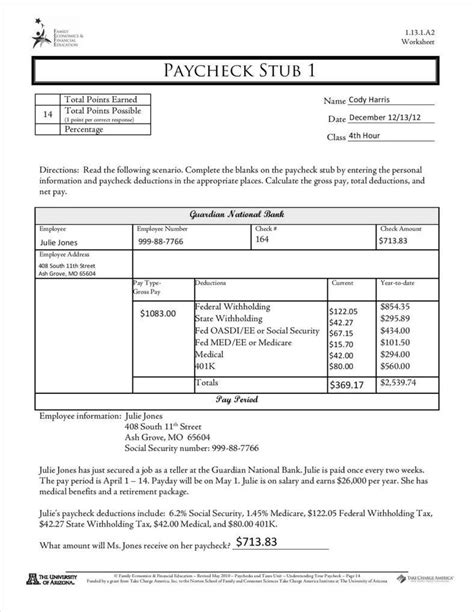

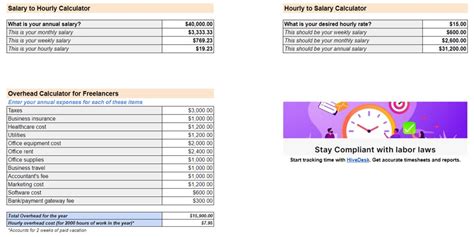

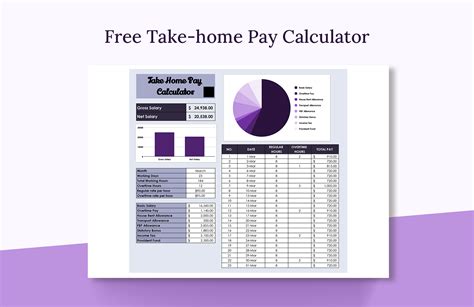

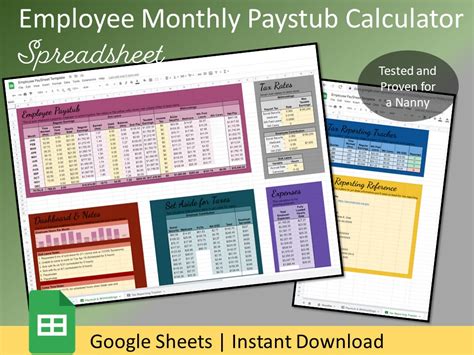

The Ohio Wage Calculator Tool is user-friendly and straightforward. To use the tool, simply follow these steps: * Enter the employee’s hourly wage or annual salary * Select the pay frequency, such as weekly, bi-weekly, or monthly * Input the number of hours worked per week * Choose the overtime rate, if applicable * Enter any tax deductions or benefits that apply The tool will then calculate the employee’s wages, including gross pay, net pay, and taxes withheld.

Benefits of Using the Ohio Wage Calculator Tool

There are numerous benefits to using the Ohio Wage Calculator Tool, including: * Accuracy: The tool ensures accurate calculations, reducing the risk of errors and disputes * Compliance: The tool helps employers stay up-to-date with changing labor laws and regulations * Transparency: The tool provides a clear breakdown of wages, allowing employees to understand their pay * Efficiency: The tool saves time and resources, streamlining the payroll process

Features of the Ohio Wage Calculator Tool

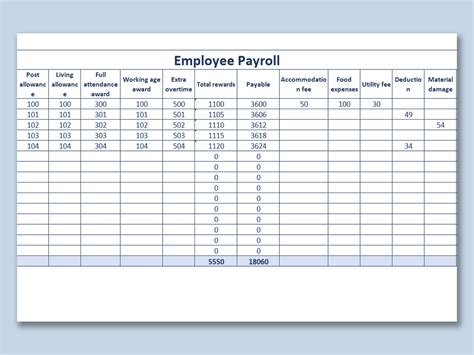

The Ohio Wage Calculator Tool offers a range of features, including: * Overtime pay calculator: Calculates overtime pay based on the employee’s hourly wage and number of hours worked * Minimum wage calculator: Ensures compliance with Ohio’s minimum wage laws * Tax deduction calculator: Calculates taxes withheld based on the employee’s income and tax status * Benefits calculator: Calculates the value of benefits, such as health insurance and retirement plans

| Feature | Description |

|---|---|

| Overtime Pay Calculator | Calculates overtime pay based on hourly wage and hours worked |

| Minimum Wage Calculator | Ensures compliance with Ohio's minimum wage laws |

| Tax Deduction Calculator | Calculates taxes withheld based on income and tax status |

| Benefits Calculator | Calculates the value of benefits, such as health insurance and retirement plans |

📝 Note: The Ohio Wage Calculator Tool is for informational purposes only and should not be used as a substitute for professional advice.

Common Uses of the Ohio Wage Calculator Tool

The Ohio Wage Calculator Tool has a range of applications, including: * Payroll processing: The tool can be used to calculate wages for employees, ensuring accuracy and compliance * Benefits administration: The tool can be used to calculate the value of benefits, such as health insurance and retirement plans * Financial planning: The tool can be used to estimate taxes and plan for future financial obligations

In summary, the Ohio Wage Calculator Tool is a valuable resource for employees and employers in Ohio, providing accurate and comprehensive calculations of wages, taxes, and benefits. By using this tool, individuals can ensure compliance with labor laws, streamline the payroll process, and make informed financial decisions.

What is the Ohio Wage Calculator Tool?

+

The Ohio Wage Calculator Tool is an online platform designed to help employees and employers in Ohio calculate wages accurately.

How does the Ohio Wage Calculator Tool work?

+

The tool uses a range of factors, including hourly wage, pay frequency, and tax deductions, to calculate an employee’s wages.

What are the benefits of using the Ohio Wage Calculator Tool?

+

The tool provides accuracy, compliance, transparency, and efficiency, making it a valuable resource for employees and employers in Ohio.