5 NC Paycheck Tips

Understanding Your North Carolina Paycheck

When it comes to managing your finances, understanding your paycheck is crucial. For individuals living in North Carolina, it’s essential to be aware of the state’s tax laws and how they impact your take-home pay. In this article, we will delve into five key tips to help you navigate your North Carolina paycheck.

Taxation in North Carolina

North Carolina has a progressive income tax system, with rates ranging from 4.99% to 5.25%. The state also has a standard deduction, which can help reduce your taxable income. It’s vital to understand how these tax rates apply to your income to make informed decisions about your finances. For instance, if you’re single and have a taxable income of $50,000, you’ll fall into the 5.25% tax bracket.

NC Paycheck Tips

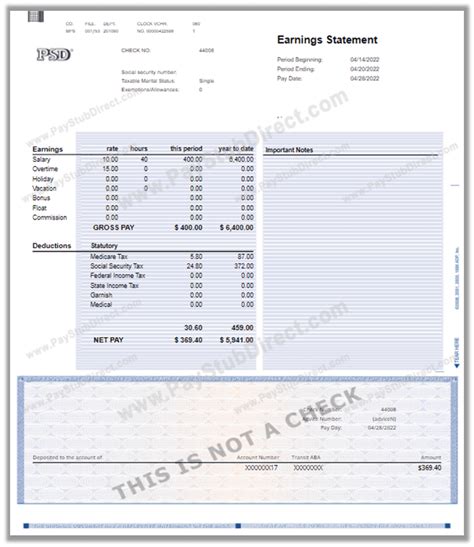

Here are five tips to help you make the most of your North Carolina paycheck: * Take advantage of tax deductions: North Carolina offers various tax deductions, such as the mortgage interest and property tax deductions, which can help reduce your taxable income. * Contribute to a retirement plan: Contributing to a 401(k) or IRA can help reduce your taxable income and provide a safety net for retirement. * Understand your pay stub: Your pay stub should include information about your gross income, taxes withheld, and net pay. Make sure to review your pay stub carefully to ensure accuracy. * Plan for taxes owed: If you’re self-employed or have a side hustle, you may need to pay estimated taxes throughout the year. Set aside funds each month to avoid a large tax bill at the end of the year. * Consult a tax professional: If you’re unsure about how to navigate North Carolina’s tax laws or need help with tax planning, consider consulting a tax professional.

NC Paycheck Calculator

To get a better understanding of your take-home pay, you can use a paycheck calculator. These calculators take into account your gross income, tax withholding, and other factors to provide an estimate of your net pay. You can find paycheck calculators online or through your employer’s HR department.

| Tax Bracket | Tax Rate |

|---|---|

| $0 - $20,000 | 4.99% |

| $20,001 - $50,000 | 5.12% |

| $50,001 and above | 5.25% |

💡 Note: The tax rates and brackets listed above are subject to change, so it's essential to stay up-to-date with the latest information from the North Carolina Department of Revenue.

As you can see, understanding your North Carolina paycheck requires careful consideration of various factors, including tax laws, deductions, and withholding. By following these five tips and staying informed, you can make the most of your hard-earned money and achieve financial stability.

In the end, managing your finances effectively is crucial for long-term success. By being aware of the intricacies of your North Carolina paycheck and taking proactive steps to optimize your finances, you can enjoy a more secure and prosperous future. Whether you’re a seasoned financial expert or just starting to navigate the world of personal finance, it’s essential to stay informed and adapt to changes in the tax landscape.

What is the standard deduction in North Carolina?

+

The standard deduction in North Carolina varies based on filing status. For single filers, the standard deduction is 10,750, while joint filers can claim a standard deduction of 21,500.

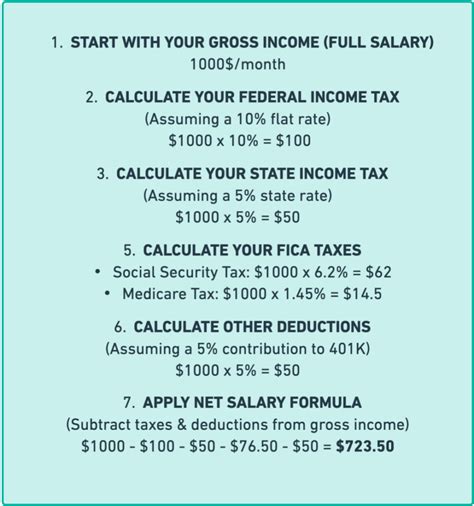

How do I calculate my take-home pay in North Carolina?

+

To calculate your take-home pay, you’ll need to subtract your taxes withheld, deductions, and other withholdings from your gross income. You can use a paycheck calculator or consult with a tax professional to get an accurate estimate.

What are the tax implications of working remotely in North Carolina?

+

As a remote worker in North Carolina, you may be subject to state income tax on your earnings. However, the tax implications will depend on your individual circumstances, including your residency status and the location of your employer. It’s essential to consult with a tax professional to understand your specific tax obligations.