Military

5 NFCU VA Home Loan Rates

Introduction to NFCU VA Home Loan Rates

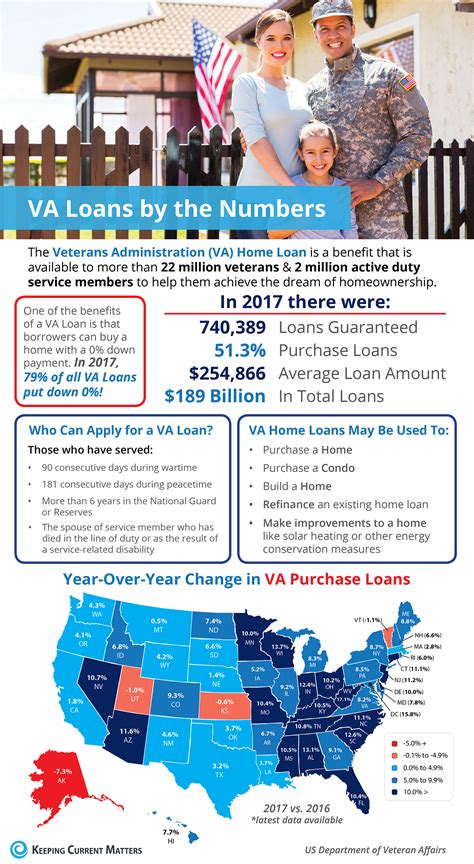

The Navy Federal Credit Union (NFCU) is a well-established financial institution that offers a wide range of financial services, including home loans. For veterans, active-duty military personnel, and their families, NFCU provides VA home loan rates that are competitive and affordable. In this article, we will delve into the world of NFCU VA home loan rates, exploring the benefits, requirements, and current rates.

Benefits of NFCU VA Home Loan Rates

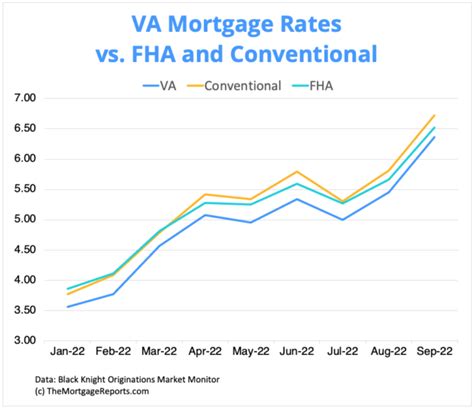

VA home loans offered by NFCU come with several benefits that make them an attractive option for eligible borrowers. Some of the key benefits include: * No down payment requirement: VA loans do not require a down payment, making it easier for borrowers to purchase a home. * Lower interest rates: VA loan rates are often lower compared to conventional loan rates, resulting in lower monthly mortgage payments. * No private mortgage insurance (PMI): VA loans do not require PMI, which can save borrowers hundreds of dollars per year. * Lenient credit score requirements: VA loans have more lenient credit score requirements, making it easier for borrowers with less-than-perfect credit to qualify.

Requirements for NFCU VA Home Loan Rates

To be eligible for NFCU VA home loan rates, borrowers must meet certain requirements. These include: * VA eligibility: Borrowers must be eligible for a VA loan, which typically requires being an active-duty military personnel, veteran, or surviving spouse. * Credit score: NFCU requires a minimum credit score of 620 for VA loan eligibility. * Debt-to-income ratio: Borrowers must have a debt-to-income ratio of 41% or less to qualify for a VA loan. * Income requirements: Borrowers must meet NFCU’s income requirements, which vary depending on the loan amount and location.

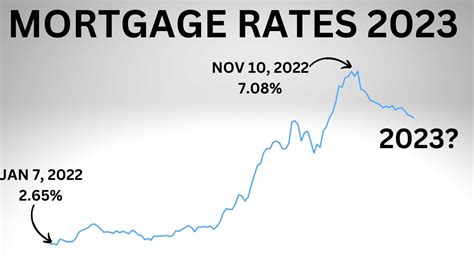

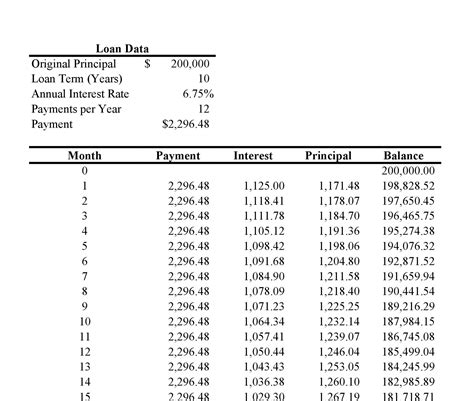

Current NFCU VA Home Loan Rates

NFCU VA home loan rates are subject to change and may vary depending on the loan term, loan amount, and borrower’s credit score. As of the latest update, here are some current NFCU VA home loan rates:

| Loan Term | Interest Rate | APR |

|---|---|---|

| 30-year fixed | 3.125% | 3.369% |

| 20-year fixed | 3.0% | 3.245% |

| 15-year fixed | 2.75% | 2.991% |

Please note that these rates are subject to change and may not reflect the current market rates.

📝 Note: It's essential to check with NFCU for the most up-to-date and accurate rates, as they may fluctuate frequently.

How to Apply for NFCU VA Home Loan Rates

To apply for NFCU VA home loan rates, borrowers can follow these steps: * Check eligibility: Verify VA eligibility through the VA website or by contacting NFCU. * Gather documents: Collect required documents, including income verification, credit reports, and identification. * Apply online or in-person: Submit an application through NFCU’s online portal or visit a local branch. * Get pre-approved: Obtain pre-approval for a VA loan to determine the loan amount and interest rate.

Conclusion and Final Thoughts

In conclusion, NFCU VA home loan rates offer a competitive and affordable option for eligible borrowers. With benefits like no down payment requirement, lower interest rates, and no PMI, VA loans can make homeownership more accessible. By understanding the requirements and current rates, borrowers can make informed decisions about their home financing options. It’s essential to stay up-to-date with the latest rates and requirements to ensure the best possible outcome.

What are the benefits of NFCU VA home loan rates?

+

NFCU VA home loan rates offer benefits like no down payment requirement, lower interest rates, and no private mortgage insurance (PMI), making homeownership more accessible and affordable.

What are the requirements for NFCU VA home loan rates?

+

To be eligible for NFCU VA home loan rates, borrowers must meet requirements like VA eligibility, credit score, debt-to-income ratio, and income requirements.

How do I apply for NFCU VA home loan rates?

+

To apply for NFCU VA home loan rates, borrowers can check their eligibility, gather required documents, apply online or in-person, and get pre-approved for a VA loan.