Nebraska Payroll Calculator Tool

Introduction to Nebraska Payroll Calculator Tool

The Nebraska Payroll Calculator Tool is a valuable resource for employers, accountants, and payroll professionals in the state of Nebraska. This tool helps to simplify the process of calculating payroll taxes, deductions, and other expenses associated with employee compensation. With the ever-changing landscape of tax laws and regulations, it’s essential to have a reliable and accurate calculator to ensure compliance and avoid any potential penalties. In this article, we’ll delve into the features, benefits, and usage of the Nebraska Payroll Calculator Tool, as well as provide guidance on how to get the most out of this resource.

Features of the Nebraska Payroll Calculator Tool

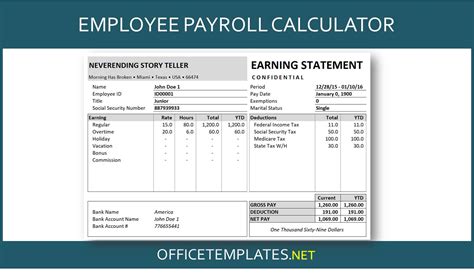

The Nebraska Payroll Calculator Tool offers a range of features that make it an indispensable asset for payroll processing. Some of the key features include: * Gross-to-Net Calculation: The tool calculates the net pay for employees based on their gross income, deductions, and taxes. * Tax Calculation: The calculator determines the amount of federal, state, and local taxes withheld from employee paychecks. * Deduction Calculation: The tool accounts for various deductions, such as health insurance, 401(k), and other benefits. * Compliance with Nebraska State Laws: The calculator ensures that payroll calculations comply with Nebraska state laws and regulations. * User-Friendly Interface: The tool features an intuitive and easy-to-use interface, making it accessible to users with varying levels of payroll expertise.

Benefits of Using the Nebraska Payroll Calculator Tool

The Nebraska Payroll Calculator Tool offers numerous benefits to employers, accountants, and payroll professionals. Some of the advantages of using this tool include: * Accuracy and Reliability: The calculator ensures accurate and reliable payroll calculations, reducing the risk of errors and penalties. * Time-Saving: The tool automates the payroll calculation process, saving time and increasing productivity. * Compliance with Regulations: The calculator ensures compliance with Nebraska state laws and regulations, reducing the risk of non-compliance and associated penalties. * Improved Employee Satisfaction: The tool helps to ensure that employees receive accurate and timely pay, improving overall job satisfaction.

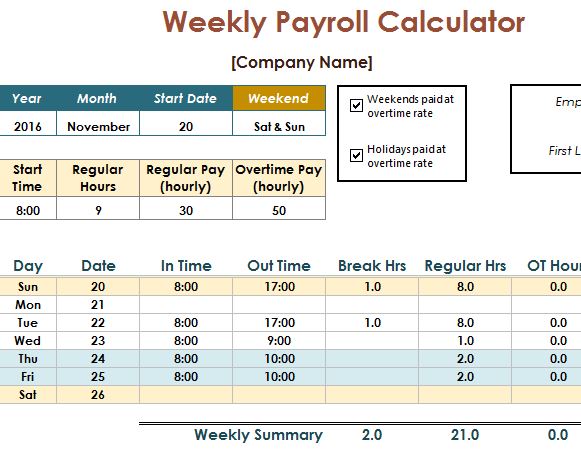

How to Use the Nebraska Payroll Calculator Tool

Using the Nebraska Payroll Calculator Tool is straightforward and easy. Here’s a step-by-step guide to get you started: * Gather Employee Data: Collect relevant employee data, including gross income, deductions, and tax information. * Enter Data into the Calculator: Input the employee data into the calculator, following the prompts and guidelines provided. * Run the Calculation: Run the calculation to determine the net pay, taxes, and deductions for each employee. * Review and Verify Results: Review and verify the results to ensure accuracy and compliance with regulations.

📝 Note: It's essential to regularly update the calculator with the latest tax tables and regulations to ensure accuracy and compliance.

Tips for Getting the Most Out of the Nebraska Payroll Calculator Tool

To maximize the benefits of the Nebraska Payroll Calculator Tool, consider the following tips: * Stay Up-to-Date with Tax Laws and Regulations: Regularly update the calculator with the latest tax tables and regulations to ensure accuracy and compliance. * Use the Tool Consistently: Use the calculator consistently to ensure accuracy and reduce the risk of errors. * Train Staff Members: Train staff members on how to use the calculator to ensure that everyone is comfortable and confident with the tool. * Monitor and Analyze Results: Monitor and analyze the results to identify trends and areas for improvement.

Common Payroll Mistakes to Avoid

When using the Nebraska Payroll Calculator Tool, it’s essential to avoid common payroll mistakes that can lead to errors and penalties. Some of the most common mistakes include: * Inaccurate Employee Data: Inaccurate or incomplete employee data can lead to errors in payroll calculations. * Failure to Update Tax Tables: Failure to update tax tables and regulations can result in non-compliance and penalties. * Inconsistent Payroll Processing: Inconsistent payroll processing can lead to errors and discrepancies in employee paychecks.

| Payroll Mistake | Consequences |

|---|---|

| Inaccurate Employee Data | Errors in payroll calculations, penalties, and fines |

| Failure to Update Tax Tables | Non-compliance, penalties, and fines |

| Inconsistent Payroll Processing | Errors and discrepancies in employee paychecks, reduced employee satisfaction |

As we summarize the key points, it’s clear that the Nebraska Payroll Calculator Tool is a valuable resource for employers, accountants, and payroll professionals. By understanding the features, benefits, and usage of the tool, users can ensure accurate and compliant payroll processing, reduce the risk of errors and penalties, and improve overall employee satisfaction. With the ever-changing landscape of tax laws and regulations, it’s essential to stay up-to-date with the latest developments and use the tool consistently to maximize its benefits.

What is the Nebraska Payroll Calculator Tool?

+

The Nebraska Payroll Calculator Tool is a resource for employers, accountants, and payroll professionals to simplify the process of calculating payroll taxes, deductions, and other expenses associated with employee compensation.

How do I use the Nebraska Payroll Calculator Tool?

+

To use the tool, gather relevant employee data, enter the data into the calculator, run the calculation, and review and verify the results to ensure accuracy and compliance with regulations.

What are the benefits of using the Nebraska Payroll Calculator Tool?

+

The benefits of using the tool include accuracy and reliability, time-saving, compliance with regulations, and improved employee satisfaction.