5 NJ Wage Tips

New Jersey Wage Laws: Understanding Your Rights

As an employee in New Jersey, it’s essential to be aware of your rights regarding wages. The state has implemented various laws to protect workers from unfair labor practices, ensuring they receive the compensation they deserve. In this article, we’ll delve into five crucial NJ wage tips to help you navigate the complex world of employment law.

1. Minimum Wage Requirements

New Jersey has a minimum wage law that requires employers to pay employees a certain hourly rate. As of 2022, the minimum wage in New Jersey is $12.00 per hour for most employees. However, this rate may vary depending on the type of employment, such as farm workers or tipped employees. It’s essential to understand the minimum wage requirements to ensure you’re being paid fairly.

2. Overtime Pay

New Jersey law requires employers to pay overtime to employees who work more than 40 hours in a week. Overtime pay is calculated at a rate of 1.5 times the employee’s regular hourly rate. For example, if you earn 12.00 per hour, your overtime rate would be 18.00 per hour. Understanding overtime pay rules can help you determine if you’re eligible for additional compensation.

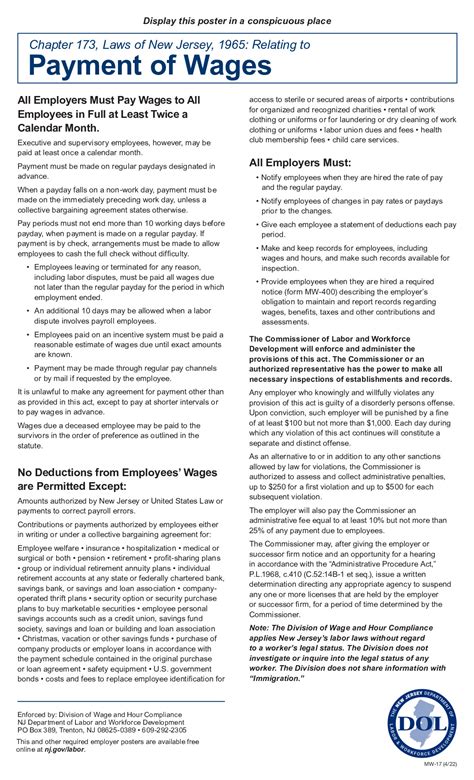

3. Wage Payment Laws

New Jersey has specific laws governing wage payments, including the frequency and method of payment. Employers are required to pay employees at least twice a month, with no more than 10 days between payments. Additionally, employers must provide employees with a written statement of wages, including the employee’s name, hours worked, and wages earned.

4. Deductions from Wages

Employers in New Jersey are allowed to make certain deductions from an employee’s wages, but only with the employee’s written consent. Permitted deductions include: * Taxes and other governmental deductions * Contributions to pension or health plans * Union dues * Charitable contributions * Repayment of loans or advances However, employers cannot make deductions for things like uniforms, tools, or equipment without the employee’s consent.

5. Wage Disputes and Enforcement

If you believe your employer has violated New Jersey wage laws, you can file a complaint with the New Jersey Department of Labor and Workforce Development. The department will investigate your claim and may take action against your employer if they find evidence of wage law violations. You can also consult with an attorney specializing in employment law to discuss your options for resolving a wage dispute.

🚨 Note: If you're experiencing a wage dispute, it's essential to keep detailed records of your hours worked, wages earned, and any communications with your employer. This documentation can help support your claim and ensure you receive the compensation you deserve.

In summary, understanding New Jersey wage laws is crucial for employees to protect their rights and ensure fair compensation. By familiarizing yourself with minimum wage requirements, overtime pay, wage payment laws, deductions from wages, and wage disputes, you can navigate the complex world of employment law and advocate for yourself in the workplace.

What is the current minimum wage in New Jersey?

+

The current minimum wage in New Jersey is $12.00 per hour for most employees.

How often must employers pay employees in New Jersey?

+

Employers in New Jersey must pay employees at least twice a month, with no more than 10 days between payments.

Can employers make deductions from an employee’s wages without their consent?

+

No, employers in New Jersey cannot make deductions from an employee’s wages without their written consent, except for certain permitted deductions like taxes and union dues.