Ohio Salary Calculator Tool

Introduction to the Ohio Salary Calculator Tool

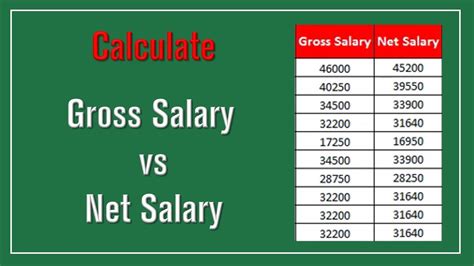

The Ohio Salary Calculator Tool is a valuable resource for individuals living and working in Ohio, providing a comprehensive way to calculate take-home pay based on gross income, tax deductions, and other factors. Understanding how much you can expect to take home after taxes is crucial for budgeting, financial planning, and making informed decisions about your career and lifestyle.

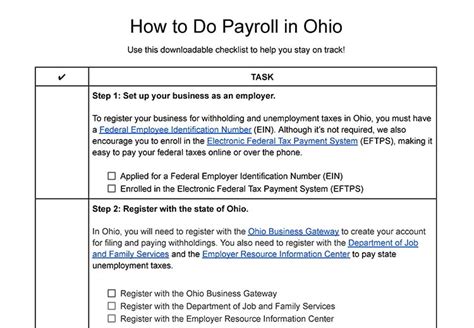

How the Ohio Salary Calculator Tool Works

The Ohio Salary Calculator Tool is designed to be user-friendly and straightforward. By inputting your annual salary, filing status, number of dependents, and other relevant information, the tool calculates your federal income tax, state income tax, and other deductions to provide an estimate of your net income. This information is essential for anyone looking to understand their true take-home pay and plan their finances accordingly.

Key Features of the Ohio Salary Calculator Tool

Some of the key features of the Ohio Salary Calculator Tool include: * Accurate Calculations: The tool uses the latest tax rates and laws to ensure accurate calculations of your take-home pay. * Customizable: You can input your specific details, such as your salary, filing status, and number of dependents, to get a personalized estimate. * Comprehensive: The tool takes into account various factors, including federal and state income taxes, to provide a comprehensive picture of your net income. * User-Friendly Interface: The tool is easy to use, with a simple and intuitive interface that makes it easy to input your information and get your results.

Benefits of Using the Ohio Salary Calculator Tool

Using the Ohio Salary Calculator Tool can have several benefits, including: * Improved Financial Planning: By understanding your take-home pay, you can make more informed decisions about your budget and financial goals. * Increased Accuracy: The tool helps you avoid errors and inaccuracies that can come from manual calculations or estimates. * Time-Saving: The tool saves you time and effort by providing quick and easy calculations, allowing you to focus on other aspects of your financial planning. * Better Career Decisions: With a clear understanding of your take-home pay, you can make more informed decisions about your career, such as whether to take a new job or ask for a raise.

Understanding Ohio State Income Tax

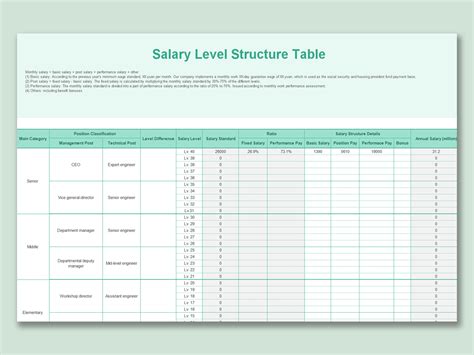

Ohio has a progressive income tax system, with tax rates ranging from 2.85% to 4.24%. The state also allows for various tax deductions and credits, such as the Ohio Earned Income Tax Credit. Understanding how these taxes and deductions work is essential for accurately calculating your take-home pay.

Using the Ohio Salary Calculator Tool for Financial Planning

The Ohio Salary Calculator Tool is not just a useful resource for calculating take-home pay; it can also be a valuable tool for financial planning. By using the tool to estimate your net income, you can make more informed decisions about your budget, savings, and investments. Some ways to use the tool for financial planning include: * Creating a Budget: Use the tool to estimate your take-home pay and create a budget that accounts for your net income. * Setting Financial Goals: Use the tool to understand how much you can afford to save or invest each month. * Planning for Taxes: Use the tool to estimate your tax liability and plan for tax season.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $44,725 | 2.85% |

| $44,726 - $89,450 | 3.24% |

| $89,451 - $110,650 | 3.62% |

| $110,651 - $221,300 | 4.00% |

| $221,301 and above | 4.24% |

📝 Note: The tax rates and brackets are subject to change, so it's essential to check for updates and consult with a tax professional if you have any questions or concerns.

In summary, the Ohio Salary Calculator Tool is a powerful resource for anyone looking to understand their take-home pay and make informed decisions about their finances. By providing accurate calculations and taking into account various factors, including federal and state income taxes, the tool helps you plan your budget, set financial goals, and make the most of your net income. Whether you’re a resident of Ohio or just looking to understand the state’s tax laws, the Ohio Salary Calculator Tool is an essential resource to have in your financial planning toolkit.

What is the Ohio Salary Calculator Tool?

+

The Ohio Salary Calculator Tool is a resource that helps individuals calculate their take-home pay based on their gross income, tax deductions, and other factors.

How does the Ohio Salary Calculator Tool work?

+

The tool uses the latest tax rates and laws to calculate your federal income tax, state income tax, and other deductions to provide an estimate of your net income.

What are the benefits of using the Ohio Salary Calculator Tool?

+

The tool provides accurate calculations, is customizable, and helps with financial planning, among other benefits.