NJ Medical Expenses Worksheet F: Simplified Guide

Medical expenses can be overwhelming, both in terms of their impact on our health and their effect on our finances. Navigating through health insurance claims, understanding NJ Medical Expenses Worksheet F, and making the most out of your coverage can be a daunting task. This guide aims to simplify the process by providing you with a step-by-step walkthrough of how to fill out Worksheet F, which is crucial for claiming medical expense deductions on your New Jersey state income tax.

Understanding NJ Medical Expenses

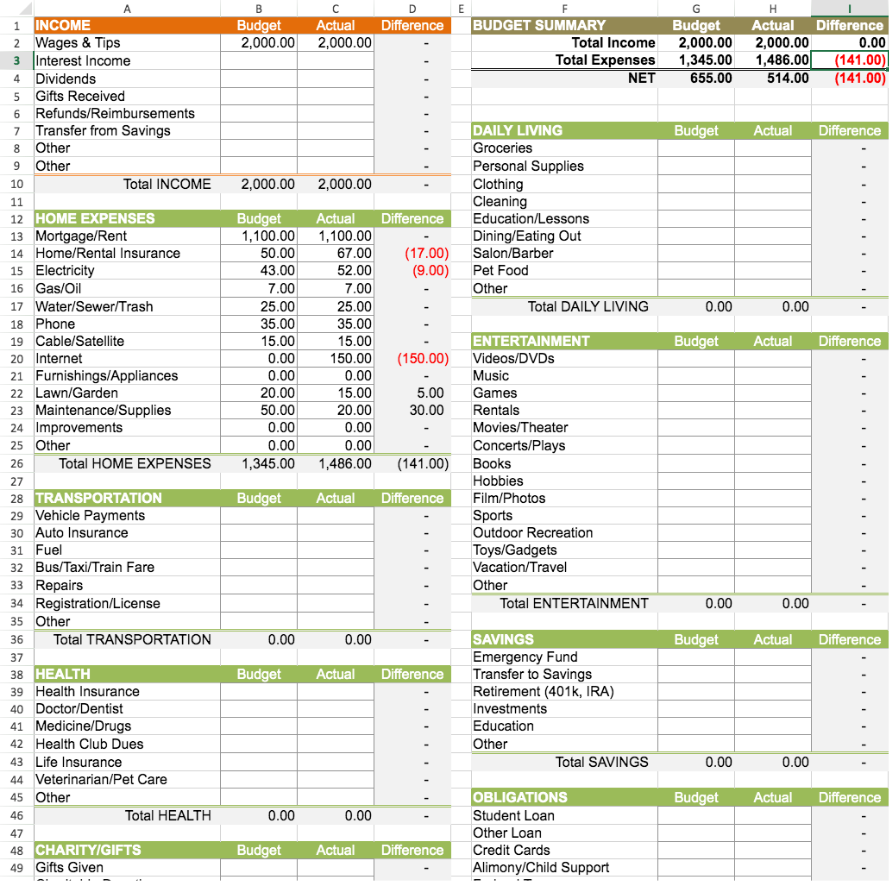

Before diving into the specifics of Worksheet F, let’s understand why it’s important. New Jersey allows residents to deduct unreimbursed medical expenses that exceed 2% of their adjusted gross income (AGI). This deduction can significantly reduce your taxable income if your medical costs are high.

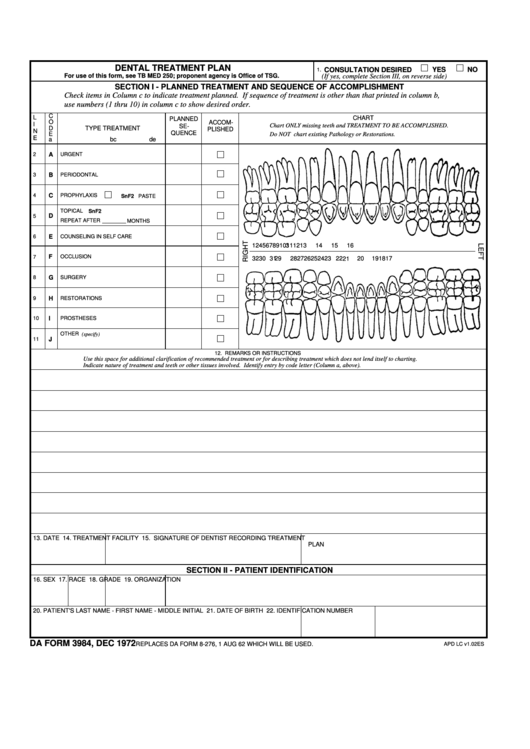

- Medical Expenses: These can include payments for doctors, dentists, surgeries, and various treatments, as well as certain items like glasses, hearing aids, and prescription medications.

- Eligible Dependents: Medical expenses can also be claimed for yourself, your spouse, and any dependents you listed on your return.

- Records: Keep thorough documentation of all medical expenses, as you’ll need these to substantiate your claims during an audit.

Where to Find NJ Medical Expenses Worksheet F

New Jersey’s Tax Division provides the necessary forms and worksheets on their official website. Here’s how to access Worksheet F:

- Visit the NJ Division of Taxation website.

- Go to the forms and instructions section for the current tax year.

- Download the NJ-1040 package which includes Worksheet F.

The worksheet is designed to help you calculate your medical expense deduction in an organized manner.

Filling Out Worksheet F: A Step-by-Step Guide

Here’s how to effectively fill out Worksheet F to claim your medical expense deduction:

Step 1: Gather Documentation

Before you begin, gather all records of your medical expenses:

- Bills from healthcare providers

- Receipts for medications

- Insurance Explanation of Benefits (EOB) statements

Make sure these are organized by date or provider for easy reference.

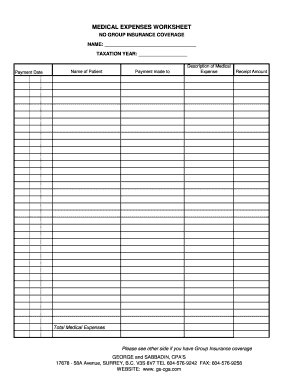

Step 2: Calculate Total Expenses

On Worksheet F:

- Enter your total unreimbursed medical expenses on Line 1.

- Record any insurance reimbursements or payments on Line 2.

- Subtract Line 2 from Line 1 to find your net medical expenses (Line 3).

Step 3: Determining Adjusted Gross Income (AGI)

This step involves referencing your federal tax return to find your AGI:

- Look at your federal Form 1040.

- Enter your AGI on Line 4 of Worksheet F.

- Multiply your AGI by 2% (0.02) and enter this amount on Line 5.

- Subtract Line 5 from Line 3 to get the deductible medical expenses on Line 6.

📝 Note: Ensure you’ve completed your federal tax return before filling out Worksheet F as the AGI from your federal return is required.

Step 4: Transfer to NJ-1040

Once you’ve calculated your deductible medical expenses:

- Transfer the amount from Line 6 to Line 29 of Form NJ-1040.

Additional Notes for NJ Medical Expenses Worksheet F

Here are some important points to consider:

- Make sure your medical expenses exceed the 2% AGI threshold before claiming.

- If you’re audited, keep detailed records of each expense, including date, amount, and nature of service.

- Certain costs like travel to medical treatments and health insurance premiums can also be included in your medical expenses.

🔍 Note: Regularly update your records to avoid missing out on potential deductions.

Key Takeaways

Successfully navigating medical expenses on your New Jersey state income tax requires careful documentation, understanding the rules around what qualifies as a medical expense, and accurately calculating your deduction using Worksheet F. Keep in mind that medical expenses must exceed 2% of your AGI to be deductible. Organize your records, double-check your math, and remember that thorough record-keeping can be your best ally if your return is audited.

Can I claim medical expenses for my child who is not a dependent on my return?

+

No, you can only claim medical expenses for yourself, your spouse, or your dependents listed on your tax return.

What if my medical expenses are less than the 2% AGI threshold?

+

You would not be able to claim a deduction for these expenses as they do not exceed the threshold required by New Jersey tax laws.

Are there any exceptions to the 2% AGI rule?

+

The 2% AGI threshold is generally firm. However, in rare cases like long-term care expenses or certain chronic illnesses, you might find alternative deductions or credits. Consult a tax professional for specifics.